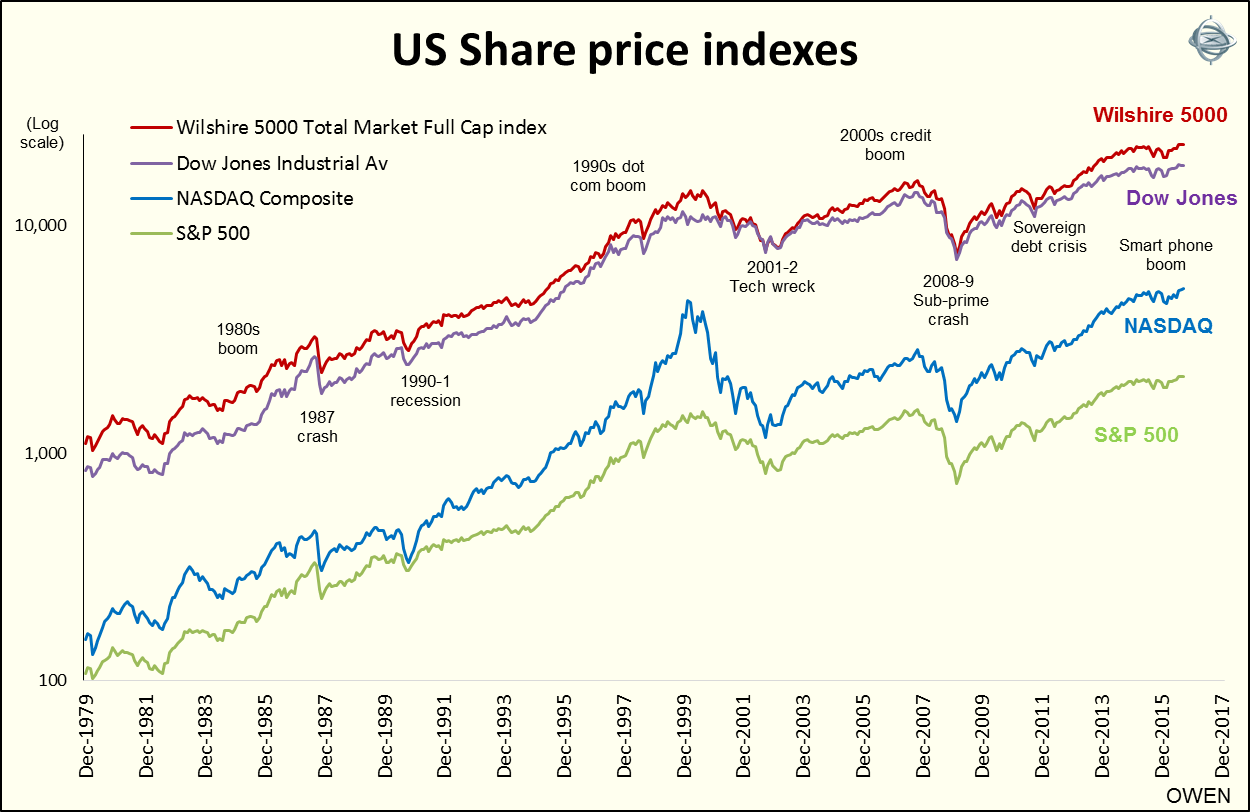

US share prices have been doing well this year. The broad market indexes have reached new all-time highs, finally topping their previous peaks at the top of the 1990s ‘dot com’ boom and the 2000s credit boom.

The chart below shows four of the main US market indexes over the past four decades.

This shows that the current boom is not confined to just a few ‘hot stocks’, but enjoyed by the whole market. The Dow Jones Industrial Average measures the prices of just 30 of the largest stocks including Apple, Microsoft, IBM, McDonalds, Coca-Cola and Disney. The S&P 500 index covers 500 large and mid-sized companies, and the Wilshire 5000 index covers 5000 companies including thousands of small and micro stocks. The NASDAQ composite is heavily weighted toward technology companies.

The stock market boom in the US has been driven by two main factors: low interest rates and the global smart phone revolution. However, the US Federal Reserve turned off the ‘QE’ tap in 2014 and started raising interest rates in December 2015. The US government has also been tightening fiscal policy in recent years with progressively lower budget deficits. So the boom is overcoming the twin headwinds of tightening monetary and fiscal policies.

The main driving force has been the global technology revolution. The smart phone is changing how billions of people in virtually every country on the planet go about their daily lives. New technology is also revolutionising how businesses operate, from cloud computing to inventory management to accounting.

All of this requires new hardware and software. Factory workers in low wage countries build the hardware out of rocks dug up from quarries like Australia. But the real money is in the know-how and software and those come mostly from American companies. The American economy may be struggling to get back to normal growth but American companies are leading the global technology revolution.

Australian versus US shares

US shares have beaten Australian shares handsomely over the past five years despite Australia enjoying stronger economic growth and population growth.

The US S&P500 Price Index is 40% above its 2007 high, and with dividends, it is 70% above. The Total Return series after US inflation is 48% above 2007 highs. But the Australian All Ords Price Index is still 18% below its 2007 highs. With dividends it is 20% above, but the Total Return series after local inflation is still 2% below the peak (these numbers are to end September 2016).

A better comparison is an Australian investor in Australian shares after Australian inflation versus the same Australian investor in US shares after Australian inflation (that is, an Australian investor can chose to invest in either Australian shares or US shares but suffers Australian inflation either way). Then US shares Total Returns less Australian inflation is +66% since 2007 high versus -2% for Australian shares. The difference is the currency effect of a falling AUD and higher inflation here than in the US. Investors tend to ignore inflation when comparing long-term performance.

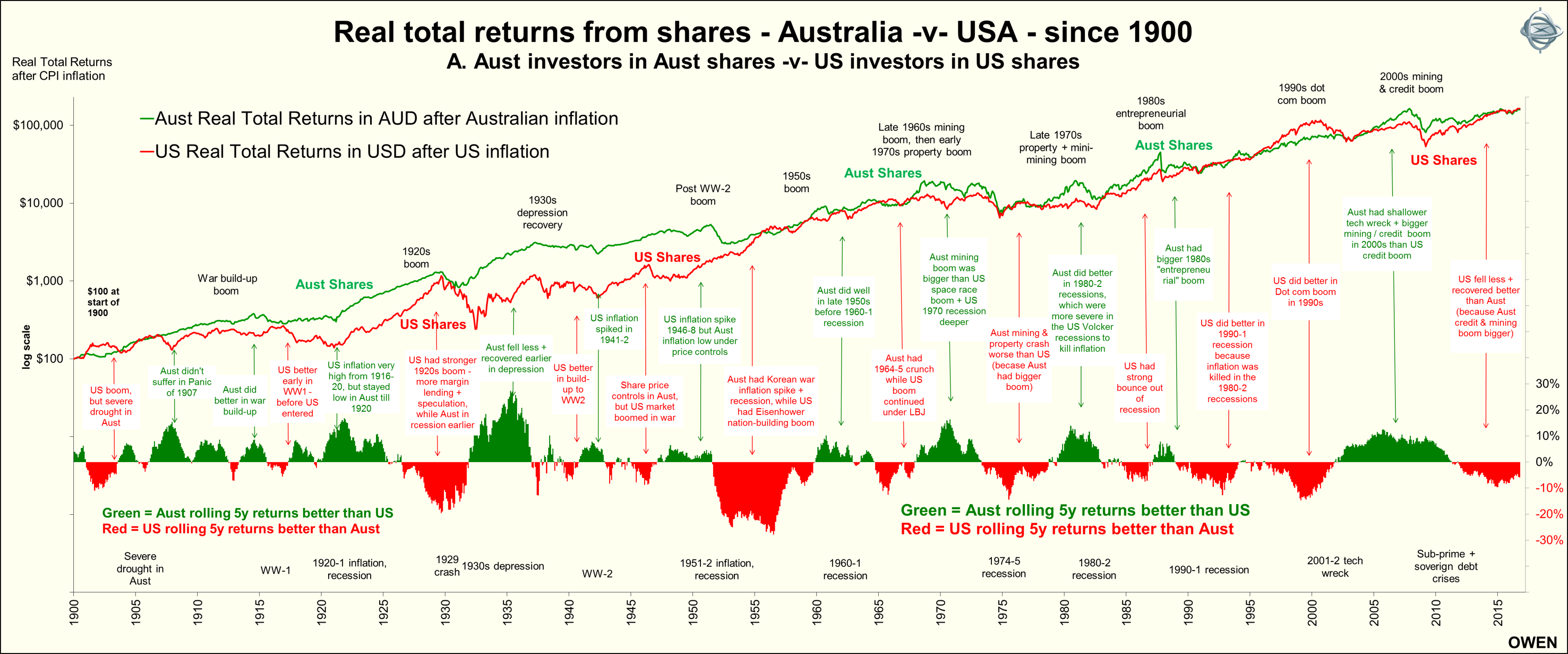

Here is the longer term picture.

Both markets have returned average real total returns (including dividends and after CPI inflation) of 6.5% per year since 1900. While the real total returns have been the same, the components of returns have been different. Australian shares have delivered higher nominal price growth and higher dividend yields than US shares, but these benefits have been neutralised by Australia’s higher inflation rate, so the net real total returns after inflation have been the same in both markets.

The two markets have also followed different paths along the way. The next chart shows the accumulated real total returns from both markets – green for Australia and red for the US.

The lower section shows when Australia was winning (positive green bars) and when the US was winning (negative red bars). Both markets have risen in global booms and then fallen in the global busts, but Australia and the US have taken turns in having bigger booms and busts.

Starting from the right side of the chart we see that Australia had a bigger 2000s boom than the US, and so it suffered worse in the 2008 bust. On the other hand, the US had a much bigger ‘dot com’ boom in the late 1990s, so it had a more severe ‘tech wreck’ in 2001 and 2002. Australia had a much bigger mid 1980s ‘entrepreneurial’ boom (Bond, Skase, Herscue, Elliott, Connell and the rest), and so it had further to fall in the 1987 crash. And so it goes back through history.

The fact that the US market has been winning in recent years is more a reflection of our bigger 2000s boom and our bigger bust in the GFC. Australia and the US both had a credit boom in the 2000s but Australia also had a mining boom that crashed as well, and it is still recovering.

So it is America’s turn, and we are seeing it already with the US clearly leading the global technology boom.

Ashley Owen is Chief Investment Officer at independent advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. These past returns are not an indication of future returns.