Two interrelated topics have been occupying much of our thoughts in recent months. The first is the deep discount currently available in many areas of the market, including in energy and mining stocks. The second is the underperformance of ‘value’ as an investment style over recent years.

The opportunity in resources

The current valuations of some of the major resources stocks present an opening to buy high-quality companies at levels well below our assessment of their intrinsic worth. The major miners represent value even with commodity prices expected to be lower for a considerable period.

We were resources ‘bears’ at the height of the commodity boom, but since then there has been dramatic de-ratings of commodity share prices. In 2010, resources companies were significantly overpriced, but this has since reversed due to a dramatic decline in resources prices relative to the S&P/ASX 200 Index.

In our valuation process we calculate a fair value for all stocks. This fair value is calculated over three years, assuming all stocks trade at our valuation in three years’ time. Using our methodology in 2010, we estimated that resources stocks were almost two and half times overvalued. Today, however, this same is trading at a 33% discount to fair value.

Or looking at it another way, as of the end of January 2016, the approximate 11% weight of resources in the Index is the lowest in 50 years (we have adjusted the financial weight to allow for the listings of CBA, AMP and IAG and added in Telstra, but not adjusted for changes in News Corp, to make the comparison as meaningful as possible). Even allowing for the bounce in March 2016, resources are still trading at the lower end of the historical ranges today.

Does this low resources weight not only reflect cycle low prices, but also the declining importance of mining in a more diversified economy? In reality, the reverse is actually true, in the sense that from 1967 to today mining exports as a percent of GDP have risen, particularly over the last ten years, as Asian demand has grown faster than the local economy.

Not all miners are created equal

Within the resources sector, we currently favour large diversified miners with cost advantages. In contrast, companies with high cost structures or high leverage may face greater stress during the post-China boom downturn. Junior miners and mining services companies generally have both higher debt levels and more volatile earnings.

This view is not based on any recovery or strong bounce-back in commodity prices. We have factored in the next couple of years of severely depressed commodity prices followed by a reversion to long-term equilibrium. The major miners remain cheap even if commodity prices remain lower for longer.

However, the major miners represent just a small part of the overall opportunity set. The kind of valuation distortion we have highlighted is available in other sectors and with other companies as well. We believe we are in an unusual period of history where the market is not focusing on ‘value’.

Valuation matters, now more than ever

For the purpose of illustrating this point, we will define ‘value’ as low price/book value stocks, and ‘growth’ as high price/book value. Put simply, ‘book value’ is a company’s assets minus its liabilities, broadly giving the equity value or net worth of the business.

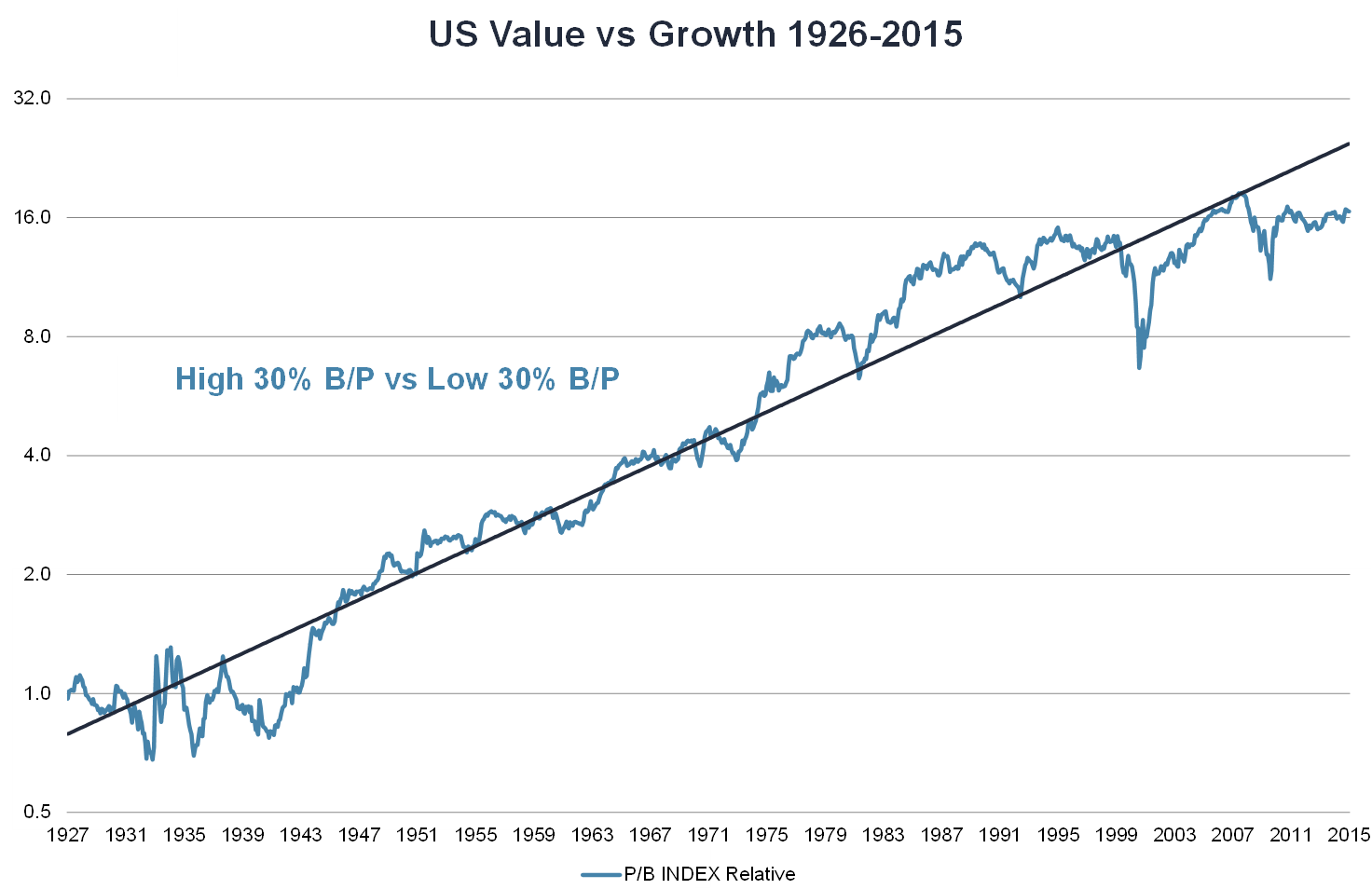

Historically, over the long term, buying companies based on cheap valuations has led to better returns. Since 1927, the cumulative return of the lowest 30% price/book value US stocks (a common measure to assess the cheapest stocks) has been 16 times higher than those with the highest valuations (Exhibit 1).

Exhibit 1 - Value outperforms growth in the long run

Source: Kenneth French, Lazard. For the period July 1926 to November 2015 using data defined in Kenneth French’s library.

However, in recent years, in a reversal of the long-term historical trend, cheap securities (or companies with high dividend yield, low price-to-earnings multiples, or low price-to-book ratios) have significantly underperformed expensive securities in Australia and around the world. Investors seem to have prioritised possible earnings growth and recent positive market performance (driven by momentum factors) over traditional value fundamentals.

Bouncing back

The good news for value investors is that while there are periods when value can underperform the market, it has always bounced back. In fact, historically, the best periods for value investing have been in the years following poor value returns.

In the recession year of 1990, the market sold down cyclical stocks to very low levels, which led to a long period of high value returns during the recovery. From 1998 to March 2000 the market inflated the prices of tech stocks and sold down so-called ‘old economy’ stocks to low levels, setting up dramatic outperformance for valuation-driven investors over the next four to five years. By June 2008, the valuation of mining stocks reached high levels, and these mining stocks subsequently collapsed. The unravelling of these price distortions enabled many value managers to outperform their benchmarks by a considerable margin in the years that followed.

We believe this cycle will ultimately be no different. When value metrics return to favour, value managers should be well placed to benefit given the valuation discrepancies currently in the market.

A company’s valuation matters and it is going to matter even more after the market has ignored it for a considerable period of time. Making decisions that go against those of the market is not always easy, yet sometimes sentiment does give the long-term valuation-driven investor the investment equivalent of a long hop down the wicket for a cricketer. Now is one such time.

Dr. Philipp Hofflin is Portfolio Manager and Analyst in the Lazard Australian Equity Team. This article is general information and does not address the needs of any individual.