(This article republishes a previous warning at the end of the financial year about timing of distributions).

Most fund managers struggle to deliver a 1% outperformance after fees, and with the cash rate at 0.1%, investors need to eke out every bit of return they can find. So it’s important to know how investment structures work. In particular, the tax impact of investing after a distribution can be a trap for the unwary and cause unexpected leakage in tax.

Distributions from a unit trust

In a unit trust, all income received (including realised capital gains) is divided among unit holders based on how many units they hold at the time of a distribution. Unit holders must then include their share of this income (which may comprise dividends, interest, capital gains and franking (imputation) credits) in their own tax return in the year it was earned.

The same distributions are paid to all unit holders according to their holding on a particular day, whether or not the investor was in the fund one day or one year. Distributions are not pro-rated for investors who were not unitholders for the whole period. An investor may receive some of their investment back immediately as income if they invested just before a distribution.

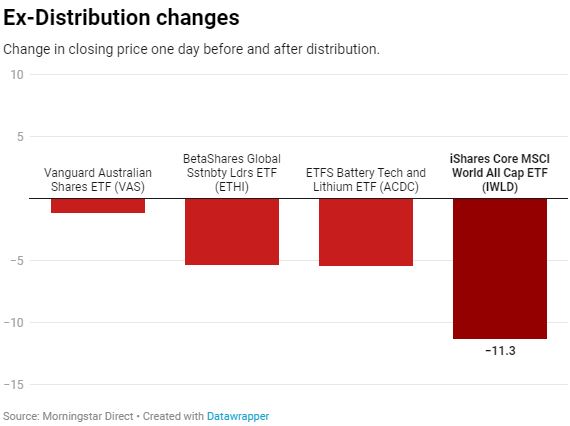

Immediately after a distribution is declared, the unit price of the fund will usually fall by the amount of the distribution, because the distribution reduces the fund’s assets. For example, these ETFs listed on the Australian exchanges fell heavily after their FY21 distributions.

Don't convert capital to taxable income

An investment in June that receives a distribution in July may be converting capital to taxable income. For example, if someone invests on 25 June when the unit price is say $1.00 and then a 10 cent per unit distribution is made on 30 June, the unit price will fall to 90 cents (assuming no market movement) at the beginning of July. The 10 cents will be taxable income in the hands of the unit holder in their tax return.

Obviously, the worst consequences are for individuals with high marginal tax rates where the distribution includes no franking credits. This might be the case for a global equity fund which distributes once a year with no franking credits from Australian companies.

Alternatively, an investor such as a tax-free charity or super fund in pension mode in an Australian equity fund might pay no tax and receive a franking credit, so a June investment might actually be favourable for them.

The only way to eliminate these effects would be for the fund trustee to make a daily distribution, but clearly this is not practical. The more often a fund distributes income during the year then the less of an issue this distribution inequity becomes. For example, most Australian equity funds distribute twice per year but most international funds only distribute once per year.

Other funds with particularly punitive outcomes for unit holders who invest close to a distribution date might be actively-traded funds in a rising market. They might have large capital gains on shares not held for longer than 12 months (and therefore, not subject to the 50% CGT discount factor). The distribution might contain a large taxable capital gain component.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.