Weekend market update: The Australian stock market eked out a tiny gain over last week after a 5% pullback in previous weeks. NASDAQ again struggled on Friday, down another 1%, with the S&P500 off 1.1%. Despite favourable Fed words on inflation targets, the greedy market wanted even more reassurance. There are few signs of a sustained bear market yet, as these levels are little more than a stutter after a strong run since March. The main concern is a rise on COVID-19 cases, especially in Europe, with winter approaching.

***

There are many ways to value a company, but the most popular is to estimate the future cash flows and discount them by a chosen interest rate. The lower the interest rate, the higher the net present value. So does it follow that when interest rates are as low as they are at the moment, companies become more valuable? Perhaps, but only if the cash flows remain unchanged, and in a recession, future earnings are more difficult to sustain.

This is the dilemma facing every investment analyst, as lowering the discount rate in line with a company's cost of capital can lead to extremely high valuations. Consider what Warren Buffett said in 1994:

“The value of every business, the value of a farm, the value of an apartment house, the value of any economic asset, is 100% sensitive to interest rates because all you are doing in investing is transferring some money to somebody now in exchange for what you expect the stream of money to be, to come in over a period of time, and the higher interest rates are the less that present value is going to be."

Hamish Douglass of Magellan says interest rates should be part of any discussion about stock market values:

"It is concerning that there is so much commentary opining on whether or not share markets are under- or overvalued without any discussion about the likely level of future interest rates. We can confidently predict that many stock markets are presently overvalued if future long-term interest rates are 5% or greater and also predict that they are attractively valued if long-term interest rates are 3% or less in the future."

Where does this leave us in current markets? We always find a way to justify expensive markets, and low interest rates is a popular reason. We also blame central bank printing and 'Robinhood' investors, the new retail players bidding up stocks in a game of chance. The reality is shown below.

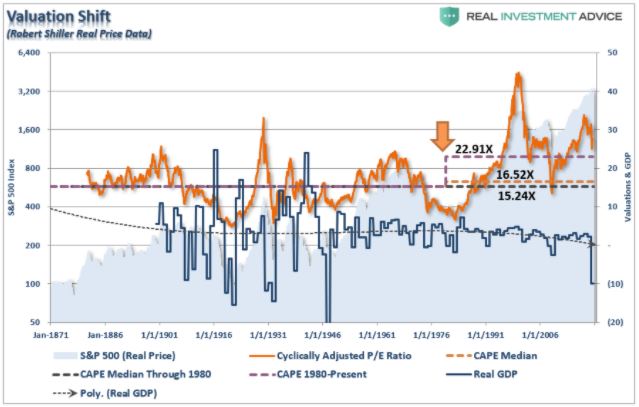

The long-term median CAPE (Shiller's Cyclically Adjusted P/E ratio) from 1871 to now is about 16 (and since 1980 about 23) and at the same time, real GDP (the blue line at the bottom) has increased a median 3.3% per annum.

But the CAPE is now at an elevated 31 despite real GDP falling heavily due to COVID-19. When economic growth is low, company valuations trend down in the future. Ed Easterling, founder of Crestmont Research and author of many books on market valuations, covers this subject well. It remains to be seen whether ultra low interest rates and ultra high central bank stimulus can hold equity markets at levels that economic growth and corporate profits do not justify.

In Australia, GDP growth has remained strong in the last 30 years driven by population growth primarily due to immigration. In an ominous confirmation of what we all know, the latest ABS numbers show a 99% decrease in overseas arrivals in August 2020 versus a year ago. Martin Conlon's article this week argues the disconnect between stock prices and economic reality has become a giant Ponzi scheme in a casino-like market.

Also in this week's packed edition ...

The $50 billion Listed Investment Companies (LICs) and Trusts (LITs) segment of the Australian market is struggling to find the right business model. Most trade at a discount to asset values, and a new primary deal has not been completed in 2020. We check the ways fund managers are addressing the problem with new structures, and investors should agitate for more LICs to do the same.

In our Interview Series, we meet Jordan Eliseo of Perth Mint, which is experiencing massive growth in demand for physical gold and gold ETFs, including from SMSFs and institutions. Here's all you need to know about gold.

Last week's survey drew well over 400 responses, and Leisa Bell has collated the fascinating results into different articles. As always, it's the comments which are most revealing. See what readers think of the early release of super (hint: Not Happy Jan), the severity of the Victorian lockdown (hint: Not Happy Dan), who will win the US election (hint: lots of support for Trump), forecasts for stock markets (hint: better times ahead). More results next week.

The survey also confirmed half our readers are trustees of SMSFs, and we must not overlook the administrative tasks of the role. There are particular obligations during the pandemic, such as documenting if you took a lower pension in FY20. Nicholas Ali provides a quick checklist to ensure your SMSF remains compliant.

Andrew Wilson outlines a difference between managing retirement income using an SMSF versus a pooled fund, drawing out implications of selling fund units in a down market.

And amid the billions of dollars that the Federal Government is throwing at the pandemic to support the economy, Ashley Owen asks whether we can afford it.

This week's White Paper from Fidelity International explores longer-term implications of work and business due to the virus, including a move to greater collaboration and decentralisation by companies.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website