Apparently, Australia has had an ‘export boom’ over the past decade. But is it (or was it) a boom?

Australians love to talk a lot about exporting but we actually do very little of it compared to nearly every other country in the world.

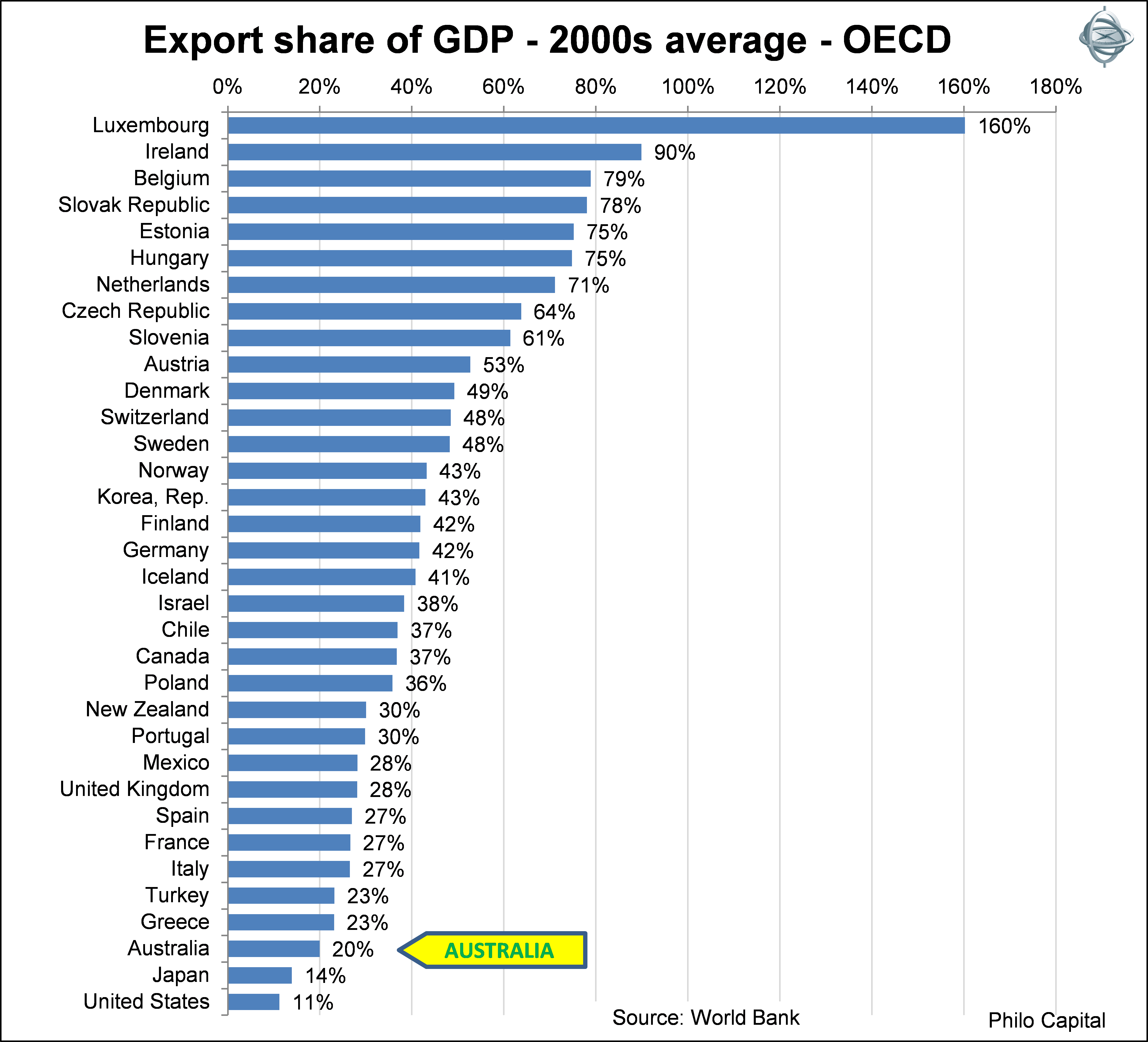

Australia is one of the smallest exporters in the world, ie one of the least reliant on exports for our national income. Out of the 200 countries in the world only six major countries export LESS than Australia as a share of their national income - Brazil, USA, Japan, Pakistan, Afghanistan and Colombia. There are also a few tiny countries that Australia does manage to beat as an exporter - including Tonga, Ethiopia and Rwanda.

Every other country on the planet exports more than Australia as a share of its national income. And that’s during our so-called ‘mining export boom’ (plus tourism, agriculture and the so-called ‘boom’ in services exports like education). There are numerous great exporting nations where exports routinely generate more than half of their national incomes from exports - a long list that includes Germany, Denmark, Belgium, Austria, Switzerland, Sweden, Netherlands, Ireland, Korea, Singapore, Malaysia, Thailand and dozens of others.

The first chart shows how the OECD countries rate on the measure of exports as a share of their national incomes, averaged over the years since 2000, which is the period of our so-called China-led export boom.

Even New Zealand beats us as an exporting nation by a big margin, and it doesn’t have anything like the abundance of natural resources we have. Even Greece exports more than we do!

The US and Japan have very low reliance on exports as a share of their national incomes. All the currency devaluations they can muster (and they are trying very hard) to boost exports will hardly make a dent on their overall economies because exports play such a minor role in them. Ask any American what America exports and to whom they export, and you will get blank stares. Exports don’t matter to Americans.

Ask the average Australian the same question and they will rattle on endlessly about China, iron ore, coal and perhaps even our agricultural exports, as being vitally important to the very survival of Australia’s existence as a nation. For some reason, the Australian media have blown the importance of exports to Australia out of all proportion to the point where it has no bearing on reality.

Exports mean even less to Australia’s overall economy than in the other non-exporters because our main export industries employ so few people. We dig up rocks and load them onto the nearest ship, wait around while other people in other countries make useful things out of them, then buy those useful things back at thousands of per cent mark-up, and pay for them with money borrowed from foreigners because we haven’t exported enough to pay for our imports.

That’s hardly a long term sustainable plan, but we’ve been doing it for over 200 years. Not even Australia’s proximity to growth markets has helped.

One may say that the great exporting countries like Denmark, Belgium, Netherlands, Hungary, Sweden, Norway, etc should have a natural advantage by being very close to the big export markets of Europe, but there are two great disadvantages with this. The first is that they must compete with the big industrial powerhouses like Germany and Austria which, thanks to the Euro system, have artificially low currencies in their favour. The second disadvantage is that Europe is the slowest growing region on the planet. Around 70% of the exports of European countries go to other European countries, but the whole of Europe is mired in recession and has suffered relatively slow growth for the past decade even before the GFC hit.

In contrast, only 10% of Australia’s exports go to Europe but 70% of our exports go to Asia - the fastest growing region with the lowest unemployment levels and greatest demand growth in the world. More than half of all humans on the planet live in Asia, and they account for 70-80% of the total global growth in demand and wealth.

And we have plenty of stuff Asians want, including billions of tons of rocks they use to make useful things out of, thousands of miles of pristine beaches they love to visit, millions of acres of farmland that produce food they like to eat, and dozens of funny-looking animals they love to photograph. We didn’t create or invent any of this stuff - the rocks, beaches, land and animals were all here when we got here. All we did was trip over them.

The so-called ‘tyranny of distance’ from export markets is only a problem if we export bulky goods like rocks or food. Likewise, tourism and education require people to travel here. Other countries aren’t blessed with our rocks, or beaches, or land, or our funny-looking animals, so they have to use their brains instead. In the post-industrial knowledge economy, knowledge and ideas can be transmitted around the world in fractions of a second, so physical distance from markets is irrelevant for real high value, high tech exporters.

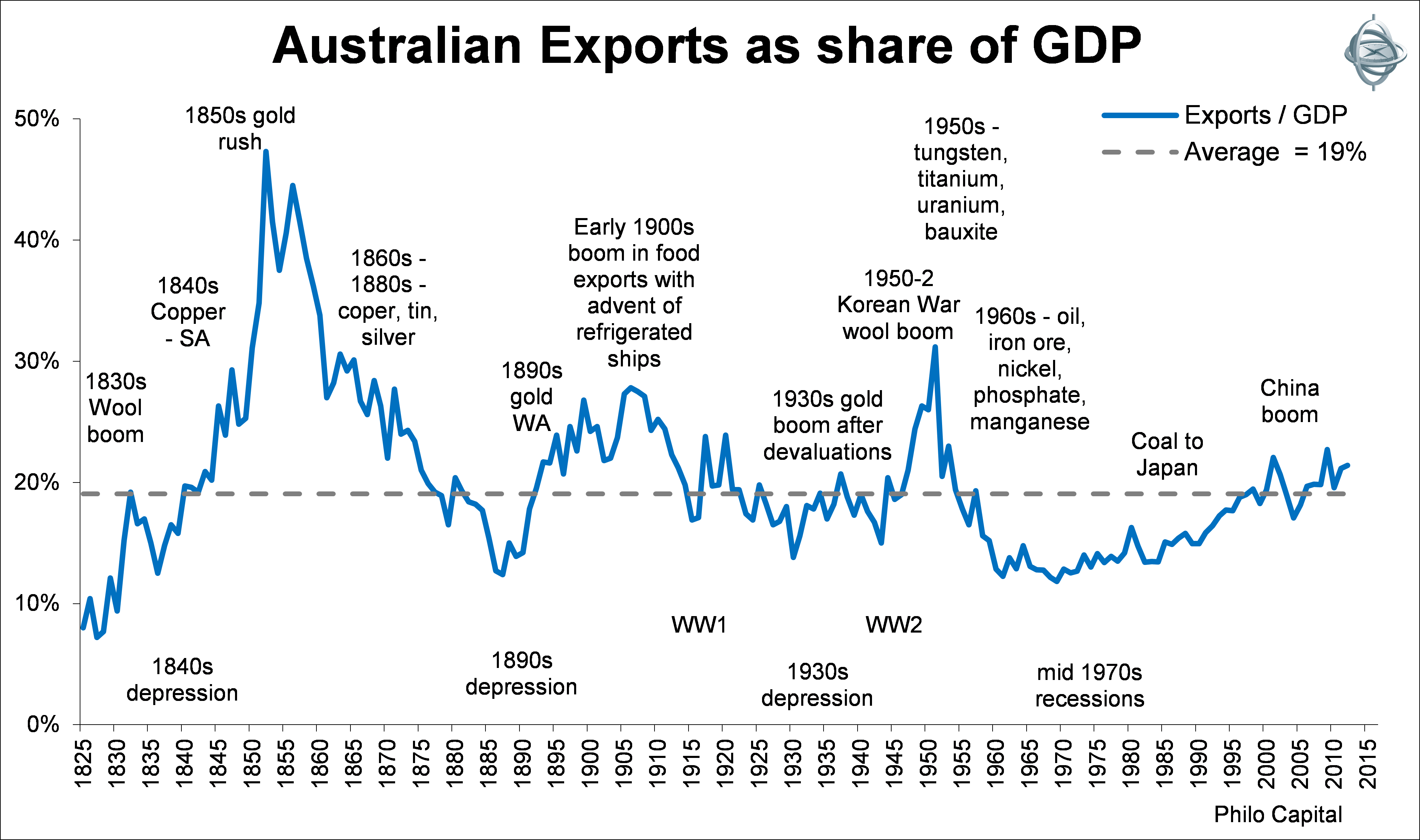

The reality is that Australia has never been a great exporter at any time in its history. Even in the 1850s gold rush, exports did not reach 50% of GDP (which dozens of countries exceed and have done for many years). Australia’s exports have only ever been near 30% of GDP a couple of times, and only for very brief periods.

The following chart shows Australia’s exports as a share of GDP since 1825 and indicates all of our export booms.

The so-called China export boom just lifted exports as a share of national income back to its (very low) long term average following the great export slump of the 1970s and 1980s. In fact the only times in our history when we were less reliant on exports than we are today was in the 1840s depression, the 1890s depression, the 1930s depression and the 1970s recessions.

Of course, a country doesn’t need to export at all. Its citizens can quite happily make and consume their own goods internally, as hunting and gathering societies did thousands of years ago. However, if we want to buy imports from other countries, we need foreign exchange, and we can only get foreign exchange by exporting.

Everything we do every day relies heavily on imports: the sheets on our beds when we get up in the morning, the clothes we wear, the furniture we sit on, the electronic gadgets we communicate with, the household appliances we use, the books we read, the TVs we watch, the cars we drive, and much of the food we eat. In fact most of what we see around us in our offices or our homes is imported or relies on imported machinery to produce. Just about the only thing we don’t import is the water we drink and the air we breathe.

We are addicted to imports and we have always had a chronic current account deficit problem. (The current account is essentially revenue from exports minus the cost of imports and net interest paid on foreign debt). We haven’t had a current account surplus since 1973, and before that one-off freak year, back in the Korean War boom in the early 1950s.

The problem for investors is that every couple of decades or so we have a mining ‘boom’, and for a short while mining companies dominate the stock markets. But the booms soon fade when supply catches up to and overtakes demand, substitutes are found, and prices fall. The excitement goes into hibernation for a couple of decades until the next ‘boom’.

Australia does have some world class companies that don’t rely on rocks but actually use their brains to compete and win on the world stage (such as CSL, News Corp, Orica, Amcor, Computershare, ALS, Ansell, Ainsworth). These companies are very few and far between, and because they are so rare they tend to be overpriced much of the time. But every so often their share prices fall to a point at which they become great value to buy.

Our local stock market is still littered with big, cosseted oligopolies that dominate virtually every domestic market segment - including banking, insurance, retailing, food, telecoms, gambling, gas, electricity, transport, airlines, and just about every other domestic industry in which listed companies operate. They are protected from real competition by the same ‘tyranny of distance’ and ‘high dollar’ they complain about.

Let us hope that our companies stop their endless bleating about the dollar and the distance, and get on with competing and winning in the knowledge economy where there are no barriers or distances or other excuses for a lack of vision.

Ashley Owen is Joint CEO at Philo Capital Advisers.