What an unbelievable couple of months! The non-essential parts of the Australian economy were shut down in a matter of weeks, as was the case in many other countries around the world, notably the US and UK. We are all dusting off the history books on the 1918 Spanish Flu pandemic and becoming part time virologists and epidemiologists!

To truly understand the unfolding crises, it’s critical to have the appropriate perspective on how things may unfold from here and hence inform decision making in a time of significant uncertainty.

No portfolio was positioned for a shutdown

March 2020 was an extremely volatile month as the reality of social distancing and other containment measures designed to 'flatten the (infection) curve' kicked in. Records were broken as markets swung wildly, oil was crushed and governments stepped up to the plate and injected record levels of stimulus aided by central banks who provided support to the plumbing of the financial system (credit markets) and used up their last remaining interest rate cut ammunition.

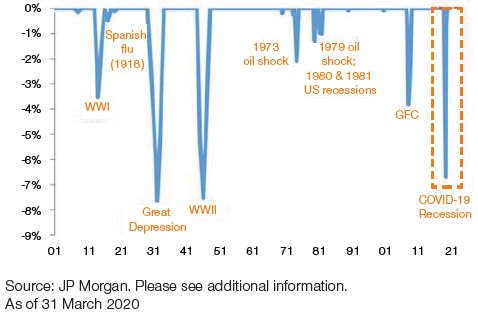

The figure below shows COVID-19 delivered one of the largest growth shocks in a century, but also the shortest. (The figure shows peak-to-trough change in global real GDP growth, negative indicates recessions, zero indicates expansions. Annual data pre-1970, then quarterly).

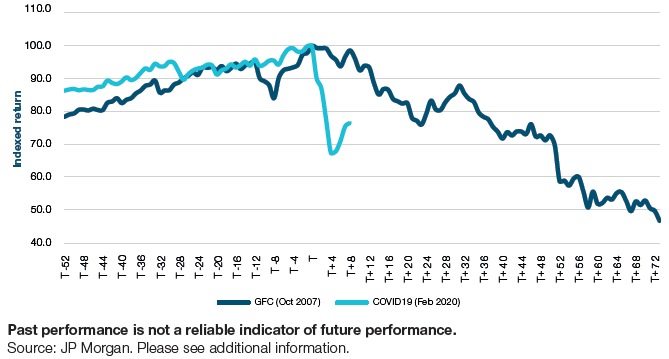

The fastest downward correction

The Australian market was no exception to this rapid fall, as shown below.

ASX 200: COVID-19 vs GFC, peak rebased to 100, as at 31 March 2020

Markets reacted to both the spread of COVID-19 and the containment measures designed to slow it (the health and economic crises are currently joined at the hip), which was basically to bring non-essential economic activity to a halt. It is fair to say that our view in early 2020 of a housing and stimulus-led domestic recovery, no longer holds.

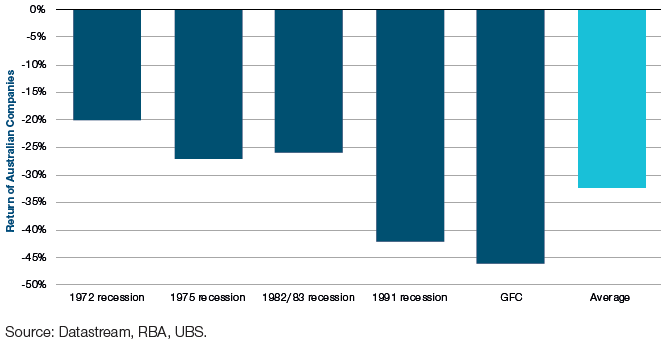

Containment measures are resulting in a sudden loss of revenue for Australian companies and downgrades are inevitable. However if history is a guide, the current -9% consensus downgrades since the peak are grossly understating the pain. On average since 1972, the peak-to-trough fall for earnings-per-share (EPS) in prior recessions has been closer to -30%.

Peak-to-trough EPS fall in prior recessions for Australian companies

Being approximately right, not precisely wrong

Within our Australian equity portfolio, we have always thought in scenarios. Getting a price and timing exactly right is an impossible target and definitely not practicable when building or reducing positions as part of managing an equity portfolio. Our approach is to be approximately right as opposed to precisely wrong.

Markets will recover when things stop getting worse, which relates to both the health and economic crises, but when is that? The framework for our modeling scenarios is based on three phases:

- Containment phase – social distancing and other containment measures to slow the spread of COVID-19 so as to not overburden the health care system. This is having a positive impact on the new infection rates (ie slowing) and we are almost through this phase.

- Hibernation phase – continuation of containment measures until a point where infections are 'under control', particularly community spread. How long this will be for is the big question and greatest uncertainty for markets.

- Recovery phase – gradual removal of containment measures. It is considered likely that some measures like social distancing are with us for some time, potentially until a vaccine is available. Whilst there will be a recovery, we don’t expect business as usual any time soon.

Markets should recover at some point between phase 2 and 3, particularly once confidence grows that infections are under control.

The recovery is likely to be a function of four key variables:

- Length of hibernation (how much economic damage)

- Containment measures in place (what level of activity and type of activity comes back)

- Size and duration of economic stimulus from Governments and central banks, and

- Psychological impact and behavioural change of businesses and consumers.

Portfolio management in this market

The benchmark of investment success will be the next 12 months as opposed to the next 12 weeks. We were active in March to reposition the portfolio to this new environment. We expect a potential strong divergence in stock performance over the next 12-24 months and see this as a market which will reward clear thinking of the path to recovery.

Portfolio activity snapshot:

Balance sheet tests – our first step in February was to assess the balance sheets and liquidity position of portfolio holdings and in particular the ability to withstand 3-6 months of little to no revenue. This led to us exiting several positions.

Investment market sensitivity – reduced positions in insurance and financial services. Declining equity markets, credit spreads blowing out, and other asset market falls hurt not only the earnings but can also impact the capital positions of financials.

Consumer – consumer activity and spend has halted. Reduced exposure to housing, retail and toll road infrastructure.

Beneficiaries – new positions in Fisher & Paykel Healthcare and Fortescue. The virus is creating strong respirator demand for Fisher & Paykel Healthcare, and Fortescue provides additional exposure to iron ore (in addition to Rio Tinto) where we expect iron ore to remain strong given China’s steel-intensive stimulus.

Quality growth opportunities – fear clouds the market’s judgement of quality, long-term growers. We increased our exposure to IT via potential long-term winners, as valuations sold off heavily. We also added IDP Education as it fell to its lowest valuation in over two years.

The path from here

We are currently heavily focused on what the shape of recovery could look like for stocks and sectors. We expect it to be different for various parts of the market, depending largely, on how the previously mentioned four key variables play out at a stock and sector level.

How you want to position your portfolio for a ‘V’, ‘U’ or ‘L’ shaped recovery is obviously very different.

In light of the strong market rally from the 23 March lows, we are expecting a wave of capital raisings as companies use this window of opportunity to manage debt and liquidity risks. We believe markets have and will provide liquidity to the deserving, but not all companies will be so lucky. Expect big earnings downgrades. We all know they’re coming, but how will markets react to the magnitude of downgrades some haven’t seen in their lifetime?

We expect more volatility but equally new opportunities. Our extensive experience from investing through previous crises (Asian Financial crises, Dot-com Bust, GFC), strong focus on quality growth companies driven by our fundamental research, and insights from our global research platform position us well to seek to generate strong performance in the long term despite the short-term uncertainty of current events.

Randal Jenneke is Head of Australian Equities and Portfolio Manager at T. Rowe Price Australia. This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision.