In a tough year for most investors, even Warren Buffett had a mixed year by his standards. The share price of his Berkshire Hathaway (BRK.B) investment company inched forward by just 2.5%, lagging major US benchmarks like the S&P 500.

Top holding Apple (AAPL) had a stellar year and an investment in data IPO Snowflake (SNOW) proved an immediate hit. But there were a number of misses too, with investments in US banks and financial services proving costly.

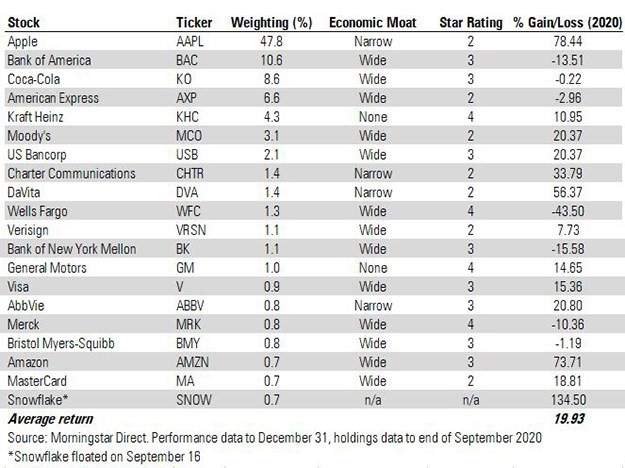

Let's take a closer look at his portfolio:

What worked

We covered the Sage of Omaha from a range of angles last year: Morningstar columnist John Rekenthaler analysed Buffett’s predictive powers, in December we dug into Berkshire Hathaway’s portfolio and in June Susan Dziubinski picked out three potential buys from the portfolio following the spring 2020 crash.

Looking in-depth at the portfolio, there were some strong performances from the likes of Apple and Amazon (AMZN), whose shares were 70% higher at the end of the year. But the standout performer in 2020 was new holding Snowflake, which floated in September at $120 and closed the year 134% higher at $281. The investment was particularly notable as value investor Buffett typically rejects the 'hooplah' associated with IPOs. Indeed, the last time he bought a newly listed company was Ford motor company in 1956.

So what were the biggest changes to the Buffett investment portfolio in 2020?

Healthcare was one of the boom areas of 2020 so it was no surprise to see an increased weighting to these stocks last year. In the third quarter of 2020, the portfolio added to positions in Abbvie (ABBV), Merck (MRK) and Bristol Myers Squibb (BMY) - the trio now accounts for 2.4% of the portfolio's assets between them.

Of these, only Abbvie posted a positive return for the year, up 20%. Merck, meanwhile, is one of four companies in the portfolio rated as undervalued by Morningstar analysts with a 4-star rating (the others are food giant Kraft Heinz (KHC), bank Wells Fargo (WFC), which fell nearly 45% last year, and US car firm General Motors (GM)). The position in Wells Fargo was reduced in 2020, as were stakes in Bank of New York Mellon, Visa, Mastercard and US Bancorp.

Merck is also one of two companies in the portfolio's top 20 positions to have a wide economic moat, an important concept gauging competitive advantage for Warren Buffett and Morningstar. General Motors and Kraft Heinz are the only stocks in the list with no economic moat, while Snowflake does not yet have a Morningstar rating.

The trouble with Berkshire

How do you measure Warren Buffett’s performance? A conventional investment portfolio with 50% exposure to Apple would have done very well in 2020. The average share price gain for the biggest holdings in the portfolio is just below 20% (see table), which beats the S&P 500’s gain of 15% for last year.

But things aren’t that simple: Berkshire Hathaway has many facets and while the investment portfolio gains investor attention because of Buffett’s status, it’s also part of a much wider empire.

Berkshire Hathaway Energy and its railway subsidiary BNSF, for example, were hit hard in 2020. The manufacturing, services and retail (MSR) arm, with holdings in metalworking companies and aircraft parts suppliers, has also been damaged by the pandemic. And exposure to insurance has weighed on performance, with much higher payouts last year in the industry as a whole.

But Berkshire Hathaway B shares are now undervalued, according to Morningstar analysts, and retains its wide economic moat. The company could come under pressure to return more of its cash mountain to shareholders this year after a lacklustre 2020 in share price terms.

Berkshire is not easily compared with an index or a conventional investment fund. While the Berkshire Hathaway share price barely moved the needle last year, Morningstar analyst Amy Arnott says the Buffett magic keeps retail shareholders loyal:

“The legions of investors who still count on it as a quasi-fund for their life savings likely aren’t complaining.”

Now 90, Buffett has handed the running of his equity portfolio to former hedge fund managers Todd Combs and Ted Weschler, who run $30 billion between them. After the portfolio’s surprise (and highly lucrative) punt on Snowflake towards the end of last year, Berkshire investors could see further unexpected developments this year. And with value investing making a tentative comeback and the real economy recovering, these conditions could be more favourable to Buffett’s approach of buying unloved stocks.

James Gard is content editor for Morningstar.co.uk. This article is general information and does not consider the circumstances of any investor. Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar.

Register for a free trial of Morningstar Premium on the link below, including the portfolio management service, Sharesight.

Try Morningstar Premium for free