International Women’s Day represents a moment where, among many other things, it’s appropriate to consider the extent to which the historical gaps that women have faced in investing and financial matters are being addressed. Findings from researcher Investment Trends shows that females are joining the active online investor population in Australia at increasing rates, but there’s a long way to go before we reach parity.

Online brokers improve access

Online brokers have allowed a large number of Australians to take control of their investing by providing easy access to direct equities and ETFs. The good news is that there has been a significant increase in the number of female online investors over recent years, with their numbers doubling from 76,000 to 150,000 between 2013 and 2018. More women are building their wealth and moving towards an independently secure financial future, but even with this strong growth, women still represent only 20% of Australia’s online investors.

ETFs are also playing an important role for female investors. Among the Australian online investor population, the proportion of females who invest in ETFs increased more than threefold in the last five years from 7% to 25%. To put the popularity of ETFs into perspective, the proportion of females who invest in managed funds has remained steady at 18% over the same period. Clearly the ability of ETFs to provide convenient, low cost access to a diversified investment portfolio resonates strongly with female investors across Australia.

Our latest research also reveals the importance of ESG factors to female investors. When it comes to their investment selection process, 29% of women say it is ‘very important’ that their portfolio contains companies that have good ethical, social, environmental and governance standards (vs 19% for male investors). This preference increases with age, with 34% of retired women seeking strong ESG performers in their portfolio (vs 19% for retired males). The growing number of ESG investment products in Australia means all investors who want these issues embedded in their portfolios will have more choices that meet their investment philosophy.

Readiness for retirement

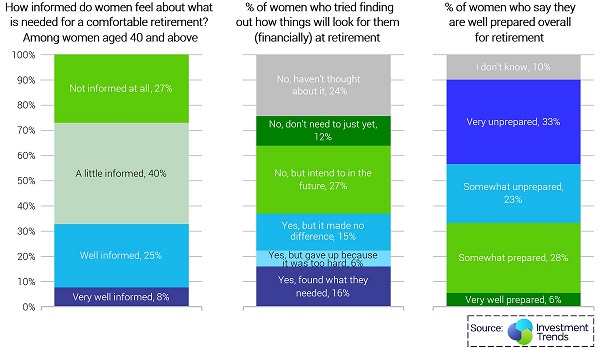

We also have data on retirement on how well-informed women feel, and the proportions of women who say they are well-prepared, as follows.

Australians have access to a vast range of online tools and resources to learn about investing and money matters, but they want more. Given the mounting challenges faced by Australians in building their wealth, planning for their retirement, and affording a reasonable lifestyle throughout their retirement, it is vital we lift financial literacy levels and retirement preparedness across the country.

Women live longer, creating financial anxiety

It is also vital that the industry delivers products and services that meet the needs of older Australians, and particularly older Australian women. With only 22% of Australians aged over 40 saying they are confident they can fund the lifestyle they seek in retirement (14% among women), an ever-widening gap in confidence and affordability exists. As Australians live longer than many planned, and as women continue to outlive their partners, this need will continue to intensify, creating enormous financial anxiety at times when stress is already high.

While more women are investing and taking control of their financial future, the gap between the independent financial security of men and women remains too large. The wealth management industry needs to increase its focus on delivering products and services that work for women, and work for them at every stage of their life – young, middle aged or mature; single, partnered or widowed.

Suzie Toohey is Global Head of Client Service and Sales at Investment Trends.