Last week, I wrote an article on ASX stocks that you could buy and hold forever. A subscriber suggested a follow-up article on stocks for people who want dividends which can see them through retirement. Here is my attempt to deliver on that.

I’m going to focus on stocks that can provide sustainable, growing dividends over a 10-year period. This way, it’s not just applicable to retirees but for anyone who needs a reliable income stream over the long-term.

This article has a different emphasis to the previous one. Last week’s article was about stocks that you could own forever, while this week is adopting a shorter timeframe of 10 years. That matters because owning a stock indefinitely means you must be confident that a company will be around forever, and that they can continue to grow earnings too. That criterion is loosened considerably when applying a shorter timeframe, as per this week.

Also, last week was a wish list of companies that you could buy at some point in the future. This week has a list of stocks that could possibly be bought now. I figure that people who need regular income need it right away. Because of this, unlike last week, I have taken valuation into consideration when choosing the stocks for this list.

The criteria

My goal for the dividend stocks is that each of them should provide resilient annual income and perform better than the ASX 300 index including franking credits over a 10-year period. The index has historically returned about 10% per annum including franking credits. However, this has been helped by considerable tailwinds for the biggest index weights, including a 40-year credit growth boom for banks and, more recently, an iron ore surge for the major miners. Consequently, index returns are likely to be lower going forwards.

Therefore, the objective for each of our dividend stocks is to produce steadier annual income than the index and provide +8.5% total returns per annum including franking credits over the next decade.

Here are the criteria for the list of stocks to achieve that goal:

- In the ASX 300. Ideally, you want to own well-established firms that have some history of success. The smallest company in the ASX 300 has a market capitalization of under $600 million. This criterion then excludes small caps and includes mid and large caps.

- Durable earnings and dividends. If you want regular income from stocks, you need reliable dividend payments. A stock that pays out $1 of dividends in one year, and then 25 cents the next, won't meet this goal.

- Growing earnings and dividends. Ideally, you want a company to turn their dividend of $1 in year one into $2 or more by year 10. To do this, a stock needs to be able to grow earnings over time, as dividends ultimately come from profits.

- Sustainable dividend payout ratio. The payout ratio refers to the percentage of earnings that are paid out in dividends. If a company is paying out 120% of profits in dividends, that’s not sustainable through time.

- Economic moats. For companies to grow earnings and dividends, it helps if they have economic moats. Moats are sustainable competitive advantages. They help companies defy the laws of capitalism which suggest that businesses which have high returns of capital will have these returns competed away. Competitive edges can come from many things including network effects, intangible assets, cost advantages, switching costs, or efficient scale. You can find out more about moats here.

- Sound balance sheets. It’s good to own companies that don’t rely on too much debt to generate returns. Excessive debt makes companies fragile, which can ultimately impact earnings and dividends.

- Reasonable/undervalued price. It’s unwise to ignore valuations when buying stocks, even for dividend purposes. For instance, if you buy a stock on a 50x price-to-earnings ratio and that ratio goes down to 15x over a decade, you’ll nurse a large potential capital loss, which is likely to more than offset any dividends paid throughout the period.

One thing to note is that we’re not just looking for high dividend yielding companies here. Yields can be deceptive if dividends are cut in future. Ideally, the dividends need to be sustainable, and growing.

What doesn’t make the list?

Mining stocks are notable absentees from the list. This may seem odd given many of these stocks currently sport high dividend yields. The problem is that these dividends aren’t reliable and therefore most of these companies don’t pass the second criterion.

Mining companies are highly dependent on commodity prices, which are notoriously volatile. That makes the earnings and dividends from these companies volatile too.

Even giants such as BHP don’t pass the second criterion. For instance, the company paid total dividends per share of $4.64 in 2022. A year later, that dividend had been cut 43% to $2.61 a share. It’s certainly not the first time that’s happened with BHP and won’t be the last.

The other notable absentees are great companies that could strongly grow future dividends yet are too expensive at current prices. The likes of Cochlear, The Lottery Corporation, and Transurban fall into this category.

The list

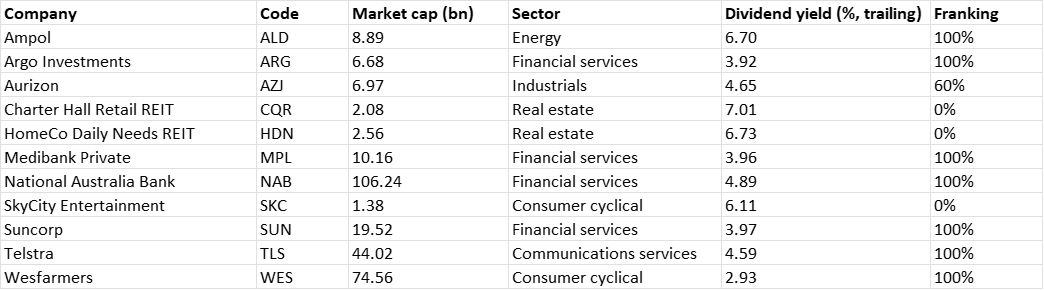

Here is my list of the best 11 ASX stocks to hold for income over the next 10 years:

Let’s go through the companies one by one:

Ampol (ASX:ALD)

The company is a fuel refiner and petrol station owner. Most investors see it operating in a sunset industry, yet the beauty of sunset industries is they discourage competition and often encourage consolidation. That is what’s happened here, and it’s likely to result in growing margins on both the retail and commercial/wholesale sides of their business. The stock has had a good run but still looks reasonable value, with a healthy 6.7% dividend yield.

Argo Investments (ASX:ARG)

A listed investment company with a long history of decent performance, shareholder friendly policies, and growing dividends. The beauty of LICs is that they can retain some of their profits to smooth out dividend payments through time.

Aurizon (ASX:AZJ)

This company has had its ups and downs though it may finally be getting its act together and its rail assets remain attractive. Rail has an enduring cost advantage over road transport for bulk commodities. The downside of Aurizon is that it is over-reliant on coal. However, this reliance will reduce over time, and should hopefully be less of a concern. I expect its earnings and dividends to grow nicely from here.

Charter Hall Retail REIT (ASX:CQR)

The property sector has been in the dumps but this one stands out for being resilient through different cycles. CQR owns $4 billion in neighbourhood retail assets, and some petrol stations. The retail assets are principally local supermarkets, with 5-10 tenancies around them, such as pharmacies, butchers, newsagents etc. Dating back 20 years, the occupancy for its portfolio has been remarkably resilient, between 97.5% and 98.5% the entire time. This is due to the quality of the anchor tenants - including Woolworths, Coles, Aldi, Ampol and BP – who account for 60% of rents. The stock remains at a steep discount to its net asset value and offers a 7% dividend yield, albeit unfranked.

HomeCo Daily Needs REIT (ASX:HDN)

This is the other REIT that I like. It’s headed by David Di Pilla, the canny former investment banker who recently put together the Sigma and Chemist Warehouse deal. HomeCo comprises a national portfolio of 51 properties, including neighbour retail assets, large format retail (think household goods) and health and services. The portfolio is 99% leased, and the largest tenants are Wesfarmers, Coles, and Woolworths. The stock should benefit from strong population and ecommerce growth, and significant potential upside comes from future development of its unused landbank.

Medibank Private (ASX:MPL)

With an ageing population, higher demand for healthcare will put pressure on the public health system. That makes private health insurers such as Medibank an attractive opportunity. Yes, Medibank operates in a heavily regulated industry where premium increases must be approved by government, but steady, growing profits seem assured, and dividends along with it.

National Australia Bank (ASX:NAB)

The best days for Australian banking may be behind it, but that doesn’t mean well run banks can’t deliver strong dividends going forward. NAB is my pick of the bunch to provide steady income and total returns that at least match the indices. It’s well managed, inexpensive, and offers a 4.9% net yield, fully franked.

SkyCity Entertainment (ASX:SKC)

This one may surprise people as casino stocks remain in the sin bin. Yet, SkyCity’s earnings and dividends will soon recover after being depressed by Covid and regulatory issues. Its economic moat comes long dated and exclusive casino licences in Auckland and Adelaide. The stock is really cheap, and I expect strong total returns, as well as dividend growth, going forward.

Suncorp Group (ASX:SUN)

With the imminent sale of Suncorp Bank to ANZ, SUN will become an insurance pureplay. Insurance is currently attractive with healthy pricing and growing investment earnings from higher bond yields, among other things. With the sale, there are also expectations of future capital returns.

Telstra (ASX:TLS)

Telstra is a market leader, with a strong competitive advantage, recurring earnings, good dividends, sound management, and is resilient to economic downturns. Importantly, it’s an industry that's inproving and becoming more rational. The company has started to grow its dividend again, and I think it’s a keeper.

Wesfarmers (ASX:WES)

Retailers don't usually make good dividend stocks as theri earnings and dividends are vulnerable to economic downturns. Wesfarmers is different as the bulk of its earnings comes from Bunnings. Bunnings has scale, an economic moat, and some growth to power Wesfarmers long into the future. The key risk with this stock is if the management uses the cash from Bunnings to diversify into lower returning industries. I am closely watching the Lithium push on this front. While Wesfarmers doesn’t have a high dividend yield, I expect a growing income stream over time.

A final word

Obviously, the list doesn’t consider your personal circumstances and portfolios. Seek advice if you need it.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au.