In his letter to shareholders in 2022, Warren Buffett, identified two stocks that he expects Berkshire Hathaway to own forever: American Express and Coca-Cola.

In this year’s letter, he elaborates on this. “When you find a truly wonderful business, stick with it,” he writes. “Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable.”

Buffett goes on to identify other businesses that he thinks Berkshire will own forever. They include Occidental Petroleum, and five large Japanese conglomerates - Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo. Buffett likes Occidental for its vast oil and gas holdings and market-leading carbon initiatives, and the Japanese businesses for their capital allocation and management skills.

It got me thinking about which ASX stocks that investors could buy and hold forever.

The criteria

It’s not an easy task. First, you must be confident that a company can last for a long time. After all, the average company in the S&P 500 has a lifespan of close to 20 years, and for the ASX, it’s unlikely to be much different. It rules out a lot of companies. For instance, ones that rely on a single drug for their success, those which have mines with finite lives, and stocks that are so big already that it makes growth difficult (something which Buffett highlights about Berkshire in his letter).

Second, it’s not just about longevity. You want to own stocks that will perform at least in line with or better than the indices. Otherwise, there’s not much point in buying them and you may as well own a broad index ETF instead.

I’ve come up with the following criteria to try to identify the ASX stocks that can be held indefinitely:

- Part of the ASX 300. Ideally, you want to own well-established firms that have some history of success. The smallest company in the ASX 300 has a market capitalization of under $600 million. This criterion then excludes most small caps and includes mid and large caps.

- Long runway of growth opportunities. This is key. It knocks out most companies in the ASX 300. For instance, ones that are mature and focus on Australia, thereby limiting growth options. Also, those that have short-lived assets. It means leaning towards companies that have global operations, and/or large markets to operate in.

- Economic moats. Moats are sustainable competitive advantages. They help companies defy the laws of capitalism, which suggest that businesses which have high returns of capital will have those returns competed away. Competitive edges can come from many things including network effects, intangible assets, cost advantages, switching costs, or efficient scale. You can find out more about moats here.

- Good returns on capital. If I had to name one metric to identify a quality company, it would be return on capital. Put simply, it’s the profits that a stock makes from the equity and debt that’s put into the business.

- Sound balance sheets. Ideally, you want to own companies that don’t rely on too much debt to generate returns. Excessive debt makes companies fragile.

- Don’t rely on exceptional managers to succeed. Having good managers in place certainly helps. But if you’re going to own a stock for a long time, it can’t be reliant on one or two managers to succeed. The business needs to be so good that it doesn’t need an exceptional CEO.

- Unlikely to be disrupted. This overlaps with other criteria, though is worth adding. When you buy a company for the long term, you are essentially betting on things that won’t change. For instance, for Buffett, he foresees that people will still be drinking Coca-Cola in 100 years, they’ll still need credit cards, and they'll need energy to power their daily lives.

It’s an extensive list of rules, though necessary given the purpose is to find the best businesses and own them indefinitely.

Note that the criteria doesn't include valuation. The list is of quality companies that are worth buying at some point in future, though not necessarily right away.

What doesn’t make the cut – banks, miners, supermarkets

I realise that the exclusions from my list are likely to be as controversial, if not more controversial, than the inclusions. Let’s first go through some of what I’ve excluded and why:

- The 4 major banks. I haven’t included any of the banks in the list. There are several reasons for this. First, there are limited growth opportunities for them as they’re almost exclusively focused on Australia. Second, they’re reliant on credit growth, which has had a stupendous 40 years that’s unlikely to be repeated in the next 40. Third, they rely on the housing market, where the future again is unlikely to be as rosy as the past. For these reasons, my view is the banks will struggle to beat indices over the long term.

- The major miners. BHP and Rio Tinto don’t make the list. Size is a major factor as it requires massive investments and returns just to move the needle for these behemoths. Also, mining is highly cyclical and capital intensive, which limits returns in the long term. Finally, the tailwind from Chinese infrastructure and property is over and that will make it harder going for iron ore in future.

- Woolworths and Coles. Yes, these grocery retailers operate in an oligopoly, but they’re in a mature market with limited growth prospects.

The list

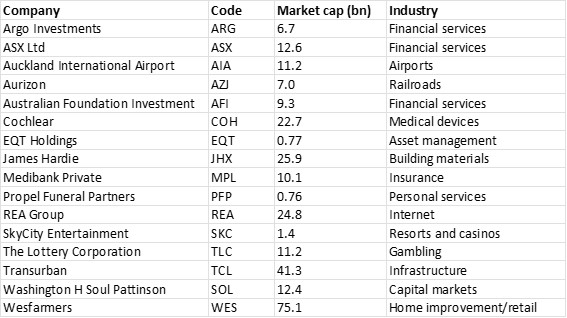

Here is my list of ASX stocks that you could hold forever:

Source: Morningstar

Let’s go through them, one by one:

Argo Investments (ASX:ARG)

One of two listed investment companies (LICs) in the lineup. Argo has a long, storied investment history. It’s managed to provide healthy returns with low costs and conservative management.

ASX Ltd (ASX:ASX)

Stock exchanges are incredible businesses. They are essentially like gatekeepers to trading securities. That makes them asset light, high return businesses. There are avenues for growth via data and technology too.

Auckland International Airport (ASX:AIA)

Airports are generally fantastic businesses as they’re often monopolies with pricing power. With Sydney Airport no longer listed (a shame), Auckland International Airport is the next best thing. It relies on airport traffic and more broadly, New Zealand being a destination that people want to visit.

Aurizon (ASX:AZJ)

This one is subject to debate. I like rail assets. Rail has an enduring cost advantage over road transport for bulk commodities. The downside of the industry is that it requires huge investment, and that limits returns on capital. With Aurizon, it’s also over-reliant on coal. However, this reliance will reduce over time, and should hopefully be less of a concern.

Australian Foundation Investment Company (AFIC) (ASX:AFI)

Another LIC that’s been around for a long time. It has a proven history of decent returns with shareholder-friendly policies. The best part about LICs such as AFIC and Argo is that they pay consistent, growing dividends over time.

Cochlear (ASX:COH)

This stock is a more controversial inclusion than most would think. Healthcare companies reliant on devices or drugs are subject to potential disruption. Just ask ResMed. Cochlear’s hearing implants do seem to have greater barriers to disruption. And the company continues to invest and innovate their products to stay ahead of the game.

EQT Holdings (ASX:EQT)

EQT is one of the two big players in trustee services. The other is Perpetual, where a number of suitors are lurking, primarily attracted to its trustee business. EQT has been around for 135 years and is exceptionally well connected, with a who’s who of people who’ve served on its board. It also benefits from tailwinds of growing wealth in Australia and an ageing population. It’s a keeper.

James Hardie (ASX:JHX)

Since it pioneered the development of fiber-cement technology in the 1980s, it’s dominated the fiber-cement siding category for houses in the US and Australia. It has a long runway of growth and an economic moat based on brand and scale that should keep competitors at bay, resulting in above average returns for decades to come.

Medibank Private (ASX:MPL)

With an ageing population, higher demand for healthcare will put pressure on the public health system. That makes private health insurers such as Medibank a no-brainer in my opinion. Yes, it operates in a heavily regulated industry where premium increases must be approved by government, but steady, growing profits seem assured, unless management does something silly.

Propel Funeral Partners (ASX:PFP)

There’s a lot to like about the funeral industry (the businesses, not the services). A growing population means steady growth in deaths. And the industry remains highly fragmented, leaving plenty of room for consolidation for the likes of Propel. Consolidation of industries has historically provided some of the best returns on the ASX and elsewhere. Hopefully, Propel doesn’t get acquired like InvoCare.

REA Group (ASX:REA)

Owns realestate.com.au – the premier online listing platform for Australian residential real estate. Even during the downturn in listings in 2022, it was able to substantially lift pricing – which demonstrated its immense pricing power and moat. In the top three business on the ASX, in my view.

SkyCity Entertainment Group (ASX:SKC)

How can I pick a casino operator after the recent shenanigans at Star and Crown? Well, SkyCity has long-dated and exclusive licences in Auckland and Adelaide. Unless they operate in the appalling ways of their competitors, their monopoly assets should continue to generate nice, long-term returns.

The Lottery Corporation (ASX:TLC)

The company has a near-monopoly on long-dated licences across all states and territories, except Western Australia. Though it’s a mature business, it has considerable pricing power and should deliver steady and sound returns for a long time to come.

Transurban (ASX:TCL)

It owns long-term toll roads in Australia and around the world. A superb business as any car owner can attest too. Yes, the toll roads are subject to expiries, though Transurban has the scale to retain the roads and buy more. Government scrutiny and intervention are the main risks for this stock.

Washington H Soul Pattinson (ASX:SOL)

This is a family-owned conglomerate that’s proven its chops over a long period. It has large stakes in Brickworks, TPG, and New Hope Corporation. And it’s expanding in areas such as aged care and financial services. The company’s edge comes from its investing prowess. The risk is that Robert Millner isn’t getting younger and those that follow may not be as canny. However, the management team he’s put in place appears capable of handling the company when he retires.

Wesfarmers (ASX:WES)

Wesfarmers is the only top 10 ASX company in the list. Warren Buffett famously dislikes owning retailers, and there are good reasons for that. They operate in very competitive industries, can be cyclical, and sometimes faddish. Wesfarmers is primarily a retailer as that’s where ~80% of earnings come from. The bulk of it is from Bunnings, and it’s this division that makes Wesfarmers a worthy inclusion. Bunnings has scale, an economic moat, and some growth to power Wesfarmers long into the future. Bunnings managed to see off Masters and it’s difficult to imagine another competitor coming into the hardware industry at scale. The risks in owning Wesfarmers are if it gets complacent with Bunnings and lets standards slip, and more so, if management uses the cash from Bunnings to diversify into lower returning industries (the jury is out on its lithium push).

What wasn’t considered

There are several things that weren’t considered when compiling this list. The most notable is valuation, as noted above. Blindly buying quality companies without regards to valuation isn’t the best strategy. Waiting for a hiccup to buy into such stocks is a better course of action.

For instance, James Hardie was hammered in 2022 when there were fears about a US recession and the impact that might have on the housing market. That proved a buying opportunity as there was nothing wrong with the company, it was the economic environment that was driving a steep fall in price. The stock has since bounced back hard as recession fears abated.

The list above also doesn’t consider an investor's personal circumstances and portfolios. If you want a portfolio for dividend income, then that would require different criteria and an alternative list of companies.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au.