Superannuation was introduced to assist people to save for their retirement. In exchange for locking some money away for the future, Australians are given some attractive tax concessions. Employers are legally obliged to pay 9% of an employee’s salary into super, and in order that self employed people are not disadvantaged, they can claim a tax deduction on super contributions up to the annual limit (currently $25,000).

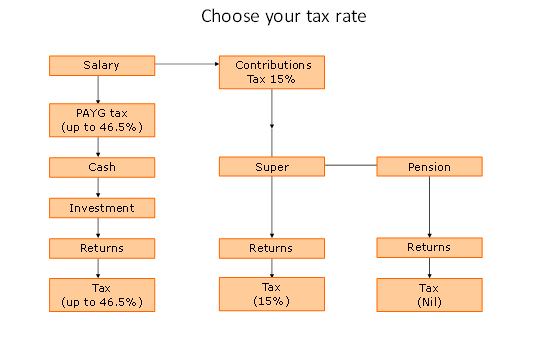

Superannuation has some powerful tax features:

- pre-tax contributions (from employer and salary sacrifice) are taxed at 15%, and after-tax contributions (from other sources like a bank account) have zero contributions tax.

- performance returns generated by the super account are taxed at a maximum of 15%, and at retirement when you convert your super from the ‘accumulation’ phase to the ‘pension’ phase, there is no tax on performance returns.

One way to represent this is:

When you reach the age of 60, there is no tax on your superannuation account. However, there are trade-offs. You are not able to make lump sum withdrawals from super until you meet a ‘condition of release’. Usually, this is when you either permanently retire or reach age 65, whichever comes first. For some, the permanent retirement condition is age 55 to 60, depending when you were born.

Super and financial planning

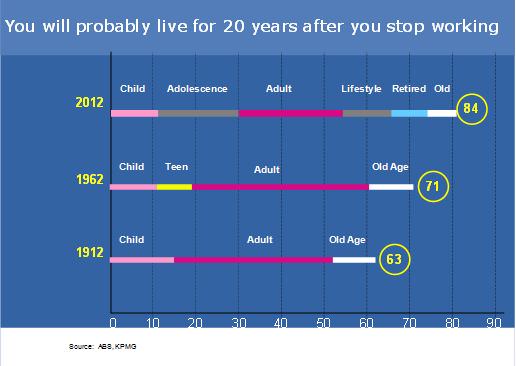

The chart below gives an idea of how our lives have changed over the last 100 years. In 1912, your probable future was fairly simple. You went to school, you got a job, you got old and you died.

It’s a completely different story now. Not only can you reasonably expect to live till you are at least 84 (and maybe much longer), but the chances are that you will spend more than 20 years in retirement after finishing work. The key messages are that you need to start planning now and you need to understand how super can help.

I don’t know how many times I’ve heard someone complain about the performance of their super, and tell me that they’d rather have the cash. There are two key points to note:

- Superannuation is a disciplined way of accumulating money. When I was a kid, I had a money box where all the spare change went. I didn’t think about the ‘return on investment’, I thought about the money I was saving. It was amazing how much was in that box when I eventually counted it. It helps to view your super in this way.

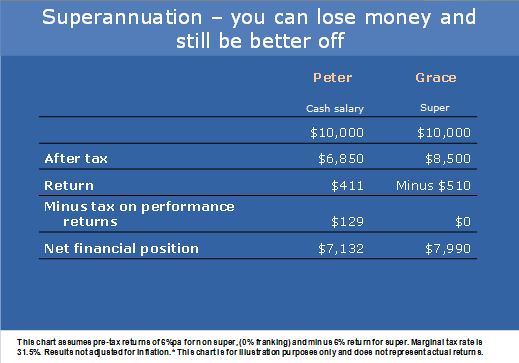

- Superannuation contributions are tax effective. Let me give you an example. Peter and Grace both qualify for a salary bonus. Peter doesn’t like super so he takes the bonus in cash and puts the money in a term deposit that pays 6% interest. Grace asks her employer to contribute the bonus to super. One year later, Grace’s contributions have delivered a minus 6% performance return. If both Peter and Grace pay tax at 30% plus Medicare, who has more money at the end of the year?

As you can see from the chart below, Grace has 12% more money than Peter.

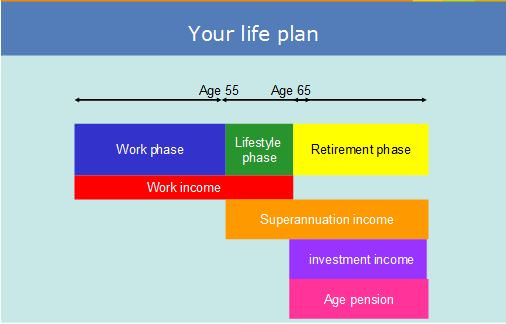

Transitioning to retirement

It’s a reasonable assumption that more people will end up working part-time. In the first place, most people will not have accumulated sufficient money to be able to retire comfortably for longer than 20 years. Secondly, it suits employers to employ part-timers and contractors as it is a more flexible way of controlling their wages bill.

This brings us to an innovative part of superannuation – the ability to convert your super to a pension whilst you are still working. This means that you can choose to work fewer hours, and top up your lost income by drawing down from your pre-retirement pension.

As you might expect, there are limitations. Firstly, you have to be 55 or older to take advantage.

Secondly, you must withdraw between 3% and 10% of the account balance each year, and up until age 60 this pension income is taxable. However, you will receive a 15% tax rebate which reduces the tax.

Once you reach 60, any withdrawals, income, capital gains and pension payments become tax free. When you retire completely, the pre-retirement pension converts to a normal retirement pension, and there are no limits to the amount that can be withdrawn.

Making ‘after tax’ contributions to super

Many people are aware of the $25,000 pre-tax contributions limit but are unaware that they can make substantial ‘after-tax’ contributions as well.

After-tax contributions (called ‘non concessional’ contributions) have an annual limit of $150,000 per annum, but an averaging policy means that you can put in $450,000 in any one financial year by using up the next two years’ allowance. Non concessional contributions have several benefits:

- there is no contributions tax

- performance returns are taxed at a maximum of 15%

- once you meet a condition of release, there is no tax on withdrawals

- when you die, non concessional contributions are inherited tax free by non dependants.

Spouse contribution splitting

Most people are not aware that one spouse can transfer up to 85% of last year’s pre-tax super contributions to the other spouse. Only the previous financial year’s contributions can be transferred, and you must do it before 30 June of the following year. For example, say one spouse made $25,000 pre-tax contributions in the 2012 financial year. Between 1 July 2012 and 30 June 2013, they could request their super fund to transfer $21,250 to their spouse’s super fund. No additional tax is payable on the transfer.

This is a useful strategy in two instances:

- Transferring a younger spouse’s contributions to an older spouse brings forward the accessibility of these contributions.

- Transferring an older spouse’s contributions to a younger spouse may enable the older spouse to claim some age pension in some circumstances.

Superannuation has many nuances and complexities, but understanding these basics will go a long way to helping investors make the most of their superannuation opportunities.