Investors tend to focus predominantly on investment capabilities and operational strength when assessing whether to engage or retain a fund manager. These are important factors, but something often overlooked is alignment, or the extent to which fund managers, acting in their own interest, can also act in the best interests of their investors.

Attention to fund manager alignment is part and parcel of good governance. As an investor, you want to know to what extent the two of you are ‘in the same boat’ – whether your partner is shoulder-to-shoulder with you or is paddling broadly in the same direction but from a separate vessel. The difference becomes most evident when the waters aren’t smooth.

We identify three key parties:

- funds management firm (including the owners)

- portfolio managers and investment staff

- investors (including advisers).

Biologists might call this scenario ‘obligate disjunctive symbiosis’, where two or more species live separately but depend on each other for survival. Each party does not necessarily benefit equally, although that is surely a worthy goal for a successful long-term relationship.

Benefits of alignment

To quote Charlie Munger of Berkshire Hathaway fame: “Show me the incentives and I’ll show you the outcome.”

Incentives drive human behaviour and we underestimate them at our peril. It’s not that the majority of fund managers don’t fundamentally want to deliver good outcomes for their clients. Rather, Munger’s quote highlights the importance of embedding a natural proclivity for that to happen.

The right alignment structure:

- motivates the investment team to ‘go the extra mile’ to the benefit of all parties

- creates an atmosphere where there is less second-guessing as to what the other party is doing and what their motives are

- should result in less fund manager switching over time. Changing managers is typically costly, time-consuming and subject to transition risk – in short, where possible it is best avoided.

Steps to improve alignment

Co-invest for success

Assume you have a large amount of money to invest. Would you want your portfolio manager to have a significant amount of their own money similarly invested or not have that sort of skin in the game? Why would they not invest in the same product?

A significant co-investment supports the notion that the manager is going to actively manage the risks in addition to pursuing as much upside as possible.

It’s more the exception than the norm to see disclosure details on co-investment, but it does happen. To quote an actual factsheet of an equity manager: “The portfolio manager has $100,000 invested in the fund, and staff have $1.5 million invested in the fund, as at quarter-end.” We can make a judgement call as to how meaningful such amounts are to the staff concerned.

Share a mutual timeframe

As an investor, do you have a long-term investment mentality and have you discussed it with your fund manager? A lot tends to get assumed.

If a portfolio manager detects that his/her client base is likely to react to short-term outcomes, they are not encouraged to make longer-term strategic decisions that may well be in the best interest of clients. Good investments often require patience and a side benefit is lower trading costs from lower portfolio turnover.

Defer a portion of rewards

If your portfolio manager performs well and gets a bonus – preferably reflecting a multi-year outcome – then great. But what should happen to that bonus? Would you rather it was released straight away as cash, or half of it was invested in the investment product for a minimum of say three years?

Most of us would take some comfort if the manager had that sum locked away for a while. Then there’s less inducement to take risks in the portfolio which may pay-off in the short term but ‘come home to roost’ later.

Support board independence

As an investor, would you want the board of the funds management entity to have independent directors or consist entirely of internal executives?

Some board independence helps balance the interests of the three parties referred to earlier – shareholders, staff, and stakeholders such as clients. While their presence is no guarantee that investor interests will be at the fore, they offer an increased chance of broad representation at the board table.

Think strategically about fees

When it comes to fees it is useful to establish some principles:

- Fund managers are entitled to rewards that reflect the true value of their skills

- As an investor you want to reward skill, though the real question is how much is too much?

- When it comes to performance-based fees (PBFs) the devil is often in the detail, but a well-designed structure will help create an alignment of interests. This means a benchmark-like performance will receive a lower fee while a great performance should garner a higher fee due to higher investor returns.

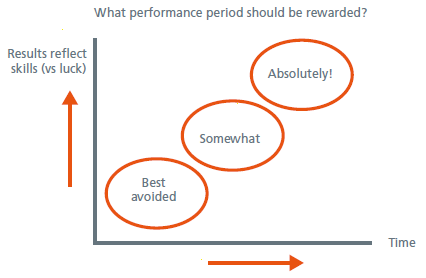

Fund managers generally prefer their performance to be judged over a period of years rather than months, as that is the timeframe over which their efforts can crystallise. This is fair enough, though by the same logic, it makes most sense for PBFs to accrue based on a similar time period, as depicted in the area towards the top-right in the chart below. The longer the period, the higher the confidence that skill rather than luck is being rewarded.

Discourage personal trading

There’s plenty of merit in your portfolio manager co-investing in a product, but would you want them to be able to trade in the same asset class separately on a personal account?

In part this represents a compliance issue (prohibiting or making transparent certain trade activity), but even if personal trades are cleared through internal compliance teams, the scope for conflict of interest is hard to eliminate. And, as a fund management firm, why open up the risk in the context that, as a general statement, portfolio managers are fairly well compensated for their ‘day jobs’.

Consider the ownership structure

Where investment staff have an ownership stake in the firm, does that promote alignment?

On the positive side, ownership by key individuals can help with staff retention, amplify incentives for the business to succeed, and help foster a longer-term mindset.

On the other hand it ties individuals more directly to the interests of the business, being the total revenue picture, rather than the out-performance of a certain product per se. This is particularly relevant if the product you are invested in does not represent a large part of the overall business, i.e. the success of the firm may not be closely tied to how well that product does. And there is an issue of what to do if a staff member is a shareholder but the strength of their contribution diminishes. Arrangements can be a bit hard to unwind, even though parting company may be the best outcome for the business and for clients.

Hence we can regard the self-ownership model as positive in many respects for alignment purposes, but not purely so.

Implementation issues

Some challenges present themselves when trying to execute material change to alignment structures. Many investors are not big enough, relative to the size of a manager’s total client base, to have meaningful influence. Existing fee structures may be so ingrained that there is little chance of affecting change. In some cases, managers have been so successful that they do not feel obliged to be flexible on arrangements – ‘there is plenty of demand so if you want to invest with us, these are the terms’.

The reality is that negotiation is mostly evident when (a) the investor is large and/or prestigious and (b) the manager or strategy is in its relatively early stages – as they saying goes, he who is most hungry is most flexible. In some cases, smaller or boutique-type firms are well-placed to apply flexibility given relatively smoother pathways to implementing internal policy changes.

Notwithstanding some implementation challenges, fund managers should be open to ways to improve mechanisms for stronger investor alignment.

Conclusion

While it is not realistic to expect every fund manager to tick every alignment box, investor interests need to be at the forefront of the manager selection process.

To sum up, well-structured alignment arrangements:

- underpin a sense of partnership between investors and fund managers

- promote strong performance and risk management, and

- minimise costs related to intensive monitoring and changing managers.

David Scobie is a Principal in Mercer’s Investments business, based in Auckland. David advises institutional clients on their investment policies and structures. He is also involved in evaluating fund managers, linking in with Mercer's research capability in Australia and globally.

For a copy of the more detailed paper on manager alignment, click on this link.