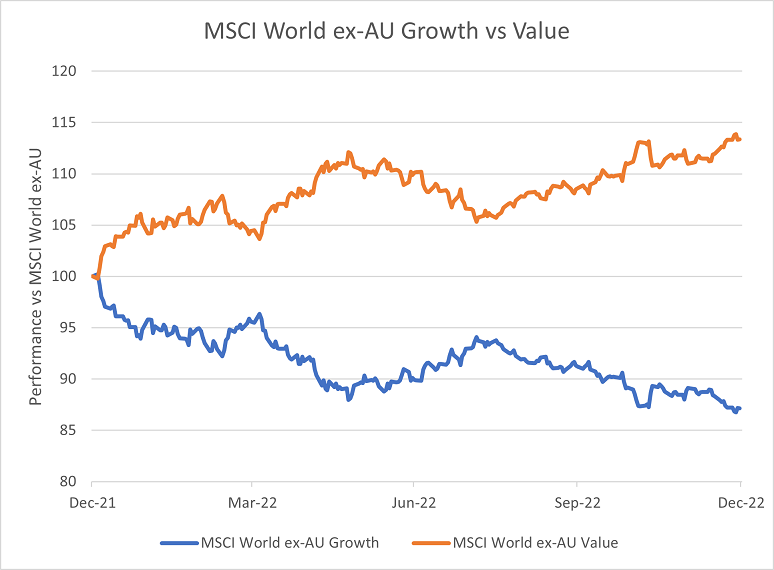

The economist and speculator John Maynard Keynes once famously quipped that “markets can stay irrational longer than you can stay solvent”. This same principle can hold true for companies just as it does for speculators. Today, inflation and its resulting capital market dynamics have created a less forgiving funding environment and one result has been a violent sell-off of growth stocks.

Source: Franklin Templeton, FactSet Data

Yet not all growth stocks require access to capital, and we believe that the market has erred by shunning growth companies indiscriminately. There are growing businesses that enjoy strong free cash flow and robust balance sheets, including three US-listed large-cap companies outlined below.

Tyler Technologies [NYSE:TYL] – Municipal service supports healthy recurring cash flow

Tyler Technologies, (Tyler) is an American company that provides software and technology solutions to the public sector, including local governments, schools, and courts. The company offers a range of products and services spanning financial management, property appraisal, tax assessment, court management, and school administration software.

Because its software offerings provide mission critical services, the company has earned a sticky customer base with a high degree of customer lock-in. This allows for strong revenue visibility, with recurring revenues at ~80%, up from ~55% in 2010. The switch from a perpetual license to the much more profitable cloud-based SaaS delivery model has primarily driven this trend.

In addition to strong customer relationships, the company generates strong free cash flow while continuing to innovate within its market. Historical cash flow margins have averaged over 20%. The company has generated cumulative free cash flow of US$1.2 billion over the last 5 years, relative to ~$200 million in capex spend for growth. A debt-light balance sheet further insulates the company from the need to access the capital markets.

We believe Tyler will be able to maintain and even grow its competitive position by leveraging its strong relationships within the public sector channel to take additional share in what is a US$12-15 billion-dollar addressable market. Further stock market turbulence may also create attractive acquisition opportunities.

Synopsys Inc. [NASDAQ:SNPS] – Integrated into the future of computing

Synopsys Inc. provides technology solutions for the design, verification, and manufacturing of electronic systems and components. The company's products and services are used by companies in the semiconductor, computer, and electronic systems industries to design and test their products.

Decades of accumulated expertise in the development of cutting-edge semiconductor design, and electronic design automation technologies means the company’s businesses have both high barriers to entry and high customer switching costs.

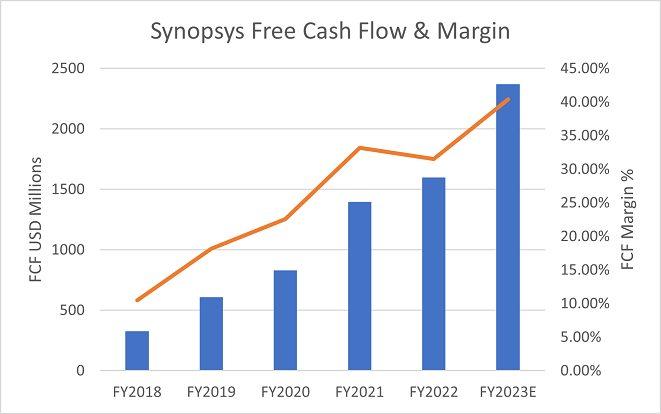

The company’s strong business model results in robust operating cash flow. Full-year 2022 free-cash-flow margin was over 30% at ~US$1.6 billion. In addition, Synopsys commands a fortress balance sheet with $1.4 billion of cash against only US$600 million of long-term liabilities.

Source: Franklin Templeton, company filings

We see the company as positioned to benefit from the increasing growth for connected devices, the internet of things (IOT). And Synopsys can help the semiconductor industry deliver scalable solutions to the rapidly expanding enterprise and consumer demand for Artificial Intelligence (AI) – think ChatGPT – through custom chip designs.

Humana Inc. [NYSE:HUM] – Scaled healthcare delivery

Humana Inc. (Humana) is an American for-profit health insurance company based in Louisville, Kentucky. It is one of the largest health insurance companies in the United States and has operations in all 50 states. The company offers a range of health insurance plans, including Medicare Advantage and Medicaid plans, as well as individual and group health insurance plans. The company also operates health care centres and clinics and has a growing presence in the telehealth market.

We believe Humana has a sustainable competitive advantage in the fast-growing Medicare Advantage market, which caters for an older population cohort. Humana is the second largest Medicare Advantage plan provider, serving over 5 million beneficiaries. It has been growing this business at over 10% since 2017, well ahead of the overall market which itself is poised for continued growth as Medicare eligibility increases.

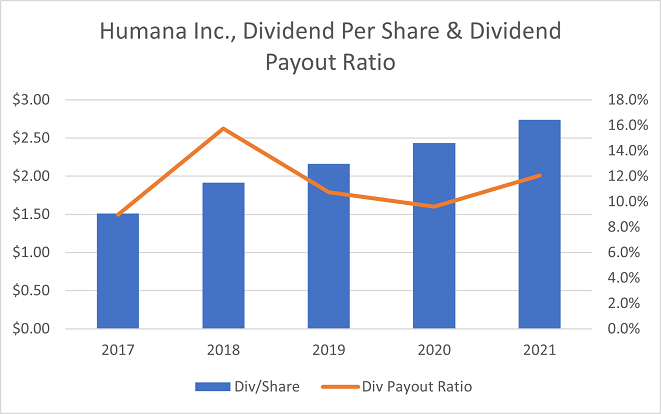

The company’s strong business position has underwritten attractive returns of capital to investors over recent years through a combination of share buybacks and dividends.

Source: Franklin Templeton, company filings

Our analysis indicates that the company’s Medicare business will continue to support robust free cash-flow over the medium term. This in combination with its balance sheet which boasts strong cash coverage ratios should hold the company in good stead to weather any future economic turbulence.

Free cash flow and growth can go hand in hand

With high-flying corporate failures dominating the headlines, it can be easy to forget that growth and healthy cash-flows are not mutually exclusive. Our experience as investors has demonstrated that strong business models can and do align with secular growth trends to create profitable businesses which can grow independent of the vicissitudes of capital markets and, to a degree, the economy.

Francyne Mu is a Portfolio Manager, Franklin Equity Group. Franklin Templeton is a sponsor of Firstlinks. This article is for information purposes only and does not constitute investment or financial product advice. It does not consider the individual circumstances, objectives, financial situation, or needs of any individual. The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.