Investors who recognise the benefits of holding global infrastructure may choose the assets in listed or unlisted form. While the benefits of unlisted infrastructure are often argued, this document highlights eight advantages of listed infrastructure. It is a universe of more than 350 companies worth over US$4 trillion at prevailing market prices.

The ownership structure does not change the characteristics of the underlying infrastructure assets, such as stable and reliable real returns and income over the business cycle.

1. Access to some of the world’s best infrastructure

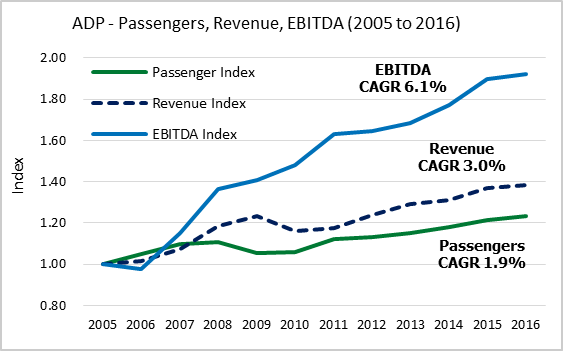

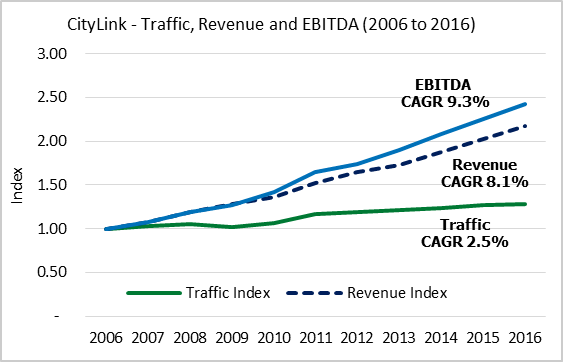

If investors want to own holdings in some of the world’s best infrastructure companies, they are forced to turn to listed markets. Paris’s Charles de Gaulle international airport, Melbourne’s CityLink, and the high-voltage electricity transmission network in England and Wales, for example, are owned by listed infrastructure companies. Investors have been well rewarded as these companies have achieved rising returns on equity and higher earnings per share. For example:

Charles De Gaulle Airport (Paris)

Source: Magellan.

Melbourne’s Citylink

Source: Magellan.

2. An ability to invest quickly

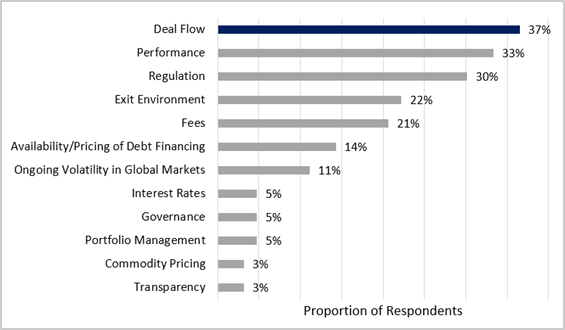

The liquid nature of the listed infrastructure universe enables investors to achieve their desired strategic allocation in relatively short order. We estimate that an investor can deploy US$500 million in some of the world’s best listed infrastructure assets within a number of weeks, while it can take investors in unlisted infrastructure a number of years to invest a similar amount. A recent Preqin infrastructure survey noted 37% of infrastructure investors are concerned with the lack of deal flow (see chart below) that has contributed to the growing levels of ‘dry powder’ in unlisted infrastructure funds. The amount of ‘committed but not deployed’ capital has exceeded US$100 billion since 2013.

Investor views on the key issues for the infrastructure industry in 2017

Source: Preqin.

3. Diversification across sectors and regions

Listed infrastructure companies own and operate assets located around the world (developed and emerging countries) and across the spectrum of infrastructure sub-sectors (including utilities, transport and social).

This compares with the unlisted world where funds typically hold a concentrated portfolio of between 5 and 15 assets with a bias to a sector or region depending on available assets, especially during the fund’s investment period.

More recently, about 50% of completed infrastructure deals were focused on renewable energy assets, resulting in most unlisted infrastructure funds having a bias to one sector. Achieving portfolio diversification can be challenging with an unlisted-only approach.

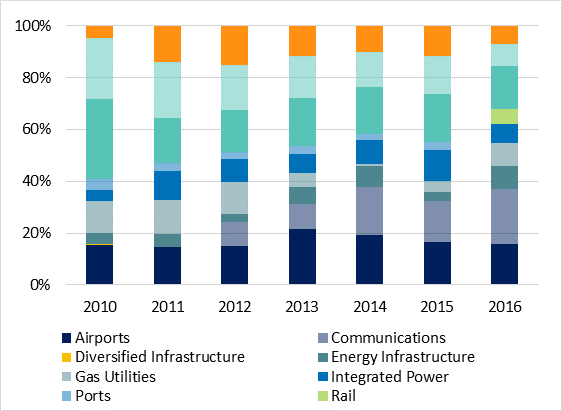

4. An ability to tilt across regions and sectors

Once investors have built a well-diversified portfolio, they can readily adjust holdings across sectors and regions to take advantage of different pricing conditions across markets. This ability can enhance the risk-return profiles of portfolios.

Unlisted infrastructure funds are generally unable to make medium-term tilts across regions and sectors during the life of the fund to take advantage of pricing opportunities.

Active sector tilts across the Magellan Select Infrastructure Strategy 2010-16

Source: Magellan.

5. Live prices reduce illusionary risk reduction

The intrinsic value of any long-dated asset is a function of its future cash flows and associated risks. Because of the predictability of their cash flows, the intrinsic valuations of infrastructure assets tend to be stable over time. Despite this, stock prices fluctuate above and below this intrinsic value, presenting the opportunity to achieve superior risk-adjusted returns.

The more infrequently asset valuation takes place, the less accurate the accounting value of an asset is likely to be. Assets in unlisted infrastructure are usually less-frequently valued. For some funds, the liquidity mismatch created by offering members the ability to transact (often daily) more regularly than the assets are valued increases the risk of prices being misrepresented to investors.

6. More mispricing opportunities

The nature of listed markets provides skilled investors with the opportunity to purchase assets at a material discount to their intrinsic value or to sell them at material premiums. In recent years, the demand-and-supply dynamics for private-market infrastructure has shifted such that many of these assets have been acquired at valuation premiums to their publicly traded alternatives.

With UK utilities valuation differences have been pronounced. Despite the country’s sophisticated regulatory regime that permits utilities to earn a set, fair return on their regulated asset base (which can be thought of as net tangible assets), and regardless of ownership, valuation premiums have persisted over the past decade. However, private-market transaction valuations have exceeded the trading multiples of listed utilities by between 20% and 50% to the underlying net tangible assets.

These mispricing opportunities are also available within global airports, with transaction multiples in the unlisted market well ahead of what investors are paying for similar cashflow streams in the listed market.

7. Transparency of assets from the outset

In listed securities, investors are well informed and aware of the likely assets that will form part of a listed infrastructure portfolio. This contrasts with private infrastructure funds that can often involve a ‘blind commitment’ to a fund that may, at the end of the investment period, hold lower-quality non-core assets than promised at the outset.

8. No forced asset sales

Another factor in favour of listed securities is that there are no forced asset sales. The closed-ended nature of private infrastructure funds can result in redeeming assets at sub-optimal market conditions. The open-ended nature of listed assets means exposure can be held indefinitely.

Ofer Karliner is a Portfolio Manager at Magellan Asset Management. Magellan is a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor.