Over the past six months, we have seen an environment of lower growth in China, uncertainty in equity markets, continuing downward pressure on the prices of resources, the start of a Federal Reserve (‘Fed’) tightening cycle and signs of a potential high yield credit squeeze and repricing. These are all cause for us to reflect on our approach to risk.

At Magellan, we seek to take a holistic view of infrastructure which considers various risk factors in whether an asset meets our definition of infrastructure and standards for investing. The stability of earnings is determined by more than an asset’s competitive position; there is a range of other risk factors which will influence earnings streams.

We assess many risk factors, but the past few months have highlighted a few worth considering:

- Sovereign risk: we avoid countries where political decisions can easily be made which undermine the contractual position or potential earnings of a company.

- Additionally, we only invest in countries where the judicial system and law are sound so that contractual positions can be enforced in need.

- Regulatory risk: we avoid jurisdictions where regulatory processes are opaque or inconsistently applied.

- Commodity price risk: we do not invest in businesses which are materially reliant on the price of the product which they transport e.g. many pipeline businesses and Master Limited Partnerships (MLPs) in the United States are excluded from our universe for this reason.

- Leverage risk: we avoid businesses with high leverage or where their ability to service their debt is tight relative to their earnings.

Interest rates, debt and leverage

We expect global monetary conditions to experience further tightening over the medium term and, consequently, for longer tenor rates to increase.

There are two key areas to focus on when considering interest rates: the impact on the businesses in which we invest, and the impact on valuations and on debt and equity markets.

1. Impact on the businesses in which we invest

We are confident that the underlying businesses in which we invest are in good shape, have strong capital management and are well-placed to manage successfully any inevitable increases in base lending rates. Strong capital management is critical and means these businesses largely have:

- Solid investment grade credit ratings, which are important to ensure they have access to multiple credit markets at all times regardless of credit cycles.

- Strong credit metrics i.e. they have a level of leverage that underlying earnings can comfortably support, and have strong debt service ratios. We estimate that, on average, the companies in our investment portfolio generate free cash to service debt of more than four times their annual debt service, which we view as a strong buffer particularly given the stability of the underlying earnings.

- Access to various debt markets (e.g. US, Europe, Canada, Australia), meaning they are not reliant on any single market.

- Improved credit ratings over time as their earnings and credit metrics have improved.

- Available liquidity and credit facilities to fund expansion or liquidity requirements.

- Lengthened and de-risked their debt maturity profiles so that the average repayment term dates are typically 8 to 10 years out, and repayments of debt in any single year is not excessive relative to the total debt burden.

- Managed interest rate exposure by undertaking material interest rate hedging or issuing fixed rate bonds to ensure earnings remain stable over the longer term.

- Reduced the cost of their borrowings throughout 2010 to 2015 by taking advantage of cheaper credit (lower base rates and margins), but also have further opportunity to reduce debt costs over the medium term by replacing more expensive ‘old’ debt which is becoming due for repayment over the next few years.

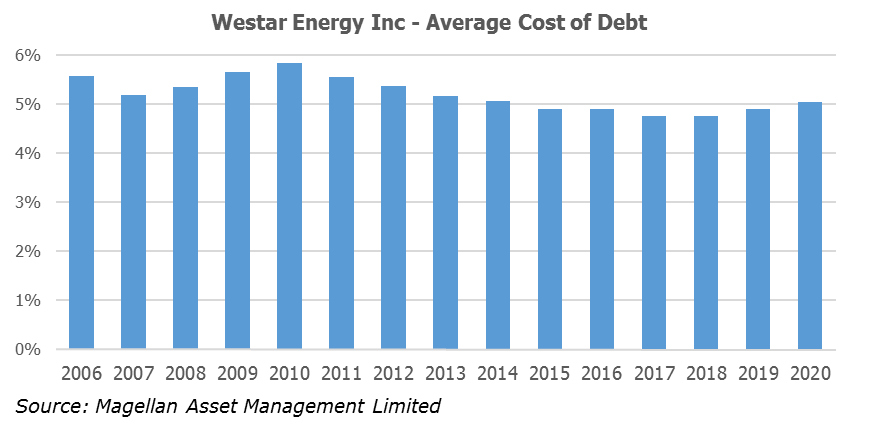

It is important to note this last point. While interest rates are very likely to increase in the United States in the next few years, the average cost of debt of the US stocks in our funds is likely to continue to fall as maturing debt is replaced with cheaper debt. As an illustration, the following graph shows consensus forecasts for the average cost of debt for Kansas-based power utility, Westar Energy Inc, showing the average cost of debt declining until 2018.

So overall, we remain confident that these businesses are well-placed to continue to meet our investment expectations over the medium term and through a period of rising rates.

2. Impact on valuations and on equity markets

An increase in interest rates can be expected to lead to a higher cost of debt and an increase in long term discount rates. Our forecasts and valuations take these factors into account in our investment analysis. However, the history of financial markets leads us to expect increasing uncertainty as a consequence of a rising rate environment.

Stocks which are regarded as ‘defensive’, including infrastructure and utilities, are often subject to negative sentiment during periods of interest rate increases as investors switch to higher growth sectors. However, it is our experience that, provided the businesses have solid fundamentals, their stock prices can be expected to revert to trend reflecting their underlying earnings profiles.

Notwithstanding equity market volatility we expect that underlying earnings of infrastructure and utilities companies in our defined investable universe should continue to be robust and reflect solid growth.

Ultimately the value of the companies in our investment portfolio reflects the future cash flows they are expected to generate and the risks associated with those cash flows. Magellan believes that, at the current time, investment markets are not pricing assets at the prevailing interest rate levels but rather, are pricing in a higher, more ‘normal’ level of interest rates in assessing the risks associated with future cash flows. This means that if interest rates increase over the medium term we can expect the impact on asset prices to be somewhat muted because investors have already allowed for some level of increase.

Gerald Stack is Chairman of the Investment Committee and Head of Investments at Magellan Financial Group and Portfolio Manager of the Magellan Infrastructure Fund. He has extensive experience in the management of listed and unlisted debt, equity and hybrid assets on a global basis.

This material has been prepared by Magellan Asset Management Limited for general information purposes only and must not be construed as investment advice. It does not take into account your investment objectives, financial situation or particular needs.