While Australian listed property stocks, or A-REITs, have gone through a challenging period during 2020, most are currently performing well and offer investors an attractive opportunity for income yield.

During the latest reporting season, most A-REITs did not provide much future guidance which is unusual, but this was more a result of the challenge in predicting the short-term future rather than any specific concerns about the property groups.

Indeed, A-REITs outperformed the broader Australian equity market during reporting season, returning 8% (compared to 3%) in August 2020 and this outperformance continued through September.

Income trajectory

On the whole, balance sheets across the sector are in good shape and within covenants, with increased available liquidity. As investors, our focus is now more on the income trajectory.

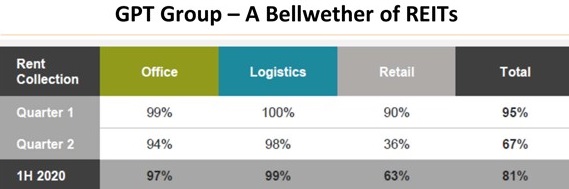

One of the key concerns about A-REITs during the lockdown was the impact it would have on rent collections and income. Across the sector, rent collections have varied. The most impacted were large scale and CBD-based retail A-REITs while sectors such as office, industrial and other subsectors were less affected.

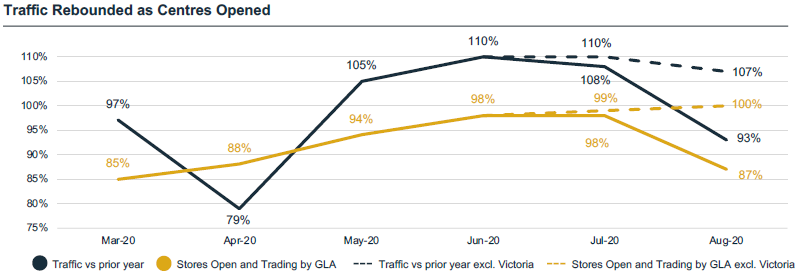

Now, with the COVID-19 lockdowns relaxing across Australia, with the exception of Victoria, stores are opening, and foot traffic is returning, and this is leading to an acceleration in rent collection.

Encouragingly, despite the drop in rent collection, income yield across many A-REITs has remained strong and, as the situation improves, we see the potential for good upside in income yields. In fact, in some cases, distributions are back to the same levels they were before the COVID-19 outbreak.

Taking the diversified GPT Group (ASX:GPT) as a bellwether for A-REITs, over the six months to June 2020, it experienced around 80% rent collection, yet the most recent distribution rate annualised still provides a yield of around 5% on current pricing.

Another example is Aventus Group (ASX:AVN), Australia’s largest owner and manager of large-format retail offerings across Australia. Aventus is arguably a barometer of what may transpire for other REITs, and why we are constructive on the sector as a source of income.

At the end of January 2020, Aventus had a share price of $2.99. Its most recent quarterly distribution at the time was 4.26 cents per share which annualised would have reflected 5.7% distribution yield.

Unfortunately, with the uncertainty of COVID, the distribution was cut to 1.06 cents per unit for the March quarter, while its security price hit a low of $1.36. By June, the quarterly distribution was increased to 2.35 cents. When Aventus reported its results in late August, foot traffic (excluding Victoria) was actually above the prior year levels.

Source: Aventus

Its most recent September quarterly distribution was increased to 4 cents, similar to pre-COVID levels, and the security price at the end of September was $2.36. The annualised rate therefore reflects a yield of 6.8%, or more than 100 bp higher than that in January.

In the meantime, long-term interest rates have also come down, making the case for alternative sources of income even more compelling. This provides the backdrop for further re-rating potential and likely a signpost for what may transpire for some other REITs.

Positioning for the recovery

A key question for investors is whether they continue to focus on the ‘stay at home’ theme or whether they start to position themselves for the ‘recovery’.

We have seen the ‘stay at home’ theme resonate throughout equity markets as companies that benefit from this trend – such as Amazon, Netflix and the like – experience soaring share prices. This has carried through into the A-REIT sector, with those groups having some association with e-commerce (logistics) or data (data centres) at high prices, while much of the traditional A-REIT sectors such as retail and offices at low prices.

In our view, some stocks at such extreme levels are over-extrapolating the ‘stay at home’ theme, whereas the reality is that there will be a return to normality as COVID-19 runs its course or when a vaccine is rolled out.

Therefore, we are positioning for the recovery trade, and there are some strong and compelling opportunities in real assets, which are out of favour at the moment that will benefit from the return to normality.

We are also seeing some good opportunities in alternative real estate, such as land lease communities, storage and childcare centres – which are currently a good source of income, diversification and re-rate potential.

However, we believe it is important to not overlook traditional core real estate in the A-REIT sector because that’s where investors can find the deepest value and some real opportunities in the current market.

Grant Berry is a Director and Portfolio Manager at SG Hiscock & Company. SG Hiscock & Company Ltd (ABN 51 097 263 628, AFSL 240679) may hold positions in companies mentioned in this article. This is general information and is not intended to constitute a securities recommendation. While the information contained in this presentation has been prepared with all reasonable care, SG Hiscock & Company accepts no responsibility or liability for any errors or omissions however caused.