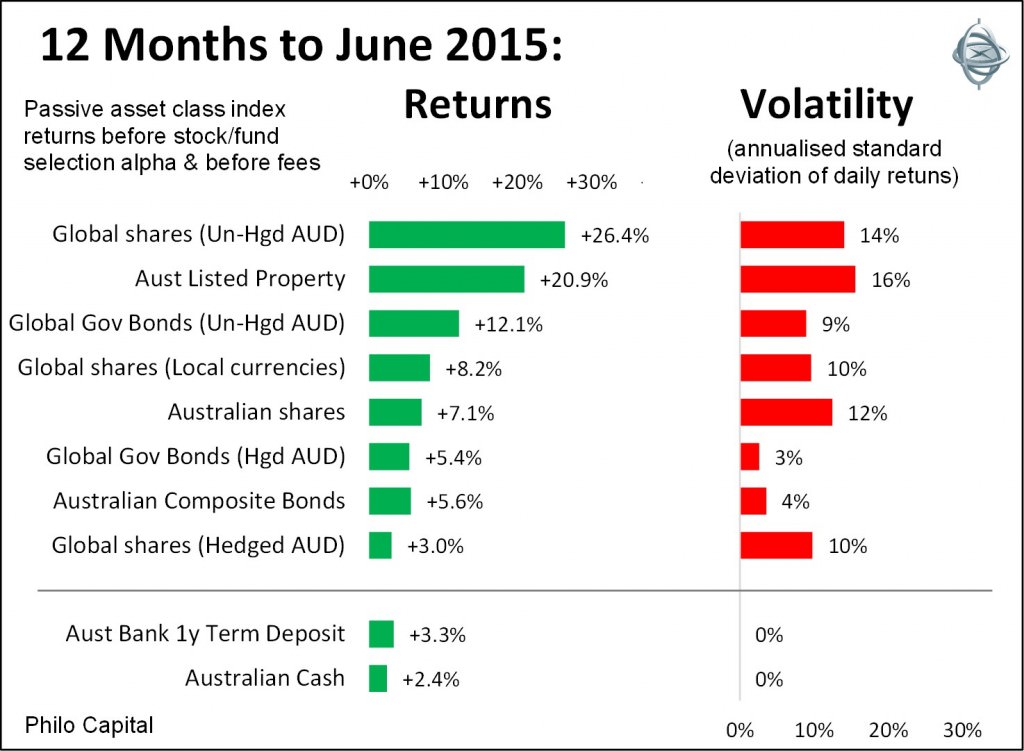

The past 12 months have been kind to long term investors, with all asset classes generating positive returns well above inflation and cash rates, and with lower than average volatility. The chart shows passive asset class index (accumulation) returns for the 12 months to the end of June 2015 before fees.

All asset classes have done well, even ‘defensive’ bonds, but how long will it last? The dominant factors remain the same – the course of the European debt crisis and the pace of US interest rate hikes. The ECB and IMF appear ready to support banks and credit markets whether Greece leaves the Eurozone or stays. Also, the US Fed appears to be bending over backwards to ensure rate hikes are as slow and as well-signalled as possible, to limit the impact on business investment, consumer spending, mortgage interest rates, and markets.

Australia

The most interesting development in macro policy in June 2015 was the public debate over Sydney house prices – whether or not they are too high, and whether or not they are preventing the RBA from cutting interest rates further. Recall that the price boom took off when RBA Governor Glenn Stevens started cutting interest rates in November 2011 with the stated intention of lifting prices in the hope that a housing construction boom might fill the hole left by the mining construction boom that has ended. Stevens now says the resultant ‘crazy’ house prices should not prevent him from cutting cash rates even further to try to bring down the dollar. The dollar would be lower were it not for the demand due to the flood of foreign money chasing residential and non-residential properties. Making further rate cuts more unlikely is the strong labour market, with the unemployment rate dropping unexpectedly to 6% on solid jobs growth. Another dampener was the relatively strong March quarter economic growth numbers released during the month.

Europe

Greece’s dire debt situation continues to deteriorate. It has been fascinating watching the ECB and IMF come up with new creative ways to allow Greece to default (ie fail to pay interest or principal when due) without actually calling it a ‘default’. Everybody, including the Greek government, knew the only way it could make payments would be with even more IMF debt that would be released if Greece agreed to a ‘cash for reform’ deal. The ECB and IMF finally have their heads out of the sand and are now openly planning how to remove Greece without making it too easy for others to follow. Aside from the Greek problem, the rest of Europe appears to be on the mend. Fears of deflation are receding and confidence and spending are rising, as is manufacturing production.

US

During June the March quarter economic growth numbers were revised downward to a contraction, caused largely by a huge trade deficit, in turn caused by the high US dollar driven up by investors preparing for upcoming US interest rate hikes. But data for the June quarter has been stronger. Retail sales are looking up and new building approvals are strong. Household incomes, spending and confidence are also improving solidly. The unemployment rate at 5.5% is continuing its slow decline since peaking at 10% in October 2009, and CPI inflation still running at zero, well below its post-GFC high of 3.9% in August 2011. Fed chair Janet Yellen appears to be signalling a start to rate hikes in the fourth quarter this year.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is educational only. It is not personal financial advice and does not consider the circumstances of any individual.