When we lift our vision from directly in front and look towards the horizon, we see much more. It’s similar with investing. Taking a long-term view forces us to think more broadly about the risks likely to confront a company and its ability to withstand them. This inevitably leads to assessing a company’s moat or barriers to entry.

'Understanding the moats' is relevant to any company but is particularly important for small cap stocks. The strengths of these moats may decide which small cap companies are destined to grow and which are consumed by the competition.

Are small cap valuations terminal?

It is little appreciated that approximately half a small cap company’s valuation is attributable to its terminal value when using the discounted cashflow method. Terminal value is a multiple of earnings roughly 10 years in the future, further underlining the importance of the long term.

So how do we assess a small cap company’s barriers to entry, and more importantly the direction of those barriers (rising or falling) given they often compete against larger companies?

The following six elements can determine the moats around small cap stocks:

1. The company’s industry: Ideally, investors are looking for a niche that requires specialist skill or an unusual product that caters for a market segment and is difficult to replicate. Larger companies typically focus on big markets, particularly during the growth phase, leaving space for smaller companies in niches to improve their barriers.

In the finance sector, for example, large banks leave gaps for smaller, specialist providers in areas like SME funding and debtor financing.

2. The product or service offered: Investors must consider the level of specialisation and the ability of others to replicate, especially a similar or better product or service at a lower price. Judgement, experience and the benefit of industry expert opinion is required for this assessment, and it must be constantly monitored due to changes through time.

Large players have more capital, so competing on cost does not create a convincing barrier for a small company, particularly when an industry matures and large companies look for new areas to grow. However, customer loyalty based on rational economic benefit is a barrier. Software often has high barriers particularly when delivered in an efficient, scalable model such as SAAS. Customer switching costs can be high when including training, human inertia and execution risk.

Some other areas to consider include benefits of scale, customer fragmentation, legal barriers (e.g. patents, ACCC restrictions), brand and reputation, contractual commitments and network effects.

At its core, investors must determine how sticky the customer is in the face of competitive threats and what price the customer would be willing to pay for the offering.

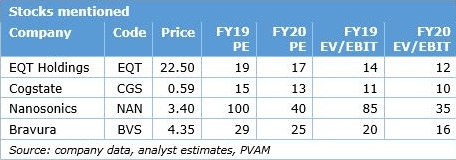

Healthcare companies often have sticky customers. Given conservative approaches to patient health, an established product can be difficult to replace when it becomes widely used and trusted. For example, Cogstate (ASX:CGS) benefits from over 10 years of data accepted by the FDA in the use of drug trials. Large pharmaceutical customers have a low tolerance for procedural error making this history a high barrier to new entrants. Nanosonics (ASX:NAN) has a large and growing installed base of Trophon machines within hospitals for which it sells highly profitable consumables. Note, investors must be aware valuations can at times be exuberant in this space.

3. Rising or falling barriers: A frequently overlooked yet exceedingly important element is the direction of barriers to increased competition i.e. are they rising or falling? This is probably the most important element of value creation as price and revenue will typically follow.

For example, Bravura Solutions (ASX:BVS) is enjoying rising barriers as it signs new customers with high switching costs, and Bravura’s greater scale enables increased product development.

The process of assessing a company’s barriers to entry never stops, and it is becoming harder to assess as technology causes rapid change.

4. The company’s management: Management’s ability to build and adjust the organisation to ever-changing circumstances will determine the success of the offering and thereby the stock price. Management with a long-term view will often reinvest in growth. This can be a very powerful earnings driver as scale enables greater investment.

We view EQT Holdings (ASX:EQT) as a good example of management taking a long-term view and balancing short and long term growth. Each additional dollar of revenue requires little additional cost meaning that profits could easily be boosted short term. But by re-investing in operating efficiencies and sales and marketing, the business reduces its cost to serve and increases customer awareness.

5. Company meetings: Meeting management is important, but the greatest insights are often gleaned by meeting other companies in an industry, particularly competitors. They are often more forthcoming with the weaknesses in a competitor’s moat and how it can be breached.

It’s also worthwhile talking to suppliers, customers and employees (past and present) to get a fuller picture of the business.

6. A measured approach: At times, meeting a new company CEO can appear an exciting opportunity, but by their nature, CEOs are typically good salespeople. Always take a measured approach to a stock’s weighting in the portfolio. Investors may like a company, but the prudent approach may be to start with a relatively small position and increase it over time as understanding increases. This is particularly the case with initial public offerings (IPOs) with time restrictions.

The process of assessing a company’s barriers to entry never stops. Barriers are rising and falling constantly and it is one of the most important aspects of small cap investing.

Richard Ivers is Portfolio Manager of the Prime Value Emerging Opportunities Fund, a concentrated fund which invests in micro and small cap stocks with a capitalisation of less than $500 million at first purchase www.primevalue.com.au. This article is general information and does not consider the circumstances of any investor.