This is an edited transcript of a video talk given by geopolitical strategist, Peter Zeihan, on new Chinese demographic data.

Today we're breaking down the new demographic data from the Chinese space. This will allow us to make some much-needed updates to an already bleak assessment...and spoiler alert, it's going to get a lot worse.

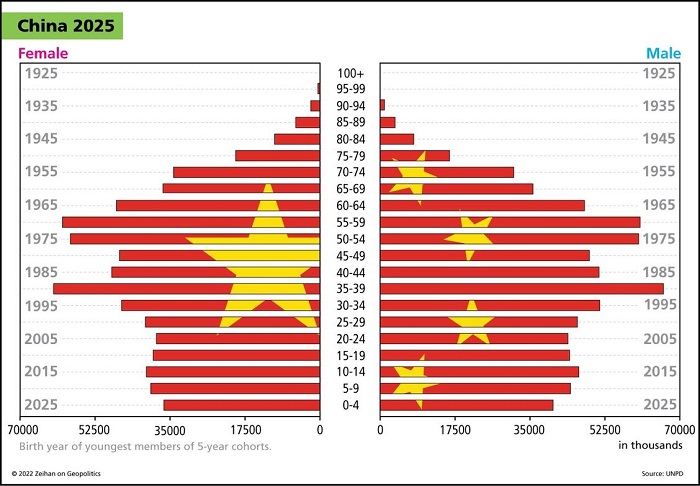

Okay, let's start with this first graphic to show you where the official data had us as of a year and two years ago.

This narrowing for the bottom seven age blocks is the fastest aging workforce in the world and arguably the fastest one in human history. This indicates that the number of new workers coming in is so small compared to the number that are retiring that you're having massive increase in labor costs and from adjacent numbers that we do trust. I mean, Chinese data is always a little touch-and-go. But from the numbers that we do have that we do trust, which is labor costs, Chinese labor is increasing at the fastest pace of any country in any era at any time in history, including during the Black Death itself.

Since 2000 the cost of Chinese labor has gone up by about a factor of 15 while the size of the Chinese economy has only expanded by a factor of roughly 3.5 to 4. The Chinese are only an industrial power today under this data because of the sunk cost of the industrial plant that it took to build everything that's there in the first place.

Now, that's not nothing. That is huge. That's trillions of dollars, tens of trillions of dollars. And it's highly relevant. But most industries and most subsectors that have decided to relocate to other countries have discovered that they've got shorter, simpler supply chains, where there's a lot less of a political headache.

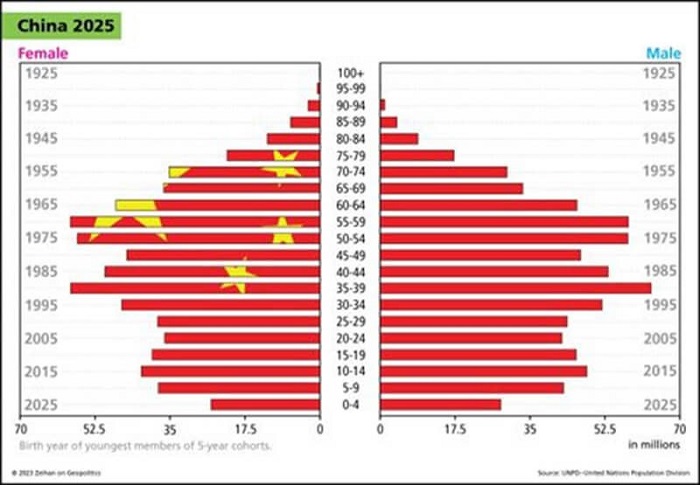

Okay, here is the new data. And as you can see that the number of children who are under age 5 has just collapsed and there are now roughly twice as many that are aged 15 as there are aged 5.

What happened back in 2017, well before COVID, is that we had a sudden collapse in the birth rate, roughly 40% over the next five years among the Chinese, the ethnic Han population and more than 50% among a lot of the minorities. And that is before COVID, which saw anecdotally the birth rate drop considerably more and before COVID, which probably raised the death rate considerably. We're now never going to get good data on death rate, or at least not anytime soon, because the Chinese, when they did the reopening, they just stopped collecting the data on deaths and COVID and everything because they didn't want the world to know how many Chinese died, so they don't know.

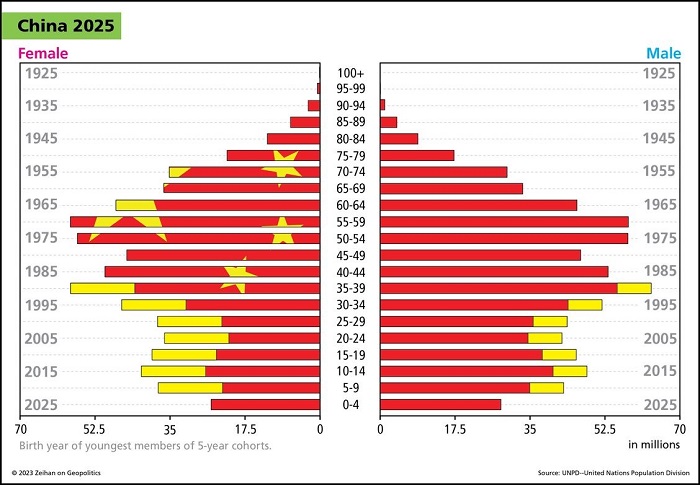

With this data, the snapshot in time, this is official state data, it's still probably not wildly accurate. We still have the Shanghai Academy of Sciences, which is like the biggest nerd group you've got in the country, saying that the country has overcounted their population under age 45 by over 100 million people in the aftermath of the one child policy. And so, really, what we need to consider is that that official data now at the very bottom, you need to play that up. And this last graphic shows you our internal estimate of where that is. Now, this is not official. Those yellow bars probably don't exist, but that is not what the official data is saying. This is an extrapolation from what the Shanghai Academy of Sciences is saying.

Anyway. Some version of this is probably the truth, which means that China aged past the point of demographic no return over 20 years ago. And it wasn't just this year that India became the world's most populous country. That probably happened roughly a decade ago. And it wasn't in 2018 that the average Chinese aged past the average American. That was probably roughly in 2007 or 2008. So, this is not a country that is in demographic decay. This is a country that is in the advanced stages of demographic collapse, and this is going to be the final decade that China can exist as a modern industrialized nation-state because it simply isn't going to have the people to even try.

For those of you who have business in China, you're becoming more and more aware of the political system, you're becoming aware that it's becoming illegal for foreigners to even access data, data that in most countries is publicly available. You now have on top of that to figure out that not only is the labor force never recovering and the labor costs you're having now are as low as they're ever going to be, consumption is as high as it's ever going to be. Even before you consider the political complications or issues with operating environment or energy access or geopolitical risks or reputational risks, the numbers just aren't there anymore.

You have to ask yourself why you're still there. Some cost of industrial plant? That's a reasonable answer. But it becomes less relevant with every passing year as everything else catches up.

Peter Zeihan, founder of Zeihan on Geopolitics, is a geopolitical strategist, speaker and author. This article is general information and does not consider the circumstances of any investor. This article is an edited transcript of Peter's video, New Chinese Demographic Data = Population Collapse, posted on 29 June 2023.