The annual BetaShares/Investment Trends Exchange Traded Fund Report was released recently. BetaShares has been associated with this Report for the past five years and it provides a snapshot of the key statistics and drivers in the Australian ETF industry, from the perspective of individual investors, SMSFs and financial planners.

The insights are based on the responses of 9,418 investors and 676 advisers.

Key findings of the Report

The specific details reveal:

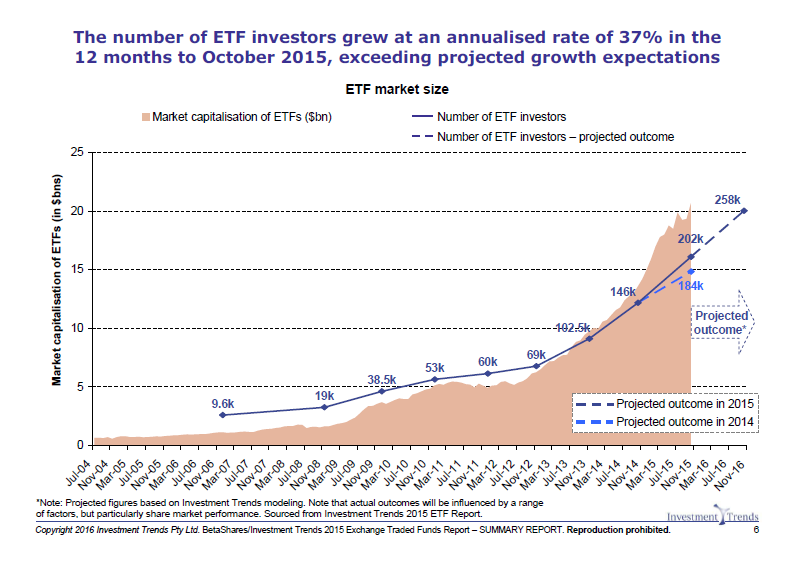

- the number of ETF investors increased 37% to an estimated 202,000 in 2015

- a record number of investors intend to make their first ETF investment in the next 12 months, estimated at 110,000

- 41% of current ETF investors (~83,000) invest through an SMSF

- financial planner usage of ETFs continues to increase. with 64% intending to start or continue using ETFs in the next 12 months

- strong latent demand for exchange traded managed funds is an unmet opportunity for industry growth.

For a copy of the 2015 Exchange Traded Funds Summary Report, click here.

The chart below shows the market capitalisation growth of the ETF market (currently at about $22 billion), the estimated user numbers and future projections.

Strong demand from retail and SMSF investors

Repeat investment into ETFs is high with 71% of investors indicating they would consider re-investing in ETFs in the next 12 months.

The number of SMSFs holding ETFs has grown in line with the increase in the number of ETF users, with an estimated 41% of ETF investors using an SMSF. This also indicates that 59% of investors are buying these products outside of SMSFs, showing the adoption of ETFs by mainstream investors.

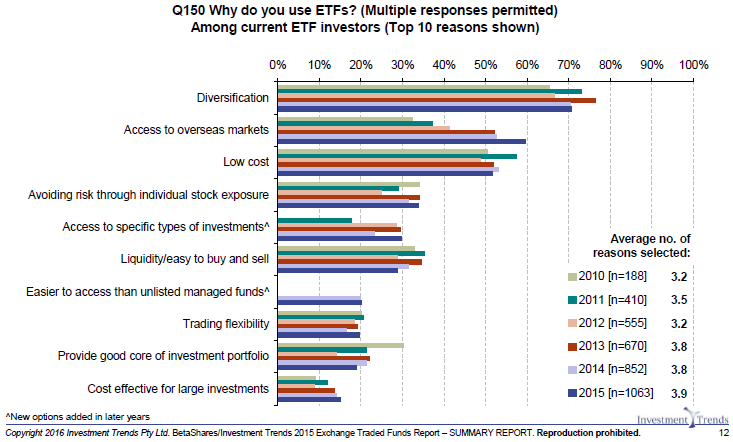

Diversification remains the primary reason individual and SMSF investors use ETFs. However, for the first time since the Report has been published, access to overseas markets has become the next most important reason individual investors use ETFs, overtaking low cost.

The Report revealed that the majority of ETF investors did not reduce usage of any other form of investment in order to invest, with 56% of investors in ETFs investing via money that was not currently invested in shares or managed funds.

Financial planners want more from ETFs

Financial planners’ appetite for ETFs continued to increase, with the Report showing 44% of advisers currently use ETFs, with an additional 20% considering ETFs in their practice over the next 12 months.

In addition, the extent of ETF usage is set to increase. While ETF flows comprise only 6% of total financial planner flows, current users have allocated 13% of new client flows to ETFs and expect this to increase to 18% by 2018. 90% of financial planners cited low cost as the top reason for recommending investment in ETFs.

Additionally, advisers who recommend ETFs allocate 46% of new ETF investments to international equities, up from 40% in the previous year, overtaking domestic equities for the first time.

While diversification is the primary driver behind ETF adoption for individual investors, about 90% of financial planners indicating low cost is the key reason for using ETFs in their practice. The Report also indicates that ETFs are used by financial planners who typically have higher levels of funds under advice and higher inflows versus those that do not use ETFs.

Strong outlook for exchange traded managed funds

One of the more exciting developments for the exchange traded product industry has been the launch of exchange traded managed funds. The Report revealed a strong latent demand for such actively-managed funds in the next 12 months. For example, 61% of financial planners indicated an interest in using these types of products, which includes 34% of planners who are not currently using ETFs at the moment.

The Report revealed a record number of 258,000 investors intend to make an ETF investment in the next 12 months (including new and existing investors).

ETFs are well on their way to becoming mainstream, based on their diversification, cost, transparency and access. There are also more sophisticated requirements from investors and their advisers. In our own business, for example, we are seeing increasing appetite for outcome-oriented products such as managed risk exposures that are starting to be used as complements to ‘plain vanilla’ index-based ETFs.

Ilan Israelstam is Head of Strategy & Marketing at BetaShares. For a comprehensive summary of the 2015 Exchange Traded Funds Report, click here. This article is general information and does not address the needs of any individual.