The ongoing surge in stock prices, including the NASDAQ, up almost 100% from its March 2020 low despite the recent pullback, has many investors fretting that stock markets are in bubble territory and at risk of a crash. Indeed, according to one survey, the majority of investors now believe the US market is in a bubble.

It has become increasingly clear over the last few weeks that, whilst we don’t believe the markets we invest in (Australian and global small and mid-caps), are in a bubble, some parts of investment markets are frothy with stretched investor sentiment.

The four pockets of exuberance described here may not be the ‘four horsemen of the apocalypse’ portending a major bear market, they are indicators that investors need to be managing risk. Ophir remains focused on investing in quality companies at reasonable valuations, but also stress testing those companies’ likely performance during a savage sell off.

Exuberance Exhibit 1: Bitcoin

The first bubbly pocket is Bitcoin. There is so much noise surrounding the digital currency and we are constantly asked about its valuation. Even Uber drivers ask for our thoughts, and advertisements for Bitcoin trading courses and transacting platforms are becoming ubiquitous.

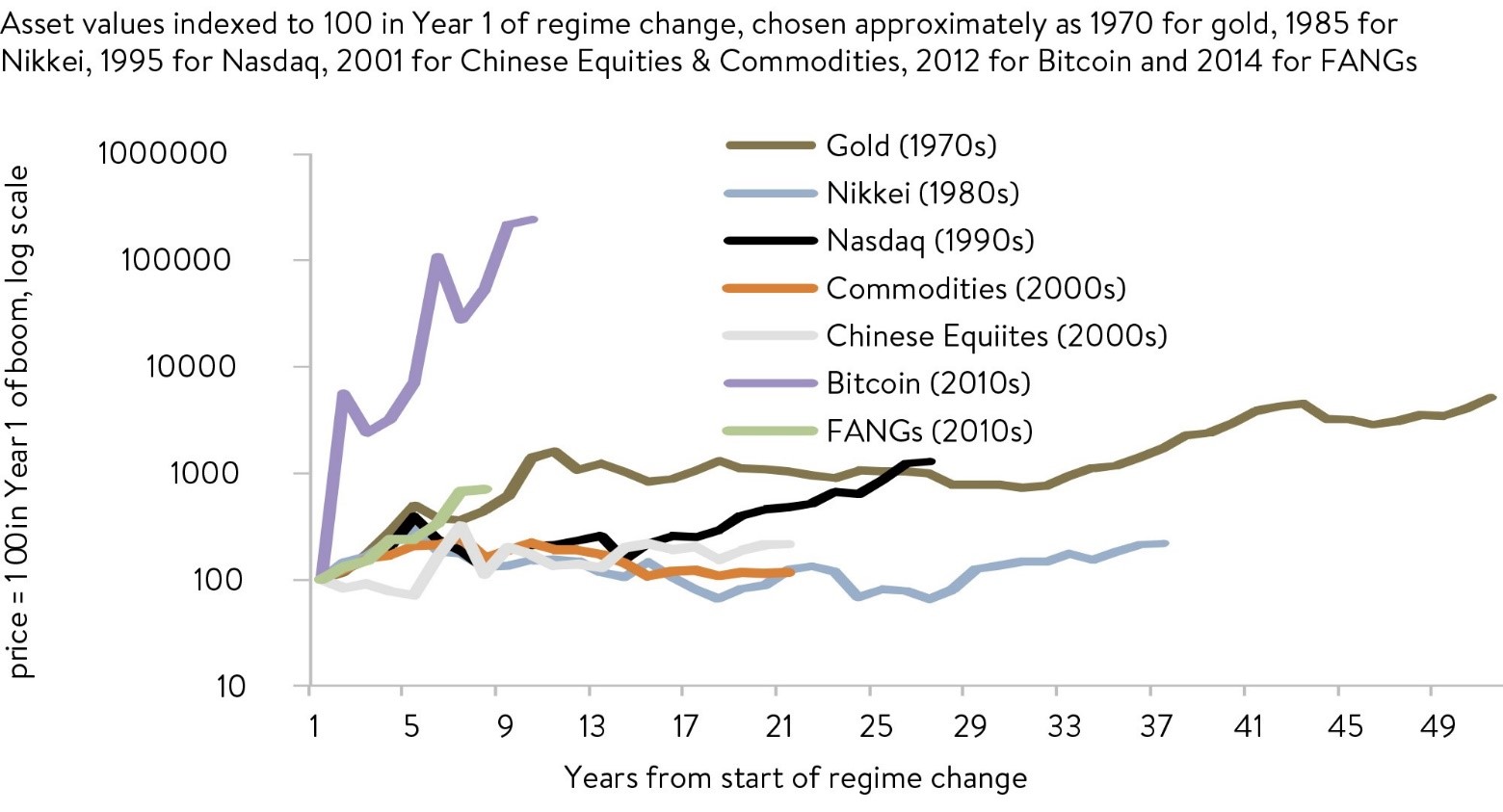

This is not unexpected given the rise in price of Bitcoin over the last few years, putting other financial market bubbles in the shade, as shown below.

The Bitcoin ascent

Source: J.P. Morgan

Bitcoin is somewhere between a collectible and a currency, and not a particularly good one yet. In our view, it doesn’t qualify as an asset because it doesn’t generate cash flows from which to value it. This makes it ripe for speculation and a good barometer for when financial market sentiment is high.

Exuberance Exhibit 2: SPAC IPOs

IPO issuance has ramped up in the US, particularly through Special Purpose Acquisition Companies, or SPACs. These vehicles, often called ‘blank cheque’ companies, have a two-year window to find a private company target which they merge with and list, or else hand back the capital to investors.

Private office leasing company WeWork is the latest in a long line said to be in talks with a SPAC to go public.

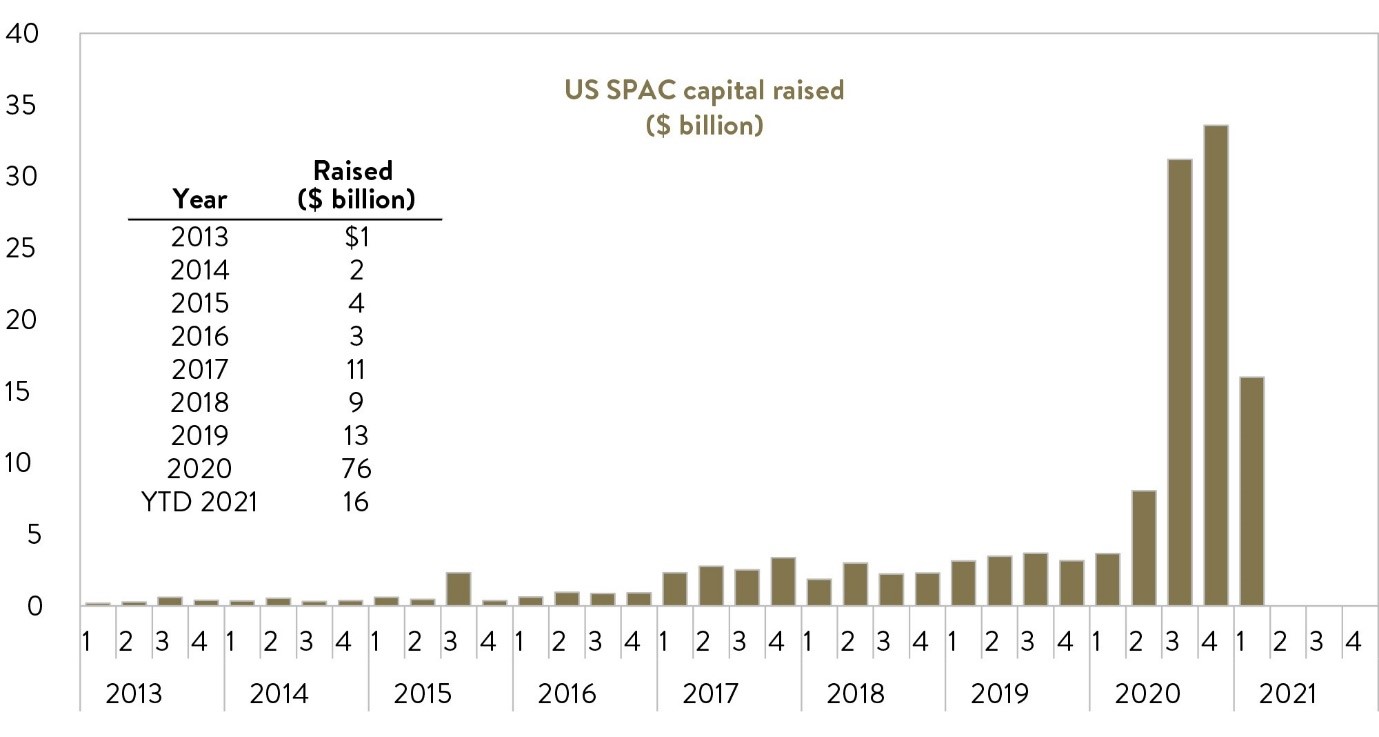

IPO issuance tends to increase when company owners think they can raise capital, or sell out, at heightened valuations, and generally not when it represents good value for buyers. SPACs have been around for a number of years but they raised six times the amount of money in 2020 than they did in 2019.

SPACs have emerged from a relative backwater to become the dominant form of listing for US companies, currently comprising over 50% of IPO activity in the US.

Their boom has come with SPACs bringing early-stage higher-growth businesses, particularly technology businesses, to market. There is huge demand for these stocks from retail traders with more time on their hands and less aversion to volatility.

The demand has been fuelled by interest rates near 0%, which means the opportunity cost for investors of having their cash tied up in a SPAC waiting for an acquisition is low.

The 2020 SPAC IPO boom has continued into early 2021 (as of 21 January 2021)

Source: Dealogic, Goldman Sachs Global Investment Research

Exuberance Exhibit 3: retail call options

The democratisation of investing has given retail investors cheap access to trading platforms and financial information. When combined with government stimulus cheques and extra time on their hands, small retail traders have been investing heavily in call options on individual listed companies.

These options essentially give the buyer the right to buy a share in a company at a certain price (strike price) and the trader executes the option if the share price rises above the strike price. They are generally bought if the investor is bullish on the company and its price is rising higher, but they are popular with retail traders because options are a cheaper way to get exposure to a price rise.

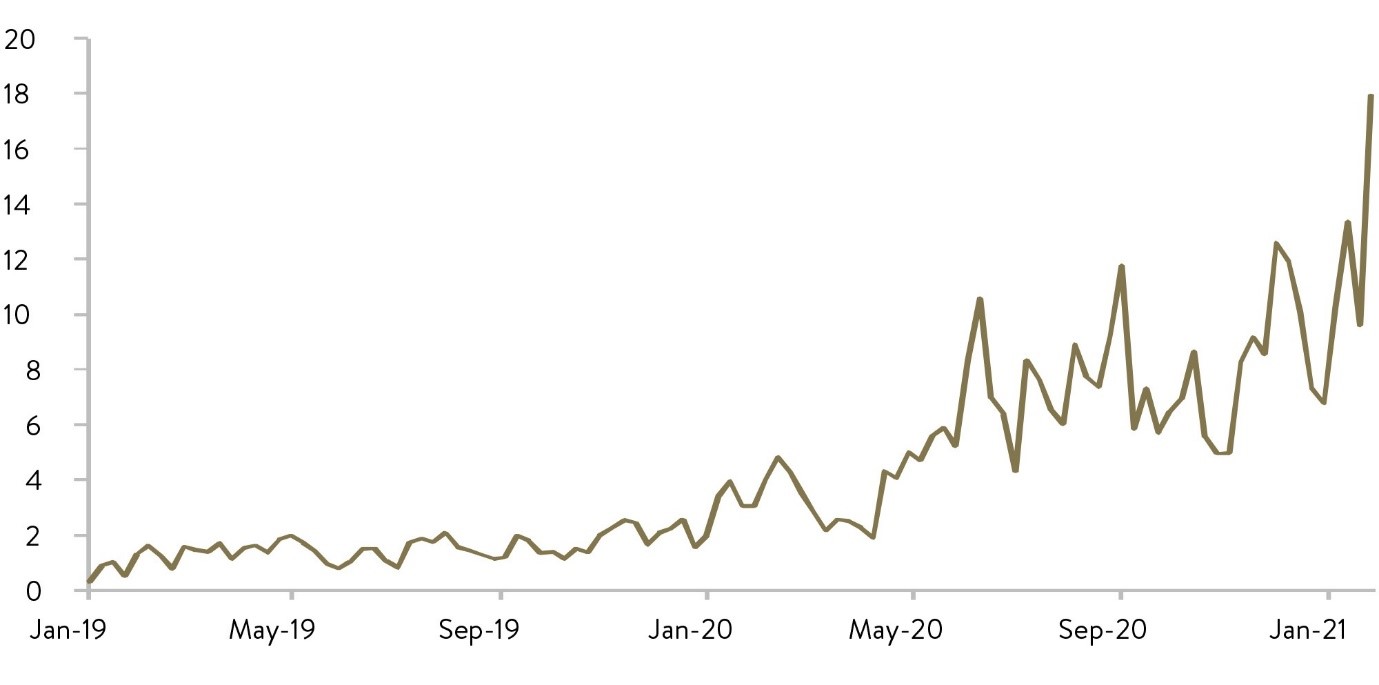

As can be seen in the chart below, call option volumes for small parcels (less than 10 contracts) that retail traders tend to buy, have risen dramatically.

Call Option Buy Minus Sell at Open for investors with less than 10 contracts for options on individual US equities. (In million contracts. Last observation is for the week ending 29th Jan 2021).

Source: OCC, Bloomberg Finance L.P., J.P. Morgan

Such betting by often value-agnostic retail traders should give long-term investors concern as this may not be a sustainable source of demand behind price rises of companies.

Exuberance Exhibit 4: growth stock volume

And, finally, trading volumes in the most expensive growth-orientated companies have exploded recently (as shown below).

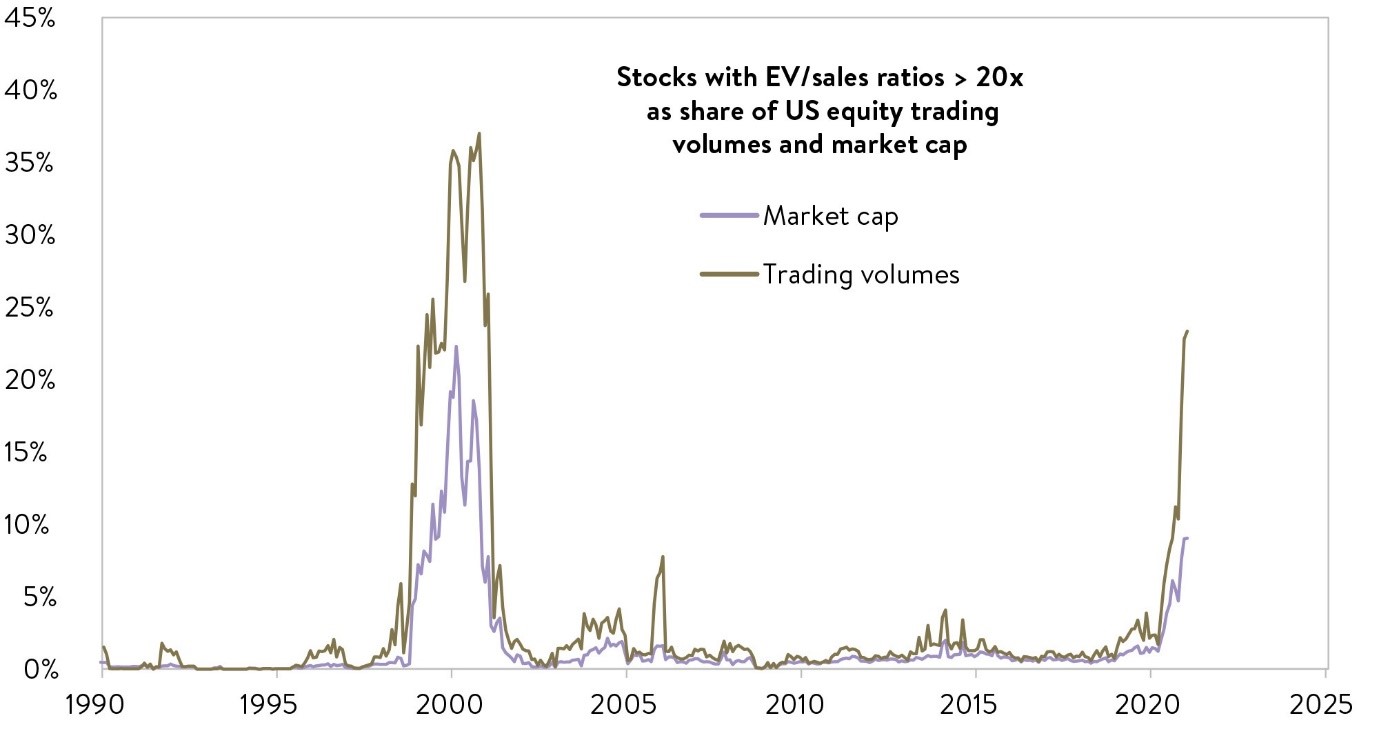

Whilst not at the dot.com levels from 2000 at present, those companies trading at greater than 20 times Enterprise Value-to-Sales ratios (an historically expensive level) are making up a much bigger part of the market and account for around a quarter of all trading activity.

There are some rational reasons for this, including some large high-growth (and high valuation) technology companies further entrenching their dominant positions during COVID, but it does suggest caution is warranted.

Trading in stocks with extremely high EV/sales ratios has surged (as of 21 January 2021: LTM EV/sales ratios of stocks with LTM revenues > $50 million)

Source: Compustat, Goldman Sachs Global Investment Research

A buying opportunity

In the short term, we would not be surprised to see a 5-10% pull back in the major share markets given the extended level of investor optimism in some corners at present. Timing for any pullbacks is always difficult to judge when it is sentiment based.

We see such a pull back as a buying opportunity in our funds and a healthy occurrence for markets.

We think it less likely that a major bear market is around the bend given the supporting backdrop to corporate earnings as the vaccines bring the virus under control, and central banks’ willingness to keep short-term and long-term interest rates lower for even longer in the absence of signs of inflation. This should support the attractiveness of equities relative to bonds for some time yet.

Our risk management plan to deal with bubbly markets

The measures of investor sentiment described above argue for caution in company selection.

Beyond being well diversified by company, sector and geography and not overexposed to any particular investing style, our risk management plan ensures the companies we hold in our funds have a high probability of upgrading earnings at their next results' announcements and are trading on reasonable valuations compared to fundamentals (cash flow and earnings) and peers.

Moreover, we track how the company is likely to fair in an economic and market ‘meltdown’. This includes tracking measures related to liquidity, dividend yield, gearing and how opaque the company’s business model is. We aggregate these measures at a portfolio level to understand how we are faring across each metric, ensuring the exposures are calibrated appropriately for where we are at in the market cycle.

These measures help provide downside protection in a market sell off. Whilst our funds are fully invested, we are paying particular attention to not overpaying for growth and being conservatively positioned across our risk metrics.

Andrew Mitchell is Director and Senior Portfolio Manager at Ophir Asset Management. This article is general information and does not consider the circumstances of any investor.

Read more articles and papers from Ophir here.