Investment risk is often viewed as the possibility of incurring a negative return over the short-medium term, as reflected in measures like volatility or drawdown. Such measures are useful for investors with shorter horizons.

But they become increasingly less effective as the horizon lengthens, especially when investing over multiple periods where cash comes into or out of the portfolio. The classic example is investing for retirement: return volatility says little about the risks of failing to generate an adequate income stream over future decades.

This article draws out the main themes from a recent paper where I discuss risk from the perspective of long-term investors, e.g. those investing for a decade or more.

Risk and long-term objectives

Risk may be defined as the failure to attain an objective. The objectives of long-term investors fall into three groups:

- building wealth (real return targets, bequests, some sovereign wealth funds and family offices)

- generating an income stream (retirement income; endowments and foundations), and

- funding long-term liabilities (defined benefit pensions; life insurance).

Two questions arise. First, what could lead to failure to achieve the objective? Second, how might the risk of falling short of objectives be measured?

Sustained losses matter more to long-term investors

Measures based around return volatility describe the possibility of suffering shorter-term loss. What matters to long-term investors is incurring a loss that is sustained over their investment horizon.

Volatility-based measures do not distinguish between losses arising from forces that can result in sustained loss, from transient effects with no consequence for ultimately achieving objectives.

Further, volatility can be as much a source of opportunity as a risk for long-term investors, as market fluctuations can provide opportunities to buy assets at attractive prices for the long run (or exit and redeploy the capital).

An alternative framework is needed.

Nature of risk for long-term investors

Viewing wealth accumulation as associated with four drivers – initial expected return, cash flow risk, discount rate risk and reinvestment risk – can help identify the factors that long-term investors should worry about. This decomposition derives from asset prices as the present value of future cash flows. Initial expected return equates to the discount rates on which assets are priced.

Deviations from the initial expected return stem from subsequent changes in the cash flows being discounted, and the discount rate applied. Wealth accumulation also depends on the rate at which cash flows released by assets are reinvested.

1. Initial expected return

For assets that offer relatively high expected returns in excess of that required, the probability of achieving an objective will not only be higher but also increases with investment horizon. The reverse holds for assets offering sub-par expected returns. The rub is that higher-returning assets tend to be more variable, raising the possibility of even worse outcomes in the ‘lower tail’.

The upshot is that equities may appear more attractive (in terms of shortfall risk) to a long-term investor on the balance of probabilities, but they need to be willing to bear some chance that things might turn out even worse than investing in (say) fixed income.

Meanwhile, fixed income may offer more reliable outcomes, but could be almost certain to fall short of a long-term objective.

2. Cash flow risk

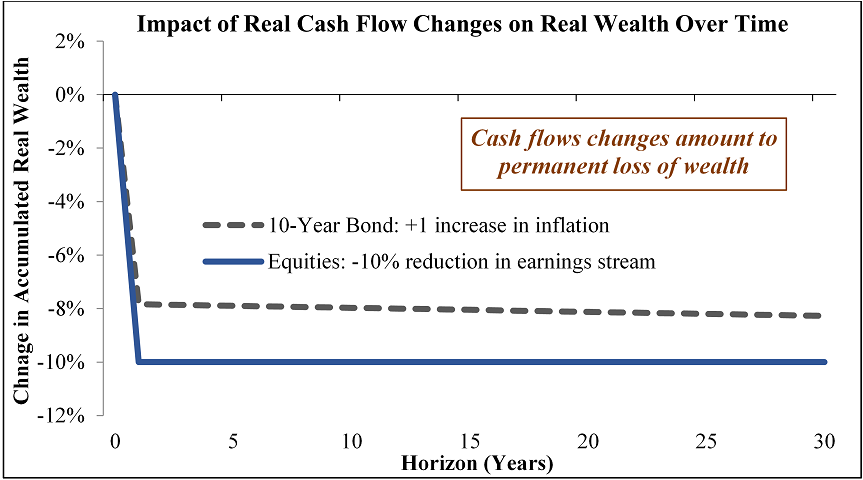

Sustained losses occur when the cash flows generated decline versus what was originally reflected in the price. For example, equities will suffer a permanent downward adjustment upon a sustained reduction in the future cash flow stream due to an earnings revision. For bonds, rising inflation can generate sustained losses by eroding the real value of their promised cash flows. Investing in assets that do not deliver on their promise for (real) cash flows is a key risk faced by long-term investors.

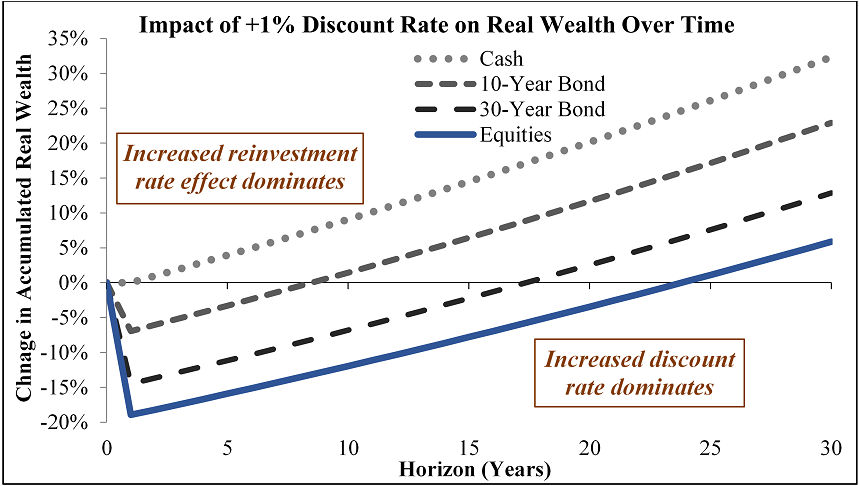

3. Discount rate risk

Asset prices also fall when discount rates rise. However, the fall leaves the asset priced to deliver higher returns thereafter, meaning that the wealth losses are gradually clawed back.

Consider how bonds respond to rising yields: there is an immediate capital loss, but the bond resets to a higher yield. If the bond is held to maturity, the investor gets the return they expected initially. The relation between asset duration (i.e. term of the cash flows) and investment horizon establishes a pivot point.

An investor faces discount rate risk when duration is longer than the investment horizon; but no discount rate risk when the two equate. If duration is shorter than horizon, then reinvestment risk comes into play.

4. Reinvestment risk

Most assets release cash flows to be reinvested, creating exposure to uncertainty over reinvestment rates. For equities, this uncertainty relates to reinvestment of dividends and retained earnings. For bonds, both coupons and principal at maturity need to be reinvested.

Reinvestment risk increases as asset duration shortens relative to investment horizon, and as horizon lengthens given that most assets continue releasing cash over time. The concern when exposed to reinvestment risk is that rates will fall; while the concern with discount rate exposure is that rates rise.

This decomposition changes how a long-term investor might perceive the risks associated with various assets.

Equities emerge as less likely to fall short of long-term objectives by virtue of their higher expected return. But they carry exposure to cash flow (i.e. earnings) risk, and reinvestment risk related to companies reinvesting at value-destroying rates. Equities may also bring exposure to discount rate risk, unless the investor has a very long horizon.

The main concern with fixed income is the likelihood of falling short of objectives due to insufficient expected returns; although mismatches between duration and horizon and whether inflation might erode the real value of cash flows should also be considered.

Path dependence

Path dependence emerges where the sequence of returns may result in shorter-term losses being crystalized, thus generating sustained losses. Two situations are notable. First is where poor initial returns disrupt the ability to follow-through on well-founded long-term investment plans. For instance, a fund might be forced to sell assets cheaply after a bout of poor performance if their investors withdraw, or support is lost from within the organization. Second is sequencing effects arising from the interaction between returns and cash flows. For instance, a retirement account will be exhausted more quickly if a fixed amount is drawn and poor returns are incurred early in retirement.

Measuring long-term investment risk

I will briefly overview the key elements involved in measuring long-term risk and leave it to interested readers to access my paper for guidance and examples.

Long-term risk analysis involves scoping out potential future ‘paths’, and then identifying paths where objectives are not attained. It will likely entail some form of simulation or scenario analysis.

As real spending power is typically the concern over the long run, it will usually be appropriate to model in real terms. Although analyzing real long-term returns may sometimes suffice, in many situations real wealth accumulation should be modelled to account for cash inflows and outflows and reinvestment at rates other than available in the market, e.g. company reinvestment. Risk metrics should convey the likelihood and magnitude of shortfall versus objectives. This involves estimating both the probability of failing to meet the objective, and the size of any shortfall that might occur.

Finally, it is important to allow for initial market conditions, especially with regard to baseline expected returns. Currently, returns on offer appear well below what has occurred historically, with fixed income priced for zero-to-negative real yields and equities and other risk assets highly priced. The risk of falling short of long-term objectives would be misrepresented significantly if the analysis drew on historical data, rather than calibrating to the current market return structure. Further, acknowledging that market discount rates have more upside than downside from current low levels will have implications for discount rate versus reinvestment risk, and hence the relative attractiveness of assets with differing exposure to these two drivers.

Standard Risk Measure (SRM)

The SRM as reported by Australian superannuation funds reports the expected number of negative return years out of twenty. It essentially reflects the volatility of yearly returns. An ideal measure would focus on the risk of failing to generate adequate income in retirement; but this needs to be implemented at the member rather than fund level. At the very least, the SRM should be replaced or supplemented with a measure conveying the probability of a fund failing to achieve its stated real return objective over a horizon like 10-years, perhaps coupled with some indication of downside risk such as the probability of delivering a zero or some negative real return.

The key question

Evaluating long-term investment risk requires shifting the mindset away from a focus on shorter-term losses towards failure to achieve a long-term objective. A key question to ask is: what developments might result in losses that are sustained over the investment horizon?

Answering this question will help distinguish exposures that need to be managed from those of little consequence. When it comes to measuring risk, analysis should be directed towards generating the range of potential future paths and estimating both the likelihood and magnitude of any shortfall versus objectives.

Dr Geoff Warren is an Associate Professor at the Australian National University's College of Business and Economics. He has an investment industry background, and currently sits on a number of advisory boards.