Since ‘Liberation Day’ on 2 April 2025, markets have experienced heightened volatility. Shifts in US trade policy and growing fiscal concerns are prompting some investors to reassess their broad exposure to US assets within multi-asset portfolios.

Recent global client surveys show that over 20% of investors based in Asia Pacific and Europe are considering trimming their benchmark allocations to US or US-dollar denominated assets[1]. With US equities making up more than 70% of the MSCI World and over 60% of the MSCI All Country World Index, investors are increasingly looking further afield for diversification.

Despite these shifts, the US dollar remains the dominant global currency, and US assets continue to serve as core components in a global portfolio. For Australian investors, European and Emerging Markets ex China equities, along with local fixed income strategies and currency hedges, are gaining traction. Additionally, some are recutting their US equity allocations to include active US equity strategies that aim to outperform the broad US equity market.

1. Diversify internationally

While we continue to see value in US equities, their benchmark dominance and high foreign ownership are prompting investors to look elsewhere. Europe is leading the shift: iShares European equity ETPs have attracted more global flows year-to-date than their US counterparts[2]. In Australia, over $52 million flowed into our European equity ETF in the first half of the 2025.[3]

Similarly, global investors have also flocked into Emerging Markets ex China equities, which has seen US$9 billion in global net inflows so far this year[4]. This trend is mirrored in Australia, where more than A$238 million has flowed into the locally-listed ETF, placing it among the top 10 iShares Australian ETFs by inflows in 2025.[5]

Europe’s resurgence is being driven by bold fiscal initiatives and improving economic fundamentals. The European Commission’s €800 billion ReArm Europe plan aims to boost defence capabilities[6] and reduce reliance on US imports. Germany alone is increasing defence spending to 3–3.5% of GDP. Meanwhile consumer confidence is rebounding, bank profitability is rising, and manufacturing output is steadily climbing across the Eurozone.[7]

European equities also offer a value tilt and exposure to long-term, structural ‘mega forces’ such as AI transformation and geopolitical fragmentation.

A similar story is unfolding in select emerging markets. Taiwan, for example, is a global leader in AI-related industries, with nearly 15% of its GDP tied to technology[8]. Brazil, rich in commodities and with a diversified exposure base spanning Asia, Europe, and the Americas, stands to benefit from the global realignment of supply chains. India, with a growing working-age population and supportive monetary policy, is also poised for long-term growth.

2. Lower beta to the US(D)

US fixed income assets remain a cornerstone of global portfolios but rising term premiums and fiscal concerns are creating vulnerabilities. Across Asia Pacific, investors are rotating into shorter/intermediate US Treasuries and diversifying into global government bonds.[9]

In Australia, we’ve also seen a marked preference for Australian government bonds and domestic investment grade credit, as investors shy away from US-dollar denominated assets.[10] Our broad Australian bond and more granular Australian corporate bond exposures were the top asset gatherers across the iShares fixed income ETF range over Q2, receiving $76 million and $124 million in flows respectively.[11] With further RBA rate cuts anticipated, Australian bonds are well-positioned for consistent performance.

3. Hedge against USD debasement

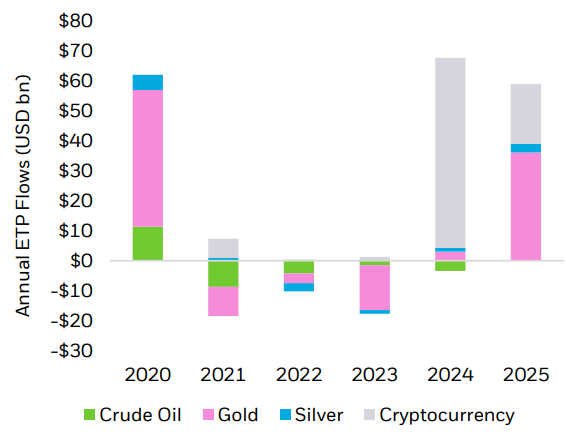

While the US dollar remains dominant, signs of a cyclical downturn are emerging – driven by slowing growth, fiscal deterioration, and rising hedging activity. Currency overlays and partial hedges are gaining popularity, and gold is back in favour. Global gold ETPs have seen the strongest inflows since 2020, with nearly US$40 billion of net flows so far this year.[12]

Global gold ETP flows have grown 10x versus 2024

Commodities ETP flows by exposure, 2020 onwards

Source: BlackRock and Markit data as of 30 June 2025

Australian investors are also embracing currency hedging. Hedged U.S. and global ex Australia equity exposures were among the top five iShares products by inflows in Q2.[13] BlackRock Australia’s model portfolios have also increased their hedge ratios to mitigate currency moves in the months ahead.[14]

4. Going active on US equities

For investors recutting their US allocations, we recommend being deliberate with exposure across style factors and sectors and keeping an eye on diversification. The US equity market has become extremely concentrated following the outsized growth of the ‘Megacap 7’ stocks[15]– Apple, Alphabet, Tesla, NVIDIA, Meta, Microsoft and Amazon – with tech and communications now making up almost half the S&P 500 Index.[16] For example, Apple, with its strong free cash flow and low debt levels, typically aligns with the ‘quality’ factor.

In US equities, blending an index exposure with an active exposure using a factor rotation strategy may help investors offset this concentration risk and potentially enhance long-term returns across their US holdings. BlackRock’s factor rotation strategy uses a combination of fundamentals, sentiment, and macro signals to dynamically tilt towards favoured factors - having recently increased its overweights to value and momentum - and has consistently outperformed the S&P 500 over 1-, 3-, and 5-year timelines.[17]

Ultimately, US assets remain central to long-term portfolio construction given the depth and liquidity of US capital markets. However, in the world of shifting policy dynamics and market uncertainty, global investors are rebalancing, diversifying across geographies, asset classes, and currencies in order to weather the short-term storm.

Tamara Haban-Beer Stats is BlackRock Australasia’s iShares ETF & Index Investments Specialist.

[1] Source: BlackRock, based on a survey of 2,557 clients globally in the week of 2 June 2025

[2] Source: BlackRock data as of 20 June 2025

[3] Source: BlackRock data as of 30 June 2025

[4] Source: BlackRock data as of 30 June 2025

[5] Source: BlackRock data as of 18 July 2025

[6] Source: BlackRock data as of 16 April 2025

[7] Source: Trading Economics, as of 22 May 2025

[8] Source: US International Trade Administration, September 2024

[9] Source: BlackRock and EPFR data as of 30 June 2025

[10] Source: BlackRock data as of 16 June 2025

[11] Source: BlackRock data as of 30 June 2025

[12] Source: BlackRock and Markit data as at 30 June 2025, refers to global ETF industry flows

[13] Source: BlackRock data as of 30 June 2025

[14] Source: BlackRock data as of 16 June 2025

[15] This is not a recommendation to invest in any particular financial product.

[16] Source: Past performance is not a reliable indicator of future performance.

[17] Source: BlackRock data as of 31 March 2025. Past performance is no indication of future performance

CLICK HERE FOR IMPORTANT INFORMATION: Issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL).

The information in this material is current as at August 6, 2025 and is subject to change at any time due to changes in market or economic conditions.

This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Before making any investment decision, you should assess whether the material is appropriate for you and obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide on its website for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction.

Information provided is for illustrative and informational purposes and is subject to change. It has not been approved by any regulator.

This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. BIMAL is a part of the global BlackRock Group which comprises of financial product issuers and investment managers around the world. BIMAL is the issuer of financial products and acts as an investment manager in Australia.

BIMAL, its officers, employees and agents believe that the information in this material and the sources on which it is based (which may be sourced from third parties) are correct as at the date of publication. While every care has been taken in the preparation of this material, no warranty of accuracy or reliability is given and no responsibility for the information is accepted by BIMAL, its officers, employees or agents. Except where contrary to law, BIMAL excludes all liability for this information.

Any investment is subject to investment risk, including delays on the payment of withdrawal proceeds and the loss of income or the principal invested. While any forecasts, estimates and opinions in this material are made on a reasonable basis, actual future results and operations may differ materially from the forecasts, estimates and opinions set out in this material. No guarantee as to the repayment of capital or the performance of any product or rate of return referred to in this material is made by BIMAL or any entity in the BlackRock group of companies.

No part of this material may be reproduced or distributed in any manner without the prior written permission of BIMAL.

© 2025 BlackRock, Inc. or its affiliates. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, ALADDIN, iSHARES and the stylised i logo are registered and unregistered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.