A question that we have often been asked over the years is: can the disruptors be disrupted?

There is a ready answer. The largest, most valuable and closest disruptor on the horizon is artificial intelligence (AI) and one of the targets is the ten blue links in Google’s search. Further, the threat is so serious that Google has been forced to disrupt itself with its own AI engine, Gemini. At stake is Google’s US$200 billion annual search revenue stream – which explains why the funding of new AI disruptors continues to rise and ‘big tech’ companies (including Google) invest to position themselves in the AI era (big tech capex is expected to be US$300 billion + in 2025). Here is a non-exhaustive summary of capital raisings to date:

OpenAI

- Amount: US$40 billion (closed March 2025)

- Valuation: US$300 billion post-money

- Lead Investor: SoftBank (US$30 billion), with Microsoft, Thrive Capital, Coatue, and others

- Purpose: Funding next-gen AI models and the massive Stargate infrastructure project

- Additional Plans: Targeting another US$17 billion by 2027.

Anthropic

- Amount: US$7 billion in 2025 alone (mix of US$4.5 billion equity + US$2.5 billion debt)

- Valuation: US$62 billion post-money (as at March 2025 equity raising)

- Lead Investor(s): Amazon, Google, Lightspeed Venture Partners and others

- Purpose: Funding next-gen AI models, expand compute capacity, deepen research and accelerate international expansion.

- Additional Plans: Targeting another US$17 billion by 2027.

Grok / xAI (Elon Musk)

- Capital Raising in Progress: US$9.3 billion (mix of US$4.3 billion equity + US$5 billion debt)

- Valuation: US$80 billion (Q1 2025)

- Investors: Andreessen Horowitz, Sequoia, VY Capital

- Use of Funds: Infrastructure (e.g., ‘Colossus’ supercomputer), Grok model development, enterprise AI expansion

These capital raisings are coming for Google’s search. Because for larger questions requiring finished documents (where the document may also be a programming routine) Microsoft’s Copilot, ChatGPT – and Google’s Gemini itself – do a much better job than Google search on its own.

For example:

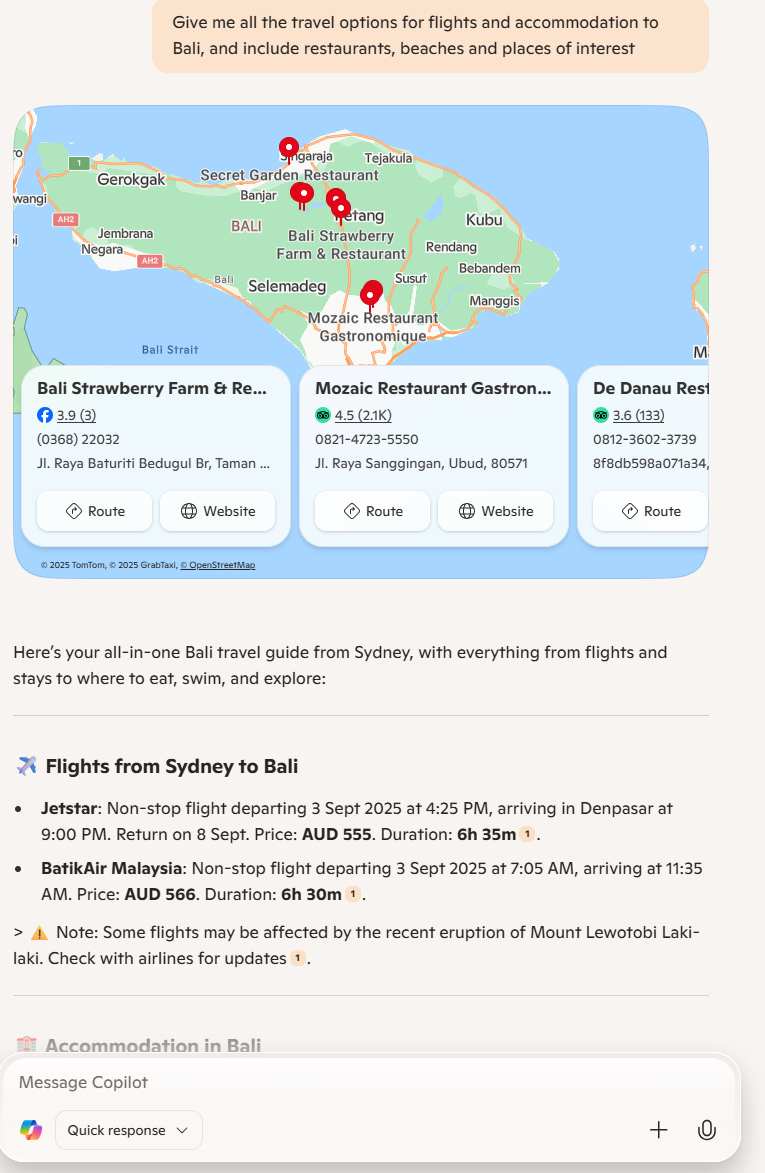

- Show the options for travel to Bali, including hotels and places of interest (shown below)

- Or “provide a timetable and the links to help me get conversational in Spanish in 1 year.” Et cetera.

Source: Microsoft Copilot

Satya Nadella, the head of Microsoft, when announcing the company’s entry into AI in November 2022, famously laid out the investment case, saying that just a 1% shift in search revenue from Google would be worth US$2bn to the company. His aim was to make Google come out from behind its search wall and be forced to compete on a battlefield where Microsoft was setting the terms. Nadella even taunted Google and its CEO Sundar Pichai by saying “I hope with our innovation they will definitely want to come out and show that they can dance. I want people to know that we made them dance”.

Gemini: Google disrupting itself

Unfortunately for Microsoft, they did not make Google dance – but ChatGPT, the AI product from Microsoft-affiliated Open AI, certainly did.

Ever since the chatbot’s launch in late 2022, it seems Google has been playing a game of catch-up. The threat was so great that reports suggested a ‘Code Red’ had been issued within the company. Would the company be able to pivot from being a search engine to an answer engine?

At least anecdotally, it seems more and more of those answers are being provided by ChatGPT (and not Google). Even if this is simply users performing non-commercial searches (often informational searches that can’t be monetised), those users might end up shifting more of their commercial searches over time. That would be bad news for Google.

While yet to show up in the headline Google Search revenue (which is still growing at a healthy 10% Y/Y), under the surface there appear to be warning signs. In the company’s latest quarterly SEC filing, the company disclosed the lowest paid click growth ever (2% Y/Y, lowest by ~2 percentage points). Meanwhile, Apple is reportedly looking at AI search as an alternative to Google in Safari and has had discussions with Perplexity (another ChatGPT-like offering). To make matters worse an Apple senior executive in testimony suggested that in April 2025 Google searches in Safari declined for the first time ever.

But is it all doom and gloom for Google?

Over the past 12 months Google has aggressively rolled out various AI-powered solutions to its existing products, including Search. Readers will have noted that AI overviews are now appearing in more and more searches – reaching approximately 1.5bn users per month according to management. The company also plans to roll out “AI mode” to users in the US which incorporates even more features.

Google also disclosed that AI overviews monetise at the same rate and are driving higher usage as well as satisfaction. Queries were also 2x longer vs traditional search – it’s because of these factors that monetisation might actually increase as a result of AI.

AI usage across Google’s surfaces is still accelerating

Source: Google (Alphabet)

Just look at the travel example referenced previously – the searcher is disclosing significant, specific intent around flights, hotels and restaurants. The provision of this data may be extremely valuable to those who may benefit, owing to the higher likelihood of patronage relative to a traditional search.

And on the technology side, Google is unrivalled. The company has its own AI research lab (Google DeepMind), which helps produce its own Large Language Models (Gemini) on specialised hardware (Tensor Processing Units) that it has designed over the course of a decade for its cloud. It also has numerous applications that provide it immediate and significant distribution for these capabilities (billions of people interact with Google’s suite of services every day).

But even with all these advantages, the company has to tread carefully so as to not upend the largest and most profitable part of its business (Google Search). This is the innovator’s dilemma and why technological change and disruption are such potent forces. Microsoft successfully navigated its own disruption – the shift from a Windows-centric business to a Cloud-centric business – but wasn’t unscathed during the process (it famously missed the shift to mobile) with a long period of underperformance from a share price perspective.

So for now, Google no longer appears in the portfolios we manage. We believe there are better exposures on a risk-adjusted basis to the big changes impacting advertising. And while we won’t know for many years the final shape of the AI search market from an investment perspective, we do know (and are observing) that there is exploding growth in revenue for those supplying the tools for this AI. Nvidia’s revenue has catapulted from US$35 billion in 2022 to an expected US$200 billion this year. And that is the reason we continue to hold it, and others in the area (including Broadcom and Arista).

Which other companies and industries are disrupting themselves?

Slightly further along is the disruption impacting the automotive industry. It was initially held that the electric car, which is a significant disruption to the car and transport industry, would be incorporated into the range of existing car companies like Volkswagen and Ford. But the speed, quality and number of the models coming from China are decimating the car industry, even the German car brands like Mercedes, as well as Toyota and US marques. It is even disrupting Tesla, which has not been able to respond adequately given the emerging scale of the Chinese car industry.

A handful of these automotive companies were disruptive in their own right – but that was over a century ago.

Disruption is dynamic – the winners of today are not necessarily the winners of tomorrow. Business models are constantly changing and new opportunities emerging, often fuelled by new technologies, and this change seems to be accelerating. An active investment strategy that recognises and takes advantage of these realities is essential.

Harry Morrow is a Senior Investment Analyst, and Alex Pollak is Chief Investment Officer and Co-Founder of Loftus Peak. This article is for general information only and does not consider the circumstances of any individual. Loftus Peak Global Disruption Fund (ASX:LPGD) is available to investors on the ASX as an active Exchange Traded Managed Fund.