One birth every one minute and forty seconds. One person arriving in Australia to live every 56 seconds. These are powerful numbers from the Australian Bureau of Statistics (ABS), which highlight the remarkable growth taking place in Australia.

The ABS projects between 31 and 42 million people will call Australia home by 2056 compared with our current population of about 25 million. This growth rate makes Australia one of the fastest-growing ‘developed’ countries globally.

With population growth typically comes urbanisation. Despite our vast continent, 90% of Australians live within 100 kilometres of the coast, with over two-thirds living in our capital cities. For investors, population growth and urbanisation is an enticing investment narrative. How can we gain exposure?

Underpinning Australia’s growth

Two core elements which underpin any developed country’s growth are property and infrastructure.

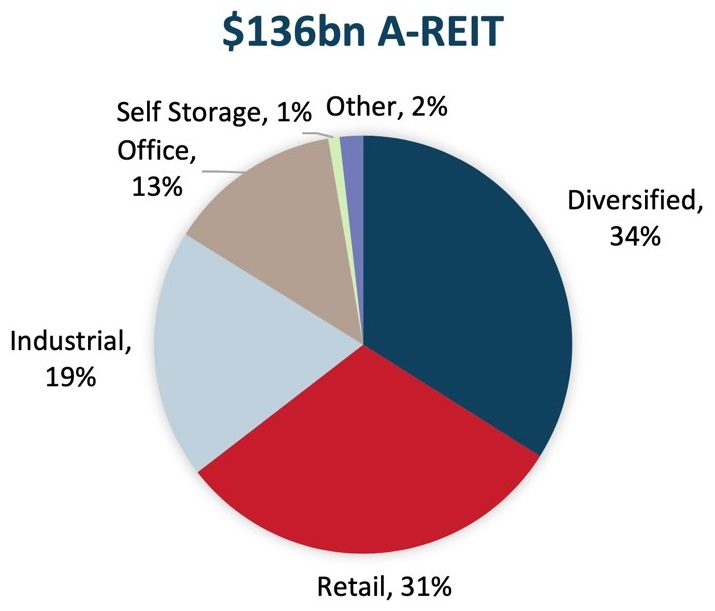

For decades, Australian Real Estate Investment Trusts (A-REITs) have provided exposure to the property growth angle, delivering strong long-term returns. While we still believe high-quality A-REITs are sound investments, the 10 largest A-REIT issuers currently account for 86% of the S&P/ASX300 A-REIT Accumulation Index market capitalisation. Additionally, almost half of the underlying assets of A-REITs are now concentrated in retail real estate, a sector experiencing significant change due to the growth of e-commerce and changing consumer behaviour.

Source: S&P, Factset, Resolution Capital

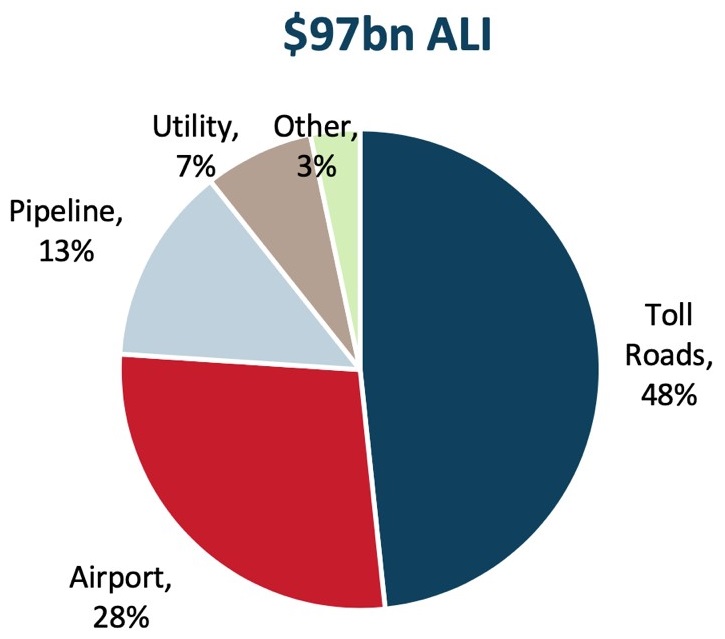

When it comes to infrastructure, Australian Listed Infrastructure (ALI) provides exposure to monopolistic assets critical to the growing population such as toll roads, airports, utilities and pipelines.

Source: S&P, Factset, Resolution Capital

We view toll roads and airports as two sectors within ALI that are well positioned to benefit from ongoing population growth and urbanisation. Infrastructure assets share some similar attributes to REITs, in that the primary source of earnings is from assets which generate sustainable, often long dated, inflation-protected cash flow. However, there are many traits relatively unique to listed infrastructure. The most distinct is that many infrastructure investments provide exposure to monopoly-like assets with high barriers to entry for assets such as pipelines, toll roads and airports.

Infrastructure assets are typically regulated which ensures stable returns, while performance is generally not dependent on the short-term condition of the economy, making infrastructure returns relatively defensive.

High-quality Australian listed infrastructure

Transurban Group’s (ASX:TCL) toll roads are critical infrastructure assets with high barriers to entry. Over three quarters of TCL’s value comes from its Sydney and Melbourne road networks, with the remainder Brisbane, Washington DC and Montreal. Its Melbourne asset, CityLink, is a 22-kilometre road connecting the Monash, West Gate, and Tullamarine freeways. Cash flows from this asset (before any debt) have increased by over 9% per annum from 2014 to 2018. We expect a slight deceleration the coming years.

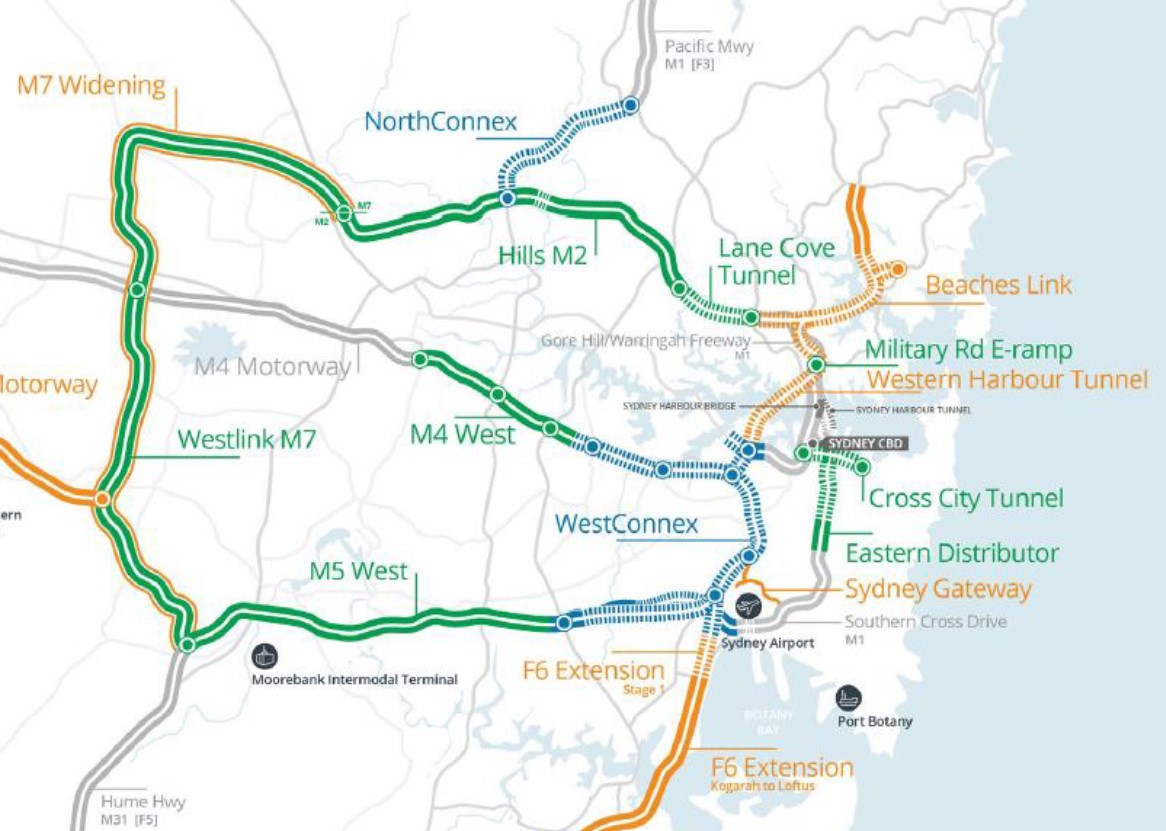

In Sydney, TCL’s toll road assets are immense, as shown in the map below. Road users who value their time have few other options, plus a shareholder might feel (slightly) better paying the tolls!

Source: Transurban Group

Source: Transurban Group

TCL has an intimate understanding of road traffic volumes. Importantly, the majority of its tolls escalate at around ~4% per annum, which is above inflation and offers real price growth in the current low economic growth environment. Furthermore, population growth in both Sydney and Melbourne is expected to remain strong in the coming decades, which should provide further patronage for TCL’s roads. When considering the valuation of toll roads, investor should analyse three factors; concession length, traffic growth and toll price growth.

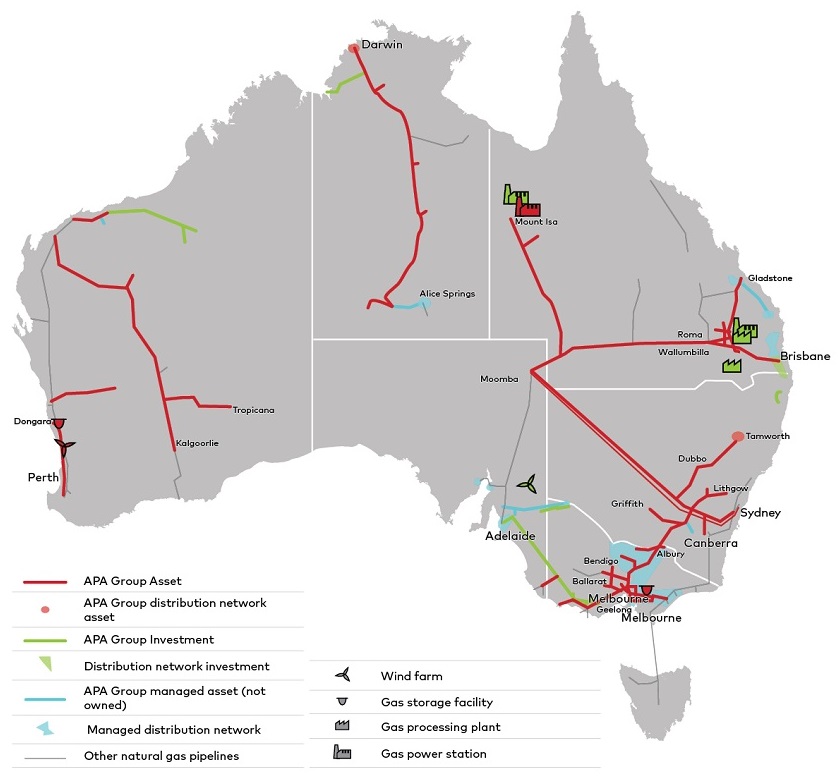

Another infrastructure with similarly powerful monopolistic traits is APA group (ASX:APA). APA has an around 60% market share of Australia’s gas transmission market and average contracts lengths are over 12 years with investment grade tenants. This picture shows how vast APA’s pipeline network spans.

Source: APA Group

Source: APA Group

Other high-quality ALI stocks include Sydney Airport (airports), Auckland International Airport (airports), Atlas Arteria (roads) and Ausnet Services and Spark Infrastructure (both energy transmission and distribution).

Airports exhibit high barriers to entry and in Australia and New Zealand there are limited effective substitutes for air travel. Road and train travel between major cities is less prevalent than in Europe, underpinning airport passenger growth. Historically, air travel growth in Oceania has proved to be resilient to external shocks and growth has over the long-term exceeded GDP growth.

Sydney and Auckland Airports are both leveraged to population and wealth growth in Asia Pacific, because with increased wealth more air travel will follow. Both airports generate around half of their revenue from their aeronautical businesses and these are subjected to regulatory oversight. The other half of their revenues is derived from non-aeronautical related activities, comprised of rent on highly productive retail shops in the terminals, including duty-free hotels, airline lounges, commercial office and logistics properties and car parking. Interestingly, Auckland Airport has immense land holdings which has enabled it to become one of the largest developers of industrial real estate in the country.

AusNet and Spark are owners of critical infrastructure assets including electricity distribution (poles and wires) and transmission networks (high voltage power lines) that effectively transport power from the generation sources to consumers and businesses, neither are susceptible to fluctuations in energy usage. Naturally, the forces of population growth and urbanisation create greater need for energy transport infrastructure.

A key positive theme for both AusNet and Spark is the decentralisation of electricity generation. This involves the retiring of coal-fired power plants replaced with new renewable power generation sources such as solar and wind farms. These renewables require energy transmission infrastructure to be built to integrate them into the electricity grid, providing a growth opportunity for both AusNet and Spark.

Australian infrastructure stocks have outperformed A-REITs over the long term, mainly because A-REITs were ill-disciplined in the lead up to the GFC, resulting in the need to repair their balance sheets at a low point in the market. Pleasingly, the sector seems to have learned from its mistakes, and the balance sheets and strategies are currently in good shape.

Property and infrastructure benefit from growth and urbanisation

We believe the best way for investors to gain exposure to Australia’s growth and urbanisation narrative is through a diverse portfolio of high-quality A-REITs and ALI.

Combined, A-REITs and ALI make up a $233 billion investment opportunity in ‘real assets’. Investing in the offices, roads, warehouses, airports, pipelines and shops that underpin our nation is an opportunity for all investors to gain from Australia’s continuing economic growth.

Andrew Parsons is Chief Investment Officer at Resolution Capital. This article is general information and does not consider the circumstances of any investor.