While domestic equities remain the main investment of choice for many Australian investors, there has been a shift in recent years towards international stock markets to increase returns and diversify portfolios. In a 2019 Investment Trends survey, a sixth of Australian investors stated that they intend to start trading international shares over the following 12 months. Overwhelmingly, the US market was seen as the starting point.

This article looks at three key areas which explain why equity investors should care about foreign exchange. We examine this issue through the lens of Aussie investors investing in US stocks, though the concepts covered are relevant for investments in other overseas financial markets.

One look at a chart of the AUD/USD exchange rate in the last year shows the range of US57 cents to US73 cents can have a profound impact on returns from overseas investments.

AUD/USD exchange rate, 12 months to September 2020

Source: IRESS

1. Investment returns due to currency risk

When you purchase and sell shares in an Australian company on a local exchange, whether your investment makes a profit will largely depend on the change in the company’s share price.

However, investing abroad is similar to going to a foreign country on holiday where the exchange rate can make a huge difference to travel costs. For international investing, the impact of foreign exchange rates can have a material impact on unhedged returns subject to currency movements.

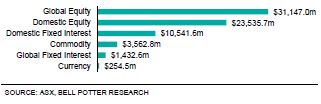

It is commonly believed that Australian retail investors are heavily underweight global shares, but this is due to a misinterpretation of ATO data on SMSFs. A more balanced picture shows global equities are the largest asset class in Exchange Traded Funds (ETFs) in Australia.

ETFs by asset class, as at August 2020

2. Company earnings

“The local bourse was up 0.6% today, with the lower Aussie dollar benefiting offshore earners.”

This is a common headline in market wrap-ups but what drives this scenario?

Some of Australia’s best-known companies are beneficiaries of a lower Aussie dollar because of their ability to generate or collect revenue in US dollars or other currencies.

Iron ore miners such as BHP Group (ASX:BHP) and Fortescue Metals (ASX:FMG), gold miners such as Newcrest Mining (ASX:NCM) and oil producers like Woodside Petroleum (ASX:WPL) receive a boost to earnings when the Australian dollar falls since the prices of their exports are benchmarked to the US dollar.

Other local companies leveraged to a strong greenback include healthcare giants CSL (ASX:CSL) and Cochlear (ASX:COH) and manufacturing and materials companies like Boral (ASX:BLD) and Amcor (ASX:AMC) who generate a large portion of their sales volumes in North America.

Companies may decide to hedge some or all of their currency exposure to deliver more stable earnings over time or they may be happy to take on the risk of short-term currency fluctuations.

3. Fees

While the fundamental rules of share investing are the same regardless of the market (buy quality companies with strong fundamentals and a resilient business), fees are more complicated and investors need to know how to minimise any erosion in investment returns. Brokerage fees, service fees, management fees, foreign exchange conversion fees and custody fees are some of the more common charges associated with international investing which require a closer inspection.

For Australian investors looking for single stock exposure, there are two common ways of investing;

- Open an international broking account and trade direct shares on the relevant exchange (Direct).

- Trade depositary receipts listed on Chi-X (now Cboe) Australia in AUD and locally through your domestic broker (TraCRs).

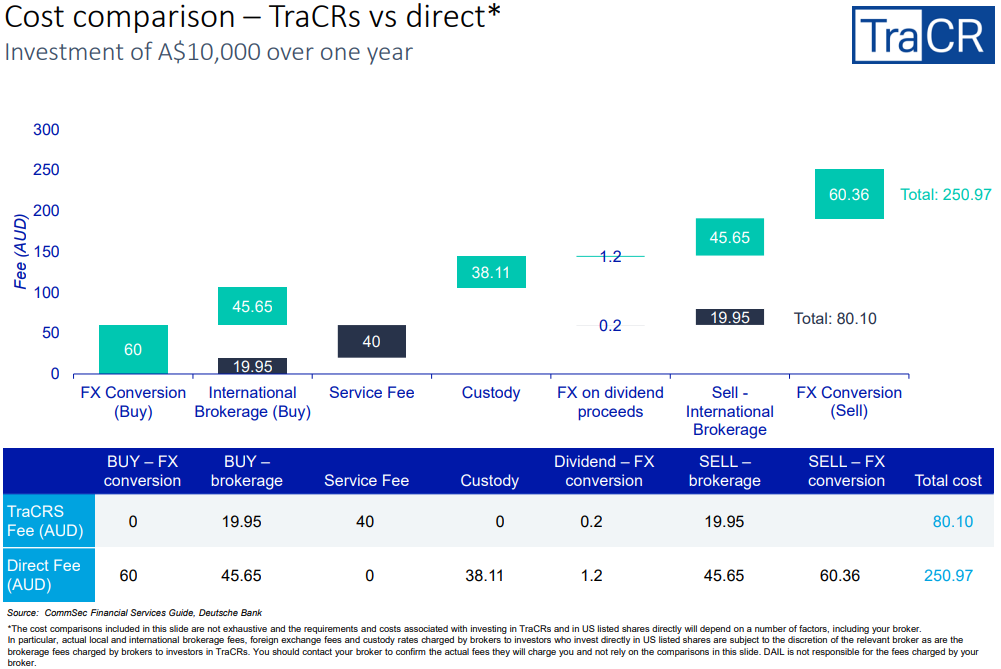

A recent report published by Deutsche Bank (the issuer of TraCRs) looks at these two options by comparing the fees charged by a large online broker which offers exposure to the US equity market via direct share investment and TraCRs. A summary of their findings can be seen below.

The cost of direct share investment is significantly higher than via a TraCR, and this is largely attributable to the foreign exchange conversion costs. Most investors may not realise that $170 in FX fees is equivalent to an additional 1.7% lost return on an investment of $10,000.

Ever wondered how the ever-expanding number of zero commission brokers earn a profit? This might explain it. In the case of TraCRs, the service fee is only applied to dividends, so if a stock does not pay a dividend, there is no service fee. And there’s a surprising range of companies which do not pay dividends that are available as TraCRs, meaning no services fees for holdings in Berkshire Hathaway (CXA:TCXBRK), Facebook (CXA:TCXFBK), Amazon (CXA:TCXAMZ), Netflix (CXA:TCXNFL), Google (CXA:TCXGOG) or even Zoom (CXA:TCXZOM).

Let’s look at an example

An investor sees many more people streaming television programmes and decides to invest in Netflix which trades on the NASDAQ exchange. She buys 100 shares in the company at USD500 per share when the exchange rate is AUD/USD 0.7000. So at the time of investment, the market value of these shares was USD50,000 or AUD71,428 (i.e. 100 shares x USD 500 / 0.70).

Fast-forward 12 months and let’s assume the price of Netflix has increased 20% to USD600 per share. The US dollar value of the 100 shares is now USD60,000, generating a tidy profit of USD10,000. However, over the same 12-month period, the value of the Aussie dollar appreciated 20% against the US dollar meaning the rate is now AUD/USD 0.8400. Converting USD60,000 to Australian dollars gives Australian dollar proceeds of AUD 71,428, the original investment!

Not a great result given the investment idea was correct and Netflix increased 20% over the year. It would equate to a small loss once the fees outlined in the previous section are taken into account.

Of course, the opposite is also possible. The currency headwind can turn into a tailwind when exchange rates move in the opposite direction. Purchasing unhedged shares, TraCRs and ETFs can be a positive if the Australian dollar depreciates. Staying with the example above, if the Australian dollar depreciates by 20% down to AUD/USD 0.56, close to the level in March this year, the Australian dollar value would be an impressive AUD107,143 (i.e. 100 shares x USD 600 / 0.56).

In this example, if the investor expects the Australian dollar to fall, they might be happy to take an unhedged position. However, for those who want to take the currency risk out of the equation, there are a number of products (including ETFs) which can assist in hedging some or all of the currency exposure.

More investing overseas means more FX risk

As companies and investors continue to explore growth opportunities outside Australia, foreign exchange movements are becoming more intertwined with equity investor returns. The range of investment products is increasing which brings choice but it’s important to consider the additional fees and charges associated with dealing in international markets.

No matter whether you are investing in local or offshore companies, or on an Australian or international exchange, it pays to take a closer look at the impact of foreign exchange on your equity investments.

Adrian Fyffe is a Product Manager at Cboe Australia, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any person.

For more articles and papers from Cboe, click here.