Adam Grotzinger is a Senior Portfolio Manager for Neuberger Berman’s Strategic Income Fund, widely available on Australian platforms. Neuberger Berman manages about US$440 billion across all asset classes in 35 offices worldwide, including Sydney.

GH: It's been a difficult time for investors with global stockmarkets down 20% and major bond indexes off 10%, even US Treasuries. Is it a ‘nowhere to hide’ period for investors?

AG: Yes, in the wake of the so-called ‘interest rate normalisation’ from very low government rates and the supply-demand imbalance after Covid, there’s a stark recalibration in yields and spreads that have hit both bonds and risk asset globally.

GH: You manage the Strategic Income Fund. How has the macro environment affected the way you've positioned the fund?

AG: When we were winding down 2021, we had a view that 2022 would bring a lot of macro, central bank-induced volatility due to the lift off from the zero boundary of interest rates. It then happened in quick order and sizable magnitude. So in Strategic Income, we brought down the risk budget of the fund in Q3 and Q4 of 2021, we reduced the high yield exposure and the market value of exposure, and we increased to about 20% cash and cash equivalents as ballast. We were largely invested but feeling good about on a line-by-line basis on the credits we owned coming into choppy waters.

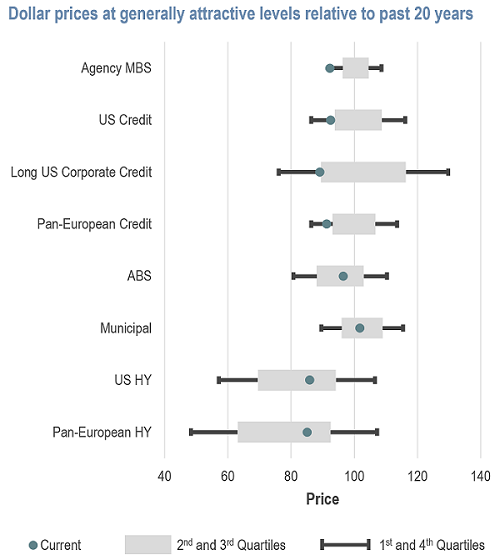

But we’ve also evolved from concern about interest rates and macro trends to increasingly economic and growth worries, so we’ve been gradually redeploying capital back into the bond market where we think there's good value. It’s mainly in investment grade assets largely in the US. As a result of the adjustment factors, they yield attractive margins and we see value at these levels. We have good quality corporate debt at 150 basis points (1.5%) over Treasuries, triple-A agency mortgages with coupons of 5%. It gives us a portfolio yielding around 7% for an average credit quality of A-minus. Cash is down to 7% so we still have some dry powder.

GH: This availability of 5% to 7% yields is something investors haven't seen for many years. Do you think credit markets are closer to pricing in a recession than equity markets?

AG: Well, right now, we see better relative value on a multi asset basis increasingly in fixed income. The adjustment has occurred in short and swift order and the risk/return looks attractive, even if we have a technical recession in the US. For instance, the US high yield market spreads have offered 500 to 600 basis points (5% to 6% above Treasuries) and that level of compensation is out of kilter. It is pricing in a much worse environment for defaults than we are modelling from a bottom up, issuer-by-issuer analysis. So we have a different takeaway there from the market and that's leading us to see better value. It started in favour of investment grade but it's seeping into the lower quality credit end.

Source: Bloomberg. Ranges represents 20-Year High/Low. As of June 2022.

GH: Even when you expect higher yields and wider spreads, you essentially need to stay invested to generate income despite some price deterioration. Do you need to communicate to clients that this year is more of an income story than a capital gains story?

AG: Yes, setting expectations is spot on for the environment we’re in and the objectives for a multi sector bond fund. We embrace market volatility, but the distinction is that we don’t want to embrace impairment risk by poorly underwriting credits. So there’s some short-term volatility in the fund but the medium-term objective is to make the opportunities work for our clients. Expectations need to be set.

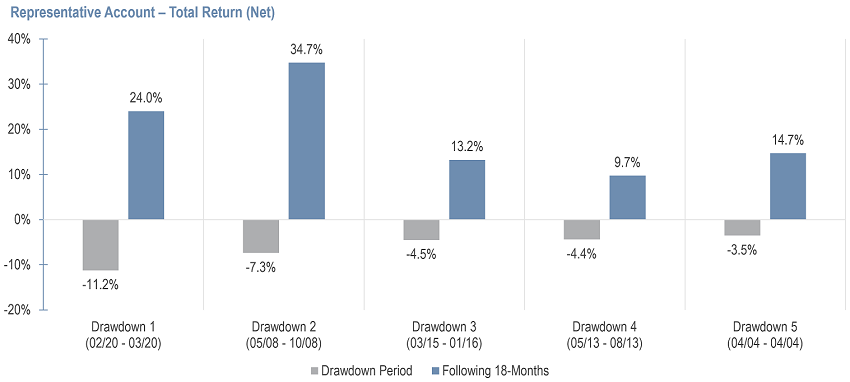

Since before the GFC, after the top five drawdowns (falls in price) in the Fund, the following 18 months more than recovered those losses. We need prudent amounts of risk so we're not forced liquidators of credits and with ample liquidity to buy assets on the cheap. It has enabled us to recover more than the temporary marks down.

Source: Neuberger Berman, as of 31 March 2022

GH: Do you own any Australian securities?

AG: Not today in the Strategic Income Fund but it has been a market we've used in the past. In looking for compelling relative value on a global basis, the portfolio is anchored on the US market given the macro environment and the greater growth opportunities versus say Europe, for example.

GH: Does the massive strength of the US dollar, now at parity with the Euro, influence your positioning?

AG: No, currency is not a big part of how we reach our objectives. It’s more about bond returns and relative value opportunities

GH: Looking at aggregate fund flows in fixed interest, we’ve seen outflows globally in the June 2022 quarter. What was your experience, and do you find it a little frustrating that when there is finally some value in fixed income, investors leave the sector?

AG: Well, I let the market determine where capital goes, but it is frustrating when we think there's good value after a painful readjustment process. We recognise the path to that value has been painful for some clients. We’ve been fine on flows, we have a long history of managing daily traded vehicles and we respect the needs of clients to adjust their asset allocations.

GH: Many active manages talk about downside protection. What are the key steps in 2022 and 2023?

AG: We're entering a period of below-trend growth, a coin toss on recession, with policy volatility. We need to get the fundamentals right and credit selection and managing risk budgets and liquidity are big parts. When the yield is close to 7% on A-minus quality, that is accruing strong income which will be a major component of returns.

GH: Can I understand better where this 7% comes from? It’s higher than my top-of-mind understanding of where yields are. What are the securities included?

AG: Let’s start with the US aggregate bond index, leaving aside global for a simple reference. It includes only investment grade securities and that's yielding (on a so-called ‘yield to worst’) today 3.7%. Treasuries are at 3.1%, securitised products like mortgages are 4.5% to 5%. Investment grade corporate debt is yielding upper 4%, close to 5%. Then depending on where you go in corporates, different levels of maturity and quality stack, into diversified, non-investment grade offering today a yield around 8.5%, a spread over government bonds of 5.5%.

A lot of the return is coming from the massive correction in Treasury yields. It’s not hard to construct a quality portfolio earning 5.5% in investment grade assets, and 7% in a broader portfolio.

For more detail, see Neuberger Berman’s Q3 fixed income outlook.

Graham Hand is Editor-At-Large for Firstlinks. Adam Grotzinger is a Senior Portfolio Manager for Neuberger Berman’s Strategic Income Fund.

Neuberger Berman is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security.

For more articles and papers by Neuberger Berman, please click here.