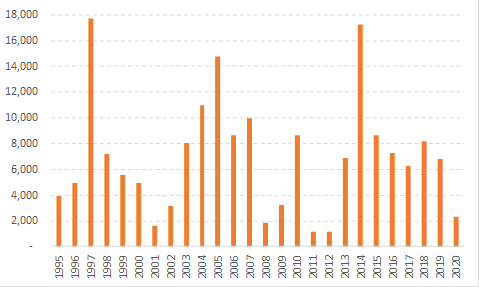

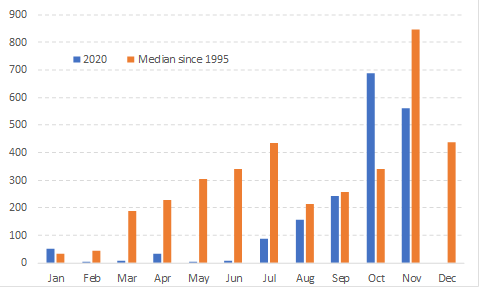

Australian capital markets have been showing signs of life recently, with the Initial Public Offer (IPO) cycle rising like the phoenix from the proverbial ashes. After a dearth of new issues for the first eight months of the year, IPOs have come roaring back in the last three months (see charts).

Of the $2 billion of new shares hitting the Aussie equity market this year 80% has been since September and we expect an unusually busy December as well.

Completed Aussie IPOs (A$M)

Value of IPOs 2020 vs median level since 1995 (A$)

Charts: Ophir Asset Management, MST Marquee.

With the surge in IPOs, investors must be asking: how do I decide which company to invest in? As we know, IPOs can deliver big profits, but also big losses.

At Ophir, IPOs are subject to the same investment process that we put every company through. This sees a strong focus on earnings and its sustainability. We particularly look at the business model, the industry structure, its returns on capital, as well as how clean the balance sheet is and the quality of its management team.

But for IPO’s, to see if it’s a deal we’ll participate in, we also ask six key questions. We believe that if investors ask these questions, they’ll be much better placed to navigate this avalanche of IPOs.

1. Who is the vendor?

First, we want to understand who the vendor (seller) is. Regarding owners, we can generally contrast private equity vs strategic sellers into the IPO. If its private equity you need to look at their track record. This can be a real mixed bag. The best private equity outfits will play the long game, leaving some money on the table for IPO investors and taking the company to market with a legitimate and sustainable cost base. The worst will be opportunistic, only going to market when they can maximise price with juiced up profits – often leaving a sour taste in the mouth for those unlucky to buy from them.

It is also important to do your due diligence on board directors. Buyer beware for those IPOs with a window dressed board that have been ’assembled’ for the IPO. We can’t stress this enough: good directors find good companies. Prospective directors get access to more information than investors and the best will do extensive research before joining a company. Steer clear of those who have a history of riding the NED (non-executive director) merry-go-round of average companies, with the primary aim of collecting directors’ fees, as opposed to adding value.

Also, how much is being sold down by the owners? Is it a small or large percentage of their holding? Importantly, it pays to understand any escrow period for the holding that is retained by pre-IPO owners. The longer the time period the less secondary market selling pressure can be expected from them.

2. Who’s the broker?

The broker, essentially the seller’s agent, needs to have a strong history in the IPO market with a large and diverse client base to help get the sale away. Most importantly, the scale of their ‘skin in the game’ is important. How much of the IPO have they underwritten (which means they will be left holding shares if they can’t sell them all) and how much are their retail clients taking up the offer? The more they have on the line, the more they care about how the company trades post IPO.

3. Who are the buyers?

The last thing an IPO buyer wants is for the brokers running the IPO book to have to go to the ends of the earth to find buyers to complete the deal. Strong demand with an over-subscribed deal will help ensure there is strong post-listing demand.

Look out for the management team that needs to do a lot of zoom meetings with overseas investors to get the deal done. Be wary of too much interest from overseas hedge funds. They can often buy at the IPO then dump the stock as soon as it lists to make a quick profit.

4. Why is the IPO happening?

Warren Buffett’s business partner Charlie Munger has famously said, “You show me the incentive, I’ll show you the outcome”. There are many reasons why companies IPO, from a forced sell down, the need for growth capital, as a retention tool for staff, to pay back debt, or simply because the IPO window is open and they can.

The best IPOs are generally where there is a forced sell down by the owners and when key staff are taking no money off the table. Again, the more skin in the game the bigger the incentive for management to grow the business post IPO.

Historically the best IPOs we have made money from at Ophir have typically been some of the least loved or overlooked. They are often subsequently repriced after listing when earnings turn out better than others expected.

5. When is the IPO?

The timing of IPOs is one area where investors can run afoul. More IPOs occur when market or industry valuations are at cyclical highs. These periods can often be times of market euphoria during the latter stages of a bull market when FOMO (Fear of Missing Out) takes hold, everyone wants in and the stock market dominates taxi/Uber discussions. This is often the worst time to invest in an IPO.

But just like share market timing in general, investors tend to do it at the worst time, flocking in after the market has gone up, and selling of staying away after the market has gone down…generally the opposite of what a rational investor should do.

IPO and aftermarket demand will usually be found for those companies where their type of business is scarce on the ASX or unique versus other competitors (e.g. Buy Now Pay Later in the early days compared to the existing payments space). Professional investors crave diversification and will usually leap at the chance to get exposure to earnings streams that move different to the rest of their portfolios.

6. The How Much?

Finally, it’s worth remembering that a great company doesn’t necessarily make a great investment – it depends on the price you pay.

No matter how good the story is, if you are forced to overpay, you will likely get poor returns. Here valuation models such as discounted cash flows (DCF) and valuation multiples versus competitors, both domestically and offshore, are key.

Naturally, the underlying performance of the company should be analysed. Ideally you have at least five years of historical revenue and profit to look at. Watch out for the company cherry picking time periods or numbers to make them look better than they are.

The forecasts in the prospectus should also be scrutinised for how conservative or aggressive they appear. Quite often it is good to find out who are the advisors and auditors of the prospectus. Some are more conservative than others. You should also check out the warranty period for the forecasts (ie how far out are sales of earnings projected) in the prospectus and should ideally test the assumptions behind them with management.

Finally, it is worth putting the IPO deal to the smell test. If you get the opportunity to grill management, looking through the risks outlined in the prospectus is a good place to start for questions. Directors want to make sure they are not liable if something goes wrong so there is valuable information here. If you do not feel comfortable with the risks, or don’t like management’s answers when questioned on them … don’t invest.

Take your due diligence checklist IPO shopping

There is no doubt the IPO market is surging at present.

While much of the IPO activity now is a result of the backlog of deals from earlier in the year, we can also count many opportunistic offerings. Gold companies are once again selling stock, no doubt trying to cash in on the elevated commodity price. Meanwhile, several consumer companies, like Adore Beauty, could be benefiting from a sharp recovery in consumer confidence (and from a potential customer base looking at itself on Zoom for the last six months!).

But unlike the last two years, when there has been many ‘pulled IPOs’, sellers are providing investors with what they want.

Still, be sure to take your due diligence checklist when IPO shopping this holiday season and you will be much more likely to pick a big winner than a big loser.

Andrew Mitchell is Director and Senior Portfolio Manager at Ophir Asset Management. This article is general information and does not consider the circumstances of any investor.