2021 was a year of records in the Listings business. The global Initial Public Offerings (IPO) market recorded highs in terms of capital raised and number of IPOs, at US$610 billion and 3,097 respectively (Dealogic). This coincided with US and Australian equity indices recording all-time highs, spurred on by fiscal and monetary stimulus.

The largest offshore IPO was California-based electric vehicle maker Rivian Automotive Inc, which raised US$13.7 billion. Investors embraced the broader themes of electrification and decarbonisation. The US market also saw a record in Special Purpose Acquisition Company (SPAC) IPOs.

Australian listing records

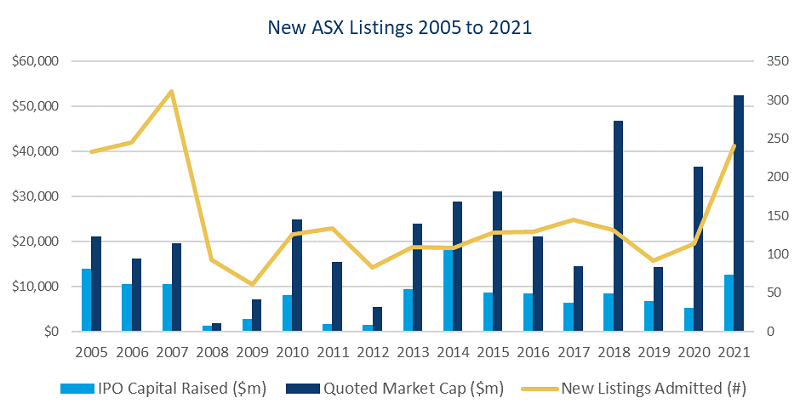

It was a standout year for ASX with 240 new listings – the biggest year since the height of the mining boom and bull market of 2007 (this includes all admissions to the Official List). By volume of listings, ASX again outperformed nearly all exchanges globally, just behind those in the world’s two largest economies, the US and China.

Australian IPOs raised over $13 billion in capital, the highest in seven years. The value of new listings, including IPOs, spin-offs, dual and direct listings, was $52 billion - another record. The average price performance of IPOs was 17%, outperforming the broader S&P/ASX 200 index, which ended 2021 up 13%.

The year saw Australian mergers and acquisitions (M&A) activity at record highs and a significant level of share buybacks and special dividends. Both factors helped increase demand for IPOs as cash was returned to investors and then redeployed.

Source: ASX

Increase in large local IPOs

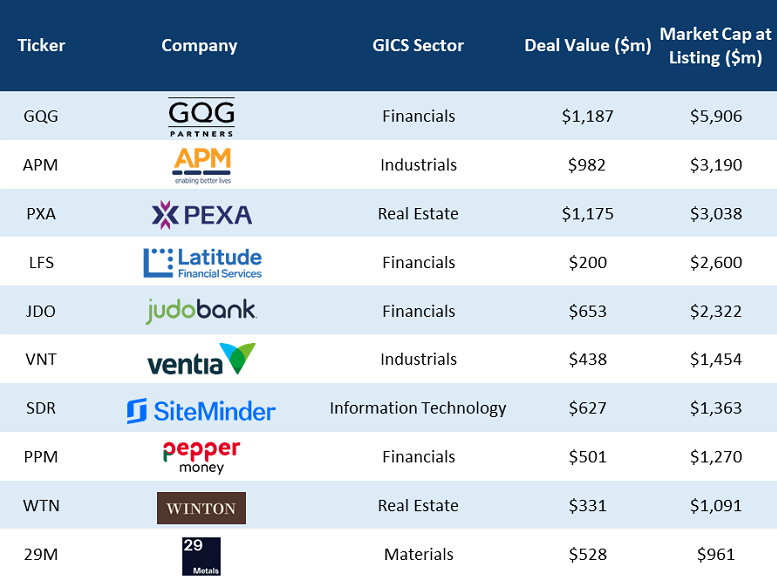

It was a record year for billion-dollar IPOs with nine in total across a range of sectors, including financials, industrials and technology.

The largest IPO of the year was Florida-based asset manager GQG Partners (GQG), which raised $1.2 billion at just under a $6 billion market capitalisation. GQG Partners chose ASX instead of a US listing largely because of comparatively attractive valuations of asset managers listed on the Australian market.

Of the top 20 IPOs by capital raised, 15 were private equity- or venture capital-backed, compared with 11 in 2020. The largest listing of the year by value was Woolworths’ hotels and bottle shops spin-off Endeavour Group (EDV) at an $11.1 billion market capitalisation.

Top 10 IPOs in 2021 by market capitalisation

Source: Dealogic, ASX

Despite travel restrictions, there were 23 international listings, with most transaction processes and investor roadshows running in virtual format due to Covid-19 restrictions. The top five countries of origin for ASX listings were New Zealand (6), the United States (5), Canada (5), Israel (2) and the United Kingdom (2).

Mining activity continues apace

Like 2020, the highest volume of listings was in the mining sector, with explorers accounting for around half of all new listings. This reflected continued elevated prices in commodities such as gold, copper, lithium and nickel.

At the opposite end of the market, 29Metals (29M) was ASX’s largest copper IPO. NexGen Energy (NXG), a Canadian uranium miner listed on TSX and NYSE, added an ASX listing to facilitate access to Australian investors.

In mining services, drilling business DDH1 Drilling’s (DDH) IPO enabled selldowns by founders and US alternative investments firm, Oaktree Capital Management.

Growth opportunities in financials and technology

Fintech companies continue to gain critical mass. The category now has over 60 listings at around $82 billion in total market capitalisation in areas such as lending, payments, capital markets and wealthtech.

Last year, IPOs in the financial sector included challenger bank Judo Capital Holdings (JDO) and non-bank lenders Pepper Money (PPM) and Latitude Group Holdings (LFS), all of which are utilising technology to scale key parts of their businesses.

Judo was the first IPO of a licensed bank on ASX in 25 years (since Macquarie listed in 1996). Judo is focusing on small and medium enterprises underserved by incumbent banks.

Listed Investment Company Touch Ventures (TVL) raised IPO capital to target investments in retail innovation, consumer, finance and data. PNG-listed BSP Financial Group, (BFL) the South Pacific’s largest bank, dual-listed onto ASX to help expand its investor base.

Hotel-booking software company SiteMinder (SDR) continued to execute on its growth strategy despite global travel restrictions. Its IPO provided growth funding and a liquidity event for the founders and early investors, including Silicon Valley-based growth equity firm TCV, which had been invested since 2013.

Other tech-enabled IPOs included electronic conveyancing platform PEXA Group (PXA), jobs marketplace Airtasker (ART) and lithium-sulphur battery technology company Li-S Energy (LIS).

Over 2021, the number of constituents in the S&P/ASX All Technology index increased from 69 to 77. The index now includes 28 ‘listed unicorns’ and has a total market capitalisation of around $190 billion.

Healthcare hitting new highs

It was a strong year for the healthcare sector with 16 listings, the majority in biotech and medtech. Highlights included:

- radiopharmaceuticals company Clarity Pharmaceuticals (CU6), which was the largest-biotech IPO

- California-based cardiovascular medical-device company, EBR Systems Inc (EBR)

- analytical science and devices company Trajan Group Holdings (TRJ)

- US-Australian rapid diagnostics company Lumos Diagnostics (LDX)

New Zealand-based NZX-listed cancer diagnostics company Pacific Edge (PEB) dual-listed to access Australian investors and accelerate growth into the US market. Australian Clinical Labs (ACL), Australia’s third-largest pathology group, was the largest healthcare IPO of the year.

The year’s largest healthcare equity capital markets transaction was CSL’s $6.3 billion institutional placement, used to partly fund its acquisition of Switzerland-based Vifor Pharma. It was ASX’s largest-ever non-privatisation capital raising and took two days to complete from the date of announcement, highlighting the speed and efficiency of the public capital-raising framework versus private markets.

2022 outlook

The listings pipeline for 2022 remains strong. Mining explorers make up the largest portion by number, with the remaining companies in a broad range of sectors including technology, consumer, financials and healthcare.

The most significant company to list on ASX is US payments giant Block Inc (NYSE: SQ). Block commences trading on ASX this week ahead of the Afterpay acquisition, which will be formally implemented on 1 February 2022. The secondary listing of Block (SQ2) is a strong endorsement of the Australian tech sector globally.

It is also a positive reflection of the Afterpay journey, demonstrating how high-growth companies can use an Australian listing to fund their development from an early stage right through to becoming multi-billion-dollar success stories. Afterpay listed in 2016 with a market capitalisation of $165 million and subsequently raised $3.7 billion in follow-on offerings and convertible debt up to the acquisition announcement in 2021.

Over the coming months, global markets will continue to deal with several key risks, including those relating to inflation, central bank policy, geopolitics and the pandemic. Nevertheless, valuations and market liquidity remain relatively high. Provided market volatility stays at reasonable levels, IPOs will continue to flow.

James Posnett is Senior Manager, Listings at the ASX. This article is for general information only and does not consider the circumstances of any individual. Letters after the company names are the listing codes. Note that these statistics do not include listings on Chi-X in Australia (a sponsor of Firstlinks).