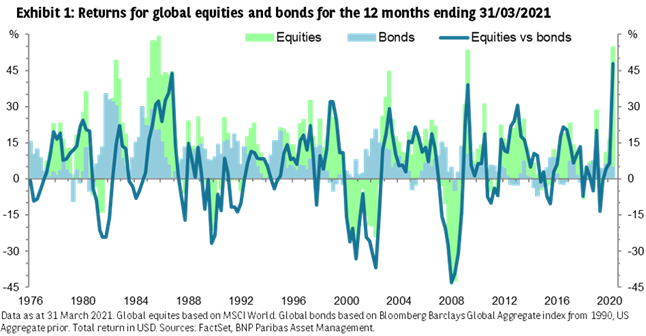

At the end of the first quarter of 2021, the MSCI World equity index had returned 55% (total return in USD) over 12 months, while the return of the Bloomberg Barclays Global Aggregate (bond) index was just 4.7%, giving equities a 48% outperformance (see Exhibit 1).

Rebalancing required

The quarter-on-quarter gap between equity and bond returns through the end of March 2021 was 9.2% compared to 12.4% in the previous quarter. The most significant change in the pattern of returns is that the equity outperformance over the last year came primarily in 2020, while the underperformance of bonds was greatest in the first quarter of 2021.

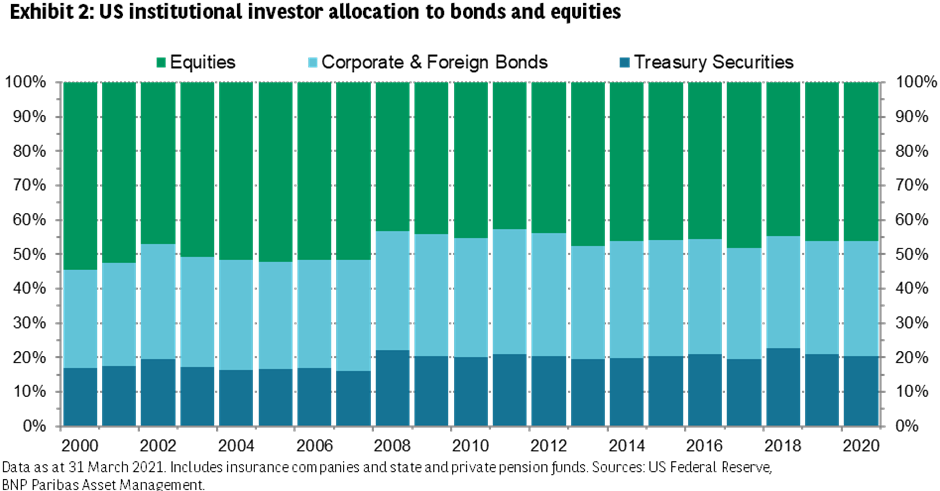

This divergence will require many institutional investors to rebalance their portfolios to attain their preferred allocation. This will be particularly true for insurance companies and pension funds that typically follow quite closely to a 50-50 split between bonds and equities in their allocations.

In the US, this split has rarely varied by more than a few percentage points and the allocation to corporate bonds and US Treasuries has been similarly stable (see Exhibit 2).

Given that equities generally outperform bonds over time, achieving this target allocation (instead of maximising total returns) inevitably requires redemptions from equities and purchases of bonds.

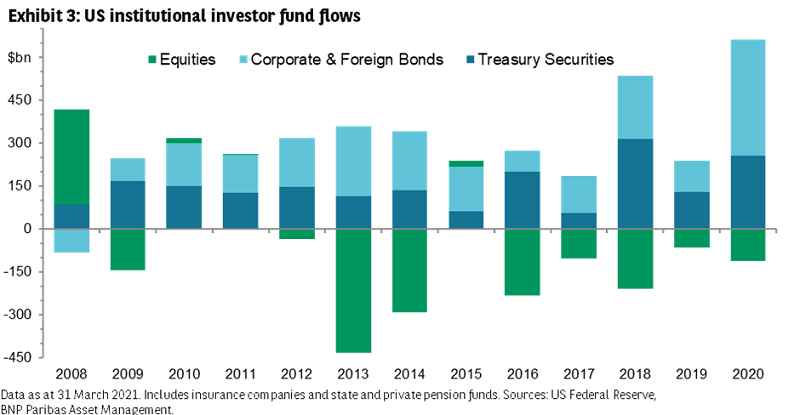

Indeed, since the GFC, institutional investors have bought bonds every year, but they bought equities only twice and then only in small amounts (see Exhibit 3).

No meaningful impact

What might we expect in terms of fund flows in the upcoming quarter as US insurance companies and pensions align their allocations with the allocations they had at the end of 2020?

Assuming funds flows in the first quarter of 2021 were the same as in the last quarter of 2020, and applying the relevant index returns to the existing asset base, in the absence of rebalancing, we estimate allocations to:

- equities would be 0.4% above target

- corporate bonds would be 0.3% below target

- Treasuries would actually be in line (the decline in the value of the Treasury portfolio due to rising rates has largely been offset by new bond purchases).

To restore the allocations, US institutional investors would need to buy about USD11 billion in Treasuries, USD58 billion in corporate bonds and redeem USD69 billion in equities.

These figures are only a percentage of typical purchases and redemptions, so we do not expect a meaningful impact on the market from institutional investor portfolio rebalancing this quarter.

Daniel Morris is Chief Market Strategist at BNP Paribas Asset Management. This article was first published on 6 April 2021 on Investors’ Corner.

This information is issued by BNP PARIBAS ASSET MANAGEMENT Australia Limited ABN 78 008 576 449, AFSL 223418. The information published does not constitute financial product advice, an offer to issue or recommendation to acquire any financial product. You will need to seek your own advice for any topic covered in the article. Investing in specialised sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions).