The recent increase in longer-term interest rates and widening spreads between government and corporate bonds has opened opportunities that investors have not seen since 2014. It’s a chance to earn better returns without taking equity risk but is this simply exchanging one market risk for another?

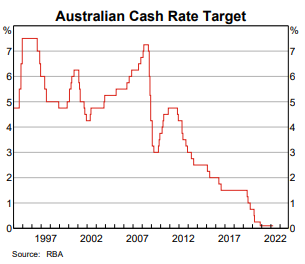

For more years than they care to remember, conservative retirees have faced a difficult choice to generate income to live on. To meet a 5% drawdown on their pension, they could either take more risk and invest in dividend-paying shares or keep capital safe in term deposits and draw on the principal. Many retirees with little tolerance for capital losses on shares have tightened the purse strings as their income dropped. It is 10 years since the cash rate was above 3%, and the last increase was on 3 November 2010.

The reach for yield

There are many ways to achieve 5% or more depending on risk appetite. Analysts forecast the dividend yield on the S&P/ASX200 for FY22 at a healthy 5.2% plus franking (some are even higher) due to increased payments from large dividend payers such as banks and miners. Investors have received $36 billion in dividends in the past month. Elsewhere, Australian property trusts offer decent yields such as Scentre (ASX:SCG) 4.9% and Charter Hall Long WALE (ASX:CLW) 5.7%. Hybrids are at 3% or more to first call depending on the issuer (see table in our Education Centre) which will increase over the next year. In the unlisted space, there are thousands of funds offering income across a vast choice of asset classes.

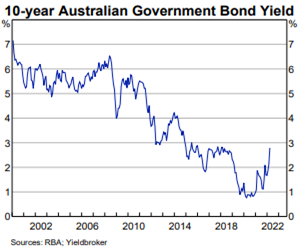

For the first time in eight years, the 10-year government bond rate is above 3%, rising further since the Reserve Bank produced its latest update below. When the spreads between government and corporate bonds are factored in, the 5% investment world suddenly has some new inhabitants.

Corporate bonds are back in the 5% game

Anyone who is a client of a fixed interest broker has received offer levels with decent credits and names they know showing a 5% yield.

Here is a selection of Bloomberg screenshots for examples. Without judging the merit of the credit quality of each company, these familiar names are now available in retail sizes, usually around $100,000 but often as low as $10,000.

As these are ‘wholesale’ bonds broken down into smaller parcels, each fixed interest broker has its favourite names and sources of supply. The screenshots show (prices as at 11 April 2022):

- Aurizon (ASX:AZJ, bond AZJAU) issued with a coupon of 2.9%, maturing in 2030, yielding almost 5.5%, up from around 2.5% in 2021. The price has fallen to below 83 delivering a heavy capital loss to existing holders in less than a year.

- Lend Lease (ASX:LLC, bond LLCAU) issued with a 3.7% coupon maturing in 2031, yield 5.3%.

- Pacific National (Australia’s largest private rail freight company, bond PNHAU) with a 3.8% coupon to 2031 yielding 5.5%.

- Transurban (ASX:TCL, bond TQLAU) with 3.25% coupon priced at about 85.5 yielding 5.25%.

There are many more examples for investors to consider, although these are fixed rate issues and if longer-term interest rates rise further, prices will drop even more. That’s the challenge of investing at fixed rates in an inflationary environment, but any retiree happy with locking away 5%+ for up to a decade now has many choices.

Further down the capital structure but issued by an undoubted name, brokers are currently offering a Commonwealth Bank subordinated issue maturing in 2027 and yielding 4.65%.

Lessons from Privium and others

What can go wrong on the credit side, besides the risk of further rises in rates? These are bonds, and all the investor needs is for the company to be solvent and liquid on maturity.

Not so easy. Unlike equities, where risk may be rewarded with unlimited upside, the most an investor in bonds can achieve is a return of 100 on maturity and the regular coupons. If a bond is offering 5% at purchase, that’s as good as it gets. If rates rise 1%, for example on the Transurban bond above with a modified duration of 7.75 years, the price will fall 7.75%. Nobody offers the extra 1% to an existing holder.

It is in the unrated or sub-investment grade bond market where retail or so-called wholesale investors can come unstuck. These bonds are marketed by fixed income brokers (some, not all) to investors who are not sophisticated enough to assess the credit quality. In fact, some of these issuers would be forced to pay more in the genuine wholesale professional market but they go to the retail market to save costs.

The small extra margin is not sufficient reward for a credit the investor cannot assess.

Let’s look at a case study of Privium, a Queensland building company with a $45 million face value issue paying 6.5% which was due to mature 12 August 2022. On 14 October 2021, it was offered for sale in the secondary market to ‘wholesale’ retail clients at a 'discounted price' of $95.25. It was called a senior secured credit with residential property security, amortised (repaid) to 49% to date. It was marked 'green' (for go) on the broker's credit tracker, plus:

"A small allocation to this sub investment grade bond issued by a QLD based home builder may be warranted for those looking for high returns, and who understand the risks involved in this investment. To reiterate, at a yield offering over 15%, this is certainly a higher risk credit and I encourage you to please review the attached documents for full credit strength and risks.

This bond has a benefit that most other corporate bonds do not have, which is a guaranteed from a group of companies with significant residential property holdings (Property Alt Group Pty Ltd, Alternative Aus Pty Ltd, Property Alternative Developments Pty Ltd, and Property Alternative Aus Pty Ltd), and a personal guarantee from the person who is CEO and major shareholder of Privium.”

The accompanying material talked of 1H21 results “well ahead of expectations” as “evidence of the strong housing market in Australia, with a commitment for new loans at historical highs” and “we believe the operating environment will remain positive for Privium over the near-to-medium term”.

Six weeks later, on 29 November 2021, The Australia Financial Review reported:

Privium failure hits more than 2000 home buyers

“More than 2000 individual home-buying customers across Queensland, Victoria and NSW have been hit by the collapse of builder Privium, which went into administration last week owing secured and unsecured creditors close to $43 million.

The company went under with liabilities of $23 million in secured notes and $17 million in unsecured liabilities – equally split between subcontractors and suppliers – with close to $3 million owed to other creditors across the nine entities in the group, creditors heard.

But while the company with a $200 million annual turnover was badly affected by delays in supplies of building materials that showed production even as overheads remained, there were still outflows of money – such as to the evangelical church Hillsong, of which chief executive Rob Harder was a senior member – that administrators were trying to track, Mr Park said.”

And what is the outcome for bond investors, those who somehow were able to gain comfort from "review the attached documents for full credit strength and risks."?

Privium is in liquidation and holders are advised there is only one likely buyer, who recently reduced the offer price, and “any attempt to enforce the original transaction would likely cost in excess of the difference (and no certainty of a positive outcome in any event)”. The note trustee advises that the recovery estimate is 23% to 43% (36% mid-point) after fees are taken out and the process could take two years to finalise.

That is, only six weeks after the broker offer, rising costs sent this company into liquidation and the other claimed protections are not worth enforcing on a $45 million transaction. It's not only equity IPOs which can collapse quickly.

But not to worry, it was only marketed to qualifying ‘sophisticated investors’.

This is not an isolated example. When Axsesstoday, a provider of equipment finance to SMEs, was placed into liquidation in April 2019, retail investors in its July 2018 bond issue paying BBSW+4.9% were left with a security which might be worth around 5% of its face value when investors are eventually paid out. The company faced higher loan arrears and inadequate capital. Perhaps even worse than Privium, these notes were listed on the exchange (ASX:AXLHA) and Axsesstoday itself was a listed company (ASX:AXL) but was delisted in October 2019. For a short time in its listed life, as part of the boom in up-and-coming financial companies, Axsesstoday was a market darling with a rapidly-rising share price, but in the end, even the bond investors were buried.

And investors in Mackay Sugar bonds, issued with a coupon of 7.75% in 2013 as a ‘wholesale corporate bond’ and expected to mature in 2018, were offered half the face value on their notes when the sugar refiner hit financial problems. Again, the flattering description of the issuer did little to protect ‘retail’ investors.

Buyer beware. Each of Privium, Axsesstoday and Mackay Sugar came to market with an investment rationale sufficient to convince retail investors to pile in with millions of their retirement savings.

Easy qualification as wholesale

We have covered the problem of retail investors qualifying as wholesale previously, including the relatively easy criteria which were designed 20 years ago. The test allows millions of Australians to qualify as if they have a special ability to value securities. We noted:

“Modelling by Australian National University Associate Professor Ben Phillips, commissioned by Coolabah Investments, and reported by The Australian Financial Review, suggests the wholesale investor test is met by 16% of Australians, or over one million households and 3.25 million consumers. It was only 100,000 in 2002.”

In addition, research company Investment Trends defines the category of High Net Worths as those with investible assets over $1 million outside the family home. At the end of 2021, they reported an annual rise of 31% to 635,000 in the number of millionaires in Australia, with investible assets up 37%.

Bonds listed on the ASX

It is not only investors who have access to fixed income brokers who can lock in better returns in the listed arena. Government bonds are listed but their rates are below the corporate deals. We have also written about fixed rate convertible notes which are backed by portfolios of equities.

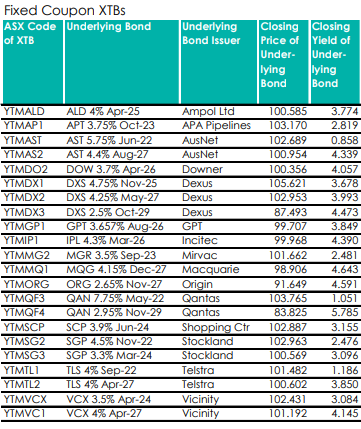

In addition, XTBs are traded on the exchange in the same way as any share and offer a range of fixed and floating bonds. The fee on XTBs is 0.4% of the face value multiplied by the number of years to the maturity date. The yield in the table is before the fee is deducted and only one of these issues achieves the 5% threshold.

Floating rate investments will protect investors from duration risk. The most liquid listed examples are hybrids, which will yield over 5% if current market expectations of increases in rates are realised.

100% downside, 5% upside

The higher yields available on corporate bonds open the opportunity for investors to construct portfolios of bonds capable of delivering 5% or more for many years.

Of course, building diversified portfolios under strict credit quality rules is what expert bond managers do every day, including long experience assessing credit, terms and conditions and thousands of alternatives. For most investors, it is better to leave it to the experts rather than hope to avoid a Privium.

The most important point if you must do it yourself is to stick to investment-grade quality and do not go into unrated names where the broker requires you to do your own credit assessment. When there is 100% downside for a 5% return, there’s little to be gained by reading a broker note and hoping you find some magically-reassuring insight.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor. Prices are correct at the time of writing. There is no attempt to analyse the credit quality of any companies mentioned in this article and credit assessment is probably beyond the competence of most financial advisers.

Disclosure: Graham invested $50,000 in Privium at issue which has since amortised to about $24,000 with regular capital repayments. About $8,000 is now expected after the liquidation process. That was an expensive lesson in credit analysis and the meaningless value of some credit enhancements.