This is an interview between Firstlinks’ James Gruber and Andrew Mitchell, Founder and Senior Portfolio Manager at Ophir Asset Management.

James Gruber: How have you managed the portfolios through Trump’s recent tariffs and market volatility?

Andrew Mitchell: Middle to late February, we were concerned that the market was not pricing in any risk in terms of what Trump was going to do with tariffs and the economic backdrop and we started taking profits in some of our names that had done well for us, and redistributing them into companies that didn’t have the same momentum, and were also perhaps less GDP sensitive.

So we'd reduced the beta in the portfolio and then when the volatility came, we were using that to really buy the companies that we liked; that had fallen a lot further than they should.

I'd give us a 7.5 to 8 out of 10 in terms of how we navigated that period. It would have been great if we bought a lot more when the prices were down. But we're quite happy with how we've gone.

JG: Small caps have struggled on the whole for a long time, yet you’ve been able to put up some great numbers - what’s Ophir’s secret sauce?

AM: It's actually a great time for you to ask this question because we were looking at some stats today, and I think it was that 25% of US small caps outperformed the S&P 500 last year. But also a similar percentage of the S&P 500 companies outperformed the S&P 500 index too. And that’s because of the performance of the Magnificent Seven.

But we just need to back ourselves to find those 25% of companies. There are far less eyeballs looking at small caps, and far more small caps than large caps so we’ve just got to find those companies that are doing well and better than everyone expects.

JG: What are the criteria that you use to choose stocks for your portfolio?

AM: There are three main ones, as well as a couple of subjective measures too. The three main ones are:

- The starting point is earnings and cashflow trajectory need to be greater than the market is expecting. This raises two questions: What is the market expecting, and how is this company going to do better than what the market expects?

- The second thing is optionality. We think the market really struggles to value optionality in a business, and we love getting free optionality, or not paying much for the optionality in a company that can make a fantastic acquisition, that can do a dividend or use cash flow to buy back shares, or maybe it could even get taken over. There are lots of different optionalities, like winning a big contract or its biggest competitor could go broke.

- The final one, which is probably as important as the first one, is valuation. If the earnings and cash flow are different to what the market expects, then that should give you a good idea of the valuation. Does this company look cheap to us and undervalued, especially if it's got a different earnings trajectory?

Then we have these subjective measures where we look at management, which is sort of related to optionality. But we do a thing where we score management, the risks, the external risk to a business and ESG considerations, and then a final one we look at is a meltdown score, where we look at how the company is placed if we're wrong on the economic backdrop and COVID 2.0 lands tomorrow, for instance.

JG: You’ve been active managers, turning over stocks every 2-3 years – what’s the strategy behind that?

AM: Turnover changes at any point in time. We’ve had a few companies that doubled and, we're going to be selling those along the way.

As I told you, we're looking for earnings that are growing at a better rate than the market expects and it's undervalued. Well, what happens if the markets work out everything we've worked out, and it's not cheap anymore? We'll sell it. That's your turnover.

We're also always judging businesses in particular parts of the business cycle - where the risk sits. So, more than half our turnover is adjusting stocks based on their earnings risks over the next quarter or two.

Returns need to always be balanced with the volatility to get those returns. We're trying to minimize that volatility and maximize the return.

JG: Have you changed or refined your investment process over time?

AM: It's certainly been refined, and it's getting refined all the time. We're making mistakes all the time. We want to create an environment where everyone can talk about their mistakes in an open forum, and we can embrace the mistakes to make us all better, and that enables you to refine your process.

So those things I went through like the meltdown score, that hasn't always been there. Putting the subjective score on management, that hasn't always been there. These are things over time that we've thought we need to factor in. So we're always just trying to get better. But the core process of outworking our competitors to understand the key drivers to cash flow over the short, medium and longer term - that's unwavering.

JG: Where are you seeing opportunities now?

AM: Right now is a really challenging time because you're in a scenario where that tail risk has been removed. Is Trump going to literally drive the US and global economy off a cliff? We've removed that and the markets have gone up. Now we’re going to have to wait for the economic data to make sure the US economy is ok.

We’re positioning a bit like back in February - reducing GDP sensitive stocks and adding to companies that have been sold off with the valuations that we're very confident about.

But here is where it gets exciting James. In April, U.S. small caps hit their lowest valuation in a long time. They nearly hit their lowest PE [price to earnings ratio] since COVID and the GFC - around 12 times. U.S. Small caps are already pricing in a recession.

So there's a real asymmetric payoff for small caps, and that has me excited and it’s why I'm still putting money into our own funds. Because all the academic studies will tell you that starting valuation is your best guide for future return in an asset class, and U.S. and global small caps are cheap versus their own history, and very cheap versus large caps. Now, to me, these are the times you make your money.

JG: What’s the one stock that has you really excited right now?

AM: One of the companies is Life360. This is a platform business that is growing organically above 20%. It’s a family safety app that has been acquiring customers when their marketing dollar is staying flat. How good is that? You're getting bigger and bigger and bigger, but you're not spending any more on marketing.

The platform nature means at the end of this year, they're going to launch a pet business which enables pet tracking. And then they're going to have elderly care, which is going to be linked with technology around your house. If Nana hasn't moved for a bit, you get alerted, and you can give her a call and just make sure she’s ok.

This is the platform, but they've also got advertising. And our view on the advertising is that the location sharing nature of this app is so powerful that there's a significant amount of money that they can make in advertising.

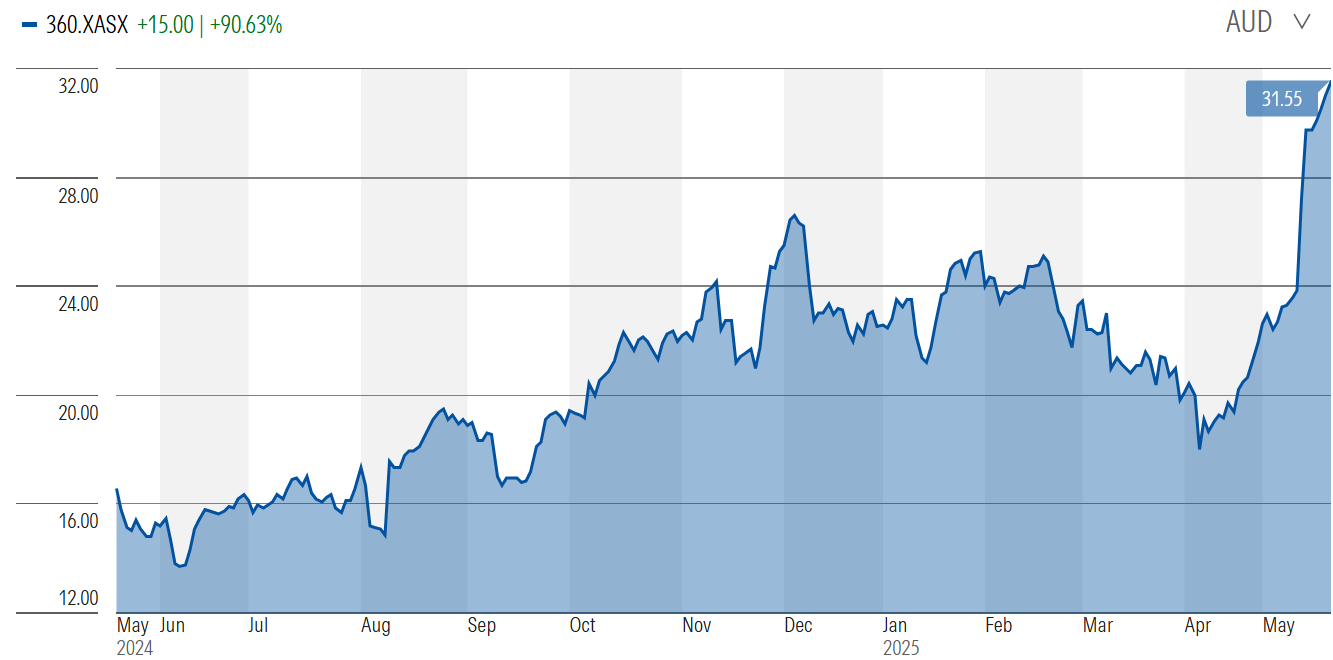

Source: Morningstar

Life360 has got 80 million monthly users around the world and is growing at 20 to 25% a year. We think out of all the businesses that we look at, this is one that could be a very big business in the future.

The biggest risk is Apple. Life360 works across Android and Apple. Apple has its own location sharing app, and if it beefs that up, it could be a risk.

We've been supporters of Life360 since it was around $2.50 a share, and we've followed it all the way through this journey. And we really pleased with what they're doing and the power of this platform business, which is unique in the Australian market.

Andrew Mitchell is Founder, Director and Senior Portfolio Manager at Ophir Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

The Ophir Opportunities Fund currently ranks as the number 1 performing Australian Small Cap fund over 1, 2, 3, 5, 7, 10, and 12 years out of around 50 funds (according to the Mercer survey).

Read more articles and papers from Ophir here.