While shorting stocks (selling borrowed shares) receives a lot of media attention, particularly when stock markets are falling, the total value of all short positions has actually been declining throughout most of 2016, based on reports compiled by ASIC. Despite this, shorting opportunities remain in particular sectors.

The strange case of the shrinking shorts

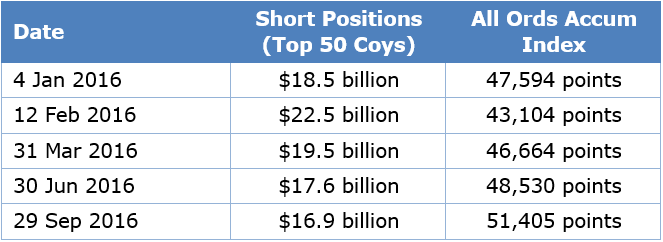

Since the ASX All Ordinaries Accumulation Index bottomed in mid-February 2016, it has made higher highs and higher lows, while the overall value of short positions has progressively decreased. As a snapshot, the trend in the value of short positions compared to the Index is shown in the table below.

Short positions typically represent less than 2% of overall ASX market capitalisation and have a much more significant effect on individual stock prices than against the broader market index.

Investors short equities for a variety of reasons but generally it's because they perceive such stocks as over-valued. This may be due to a belief that profit forecasts are overly optimistic or that the stock may face cyclical, structural or regulatory challenges.

Traditional shorts

Consumer retail stocks are popular shorting territory with Myer having the dubious honour of having the highest percentage of its share capital shorted. This is currently a whopping 16%, although it has fallen from almost 21% in early 2016. Many believe that increasing competition from large international retailers such as Zara, Top Shop and Uniqlo, as well as online retailers, will take a slice of Myer’s revenue base and crimp its operating margins.

Similarly Flight Centre, with over 10% of its shares sold short, is facing intense competition from online travel and accommodation companies such as Expedia, Priceline, and Webjet. Woolworths has over 7% of its shares shorted along with Metcash at over 11% as supermarket margins look increasingly vulnerable, partly due to the national expansion of Aldi.

The future of retail looks challenging, as global giants such as Amazon, which rarely make a profit but are rapidly increasing market share, are expected to expand into Australia.

Media companies involved in free-to-air TV, newspapers, and magazines were disrupted many years ago and Nine Entertainment still has short positions against its stock of over 5%. Even the initial disruptors such as Seek and REA Group have attracted reasonable shorts of over 5% and 3% respectively.

Fashionable shorts

More recently, short positions have been creeping up in ANZ, NAB, and Westpac on the expectation that earnings growth, dividends and outlook statements will disappoint. Challenges in the banking sector such as increased competition, low credit growth, potentially higher bad debts, and greater regulation are well known. At the end of September 2016, short positions across the Big 4 banks exceeded $6 billion.

Other companies recently caught in the cross-hairs include market darlings Bellamy’s and Blackmores, where short positions have increased to over 11% and 8% respectively. While both companies are forecast to deliver future earnings growth, they were priced to perfection and increasing regulation on the import of certain ‘clean and green’ products into China combined with short-term over-supply issues were the catalysts.

Aged care service providers Estia Health, Japara, and Regis have also been added to the shorters’ shopping list, with previously negligible short positions increasing to over 7%, 5% and 4% respectively. These companies were also highly priced and the future has become less positive due to the federal government seeking to reduce residential aged care funding outlays.

Short positions remain elevated on select resource companies including Independence Group, Alumina, and Rio Tinto, despite the recent rise in certain commodity prices. Similarly, shorts remain high on resource services companies exposed to the commodity capex cycle such as Worley Parsons and Monadelphous.

Short squeeze opportunities

There may be opportunities to take advantage of a ‘short squeeze’ where short sellers are forced to cover their positions by buying the stock which can result in the price rising. This may be applicable if an investor has a high conviction in a company’s favourable future earnings and their own valuation is above the market price. While the initial implementation of short positions typically results in share price underperformance, investors should look to take advantage of large, existing short positions in stocks and the timing of when they need to be covered.

An example of a highly shorted company that subsequently ‘shot the lights out’ is Fortescue Metals, which had 7.5% of its shares shorted in February 2016. Fortescue benefitted from iron ore prices holding up above expectations, materially reducing its production cost base, and paying off a decent chunk of debt. Not only did the share price run on the news and is currently up over 200% in less than eight months, but short covering boosted the upward move as in excess of 100 million previously shorted shares were bought back.

Similarly, Mineral Resources had nearly 15% of its share capital shorted in mid-February. It also reduced production costs, benefitted from a relatively higher iron ore price, exceeded earnings forecasts, and received greater market interest in its lithium assets. The share price increased from $4 to over $11 and short positions were reduced by 90%. Other notable beneficiaries include Whitehaven Coal, which is up over 600%, predominantly on higher coal prices and 60 million shares previously shorted were also bought back.

The reduction in these shorting opportunities on resource stocks is one reason for the fall in overall level of market shorts.

Shorting done well can improve returns

The share market, with or without short selling, is inefficient and price distortions are par for the course. In an environment where many stocks are considered to be priced to perfection, short selling provides certain investors with an additional strategy to improve on their returns.

Matthew Ward is Investment Manager at Katana Asset Management. This article is general information and does not consider all the risks associated with shorting stocks or the circumstances of any individual.