On the back of one of the longest bull markets in history and with increasing market turmoil from geopolitical events and growing recession fears in financial markets, technical analysis is becoming more relevant. It can give a sense of direction in a specific instrument or the broader market and enhance risk management in volatile markets.

Starting with Japanese rice traders in the 17th century, the concept of technical analysis has evolved, and along with fundamental analysis, is the leading school of thought when investors analyse the future direction of financial markets.

Where fundamental analysis examines the key ratios of a business, technical analysis is based on historical data from charts to see where the market is heading. When making an in-depth analysis, it makes sense to have both methods supplementing each other instead of choosing one over the other.

Some tend to misunderstand what it is about, but technical analysis is simple in its core. It is about leveraging data to strengthen risk management, especially when to enter and exit a trade.

The danger of falling in love with a trade

The market is flooded with information and investors naturally filter out the stories that they dislike and place greater confidence in the sources they like. Many investors tend to follow a few companies or indices closely, making it easy to fall in love with a position.

It is common to take greater and greater risk when holding a losing position. And unfortunately, this often makes investors change their investment horizon, hoping it will bounce back tomorrow. Investors avoid the negative feelings of a losing position by adding to it to bring down the average price. These actions are driven by emotions and can be managed by using technical analysis tools to set a proper stop-loss position.

The importance of trends

When using technical analysis, observing trends is an important discipline. In short, a trend can be described as the general direction of the market during a specified time period. Trends can be both bullish and bearish, and the length may vary between hours and months. Utilising trends can help investors piece together a full investment overview and give indications when to invest – and when not to.

Four technical analysis tools and how to use them

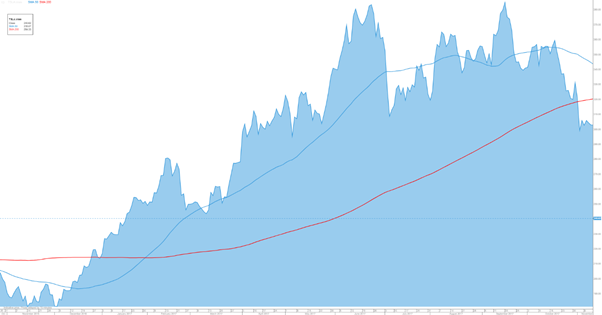

1. Simple moving average

A simple moving average smooths out price movements and reduces ‘noise’. It is calculated by adding the closing price of a security for a distinct amount of time – usually 20, 50 or 200 days – and then dividing this total by that same number. A shorter amount of days will lead to more volatility. When using a simple moving average, look for the time when the two moving averages cross which is usually referred to as either a ‘death cross’ or a ‘golden cross’. While these can be used to see a coming trend, they are not the strongest signals as the simple moving average is a lagging indicator.

BULLISH SIGNAL:

The golden cross occurs when the 50-day simple moving average crosses above a rising 200-day moving average. This is considered a sign of a bullish market and a buying indicator. This chart shows Tesla stock, where the golden cross occurred in the beginning of 2017 marking the starting point of a positive trend in the stock price.

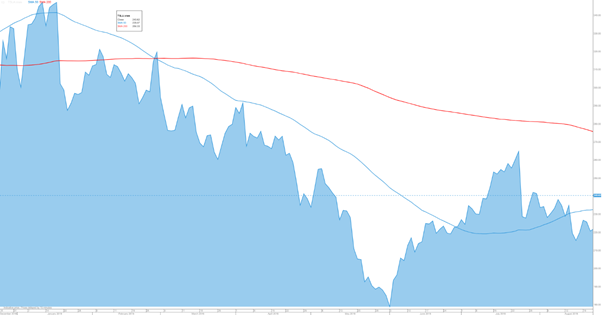

BEARISH SIGNAL:

A death cross is when the 50-day simple moving average curve crosses below a falling 200-day moving average. This is a sign of a bearish market, which could indicate it is time to sell. In this chart, the 50-day average crossed below the 200-day line (in red) indicating a longer downward trend throughout the year.

2. Trend lines

Setting up trend lines is a way to find indications on when to buy and when to cut your losses. Trend lines are made by drawing a line from between two or more price points either high points or low points to draw the resistance and support line.

BULLISH SIGNAL:

The upper trend line is the resistance trend line. When the price breaks the resistance line, it could indicate a positive trend for that given instrument and signals a buy signal. In this example it would mean the NASDAQ 100 index would have to break through 8100.

BEARISH SIGNAL:

The lower price points form the support trend line. It is to set stop-losses or identify short opportunities. If an instrument suddenly breaks the support line, it is often a bearish signal and indicates a price where the investor would typically benefit from cutting the loss rather than holding onto a falling knife. In this example it would mean the NASDAQ 100 index crossing below 7600.

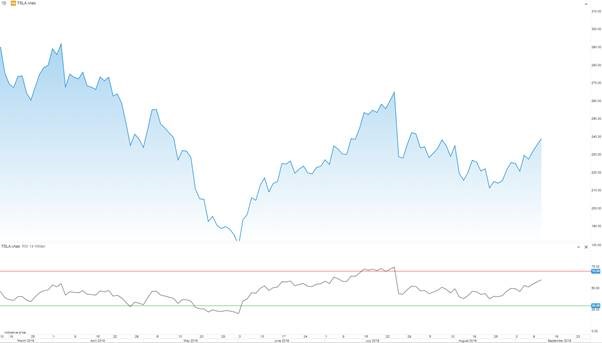

3. Relative Strength Index (RSI)

RSI is a momentum indicator ranging from 0-100 showing the relations between the latest movement in the market. This can help to indicate whether an asset is being overbought or oversold.

BULLISH SIGNAL:

When the indicator is between 0-30, it means the asset is being oversold, meaning it might be time to buy up before the trend is turning. In the case of Tesla in May, the RSI dipped below 30 before bouncing back up in the coming months.

BEARISH SIGNAL:

If the indicator is placed between 70-100, it shows the asset is being overbought. This means it might be the right time to withdraw before the trend turns. In the Tesla example, that is shown in July when the RSI went above 70, which marked a turn in trend.

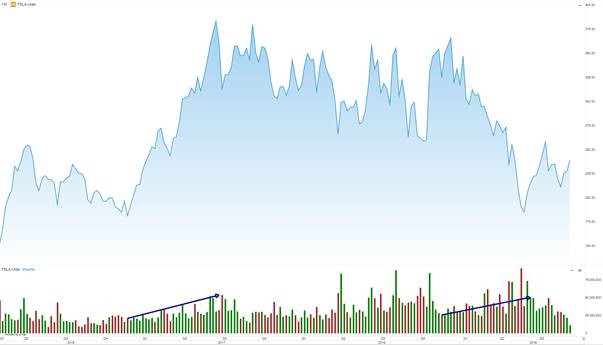

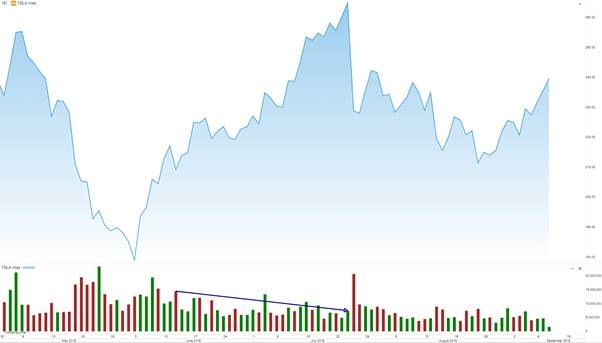

4. Volume

Keeping an eye on the trading volumes can indicate when the market is about to go up or down. The volume increases when investors buy or sell a certain asset and decreases when it is not being traded. Price and volume go hand-in-hand since there is no market without price movement, and there is no price movement without volume. Volume represents balance of supply and demand that moves prices up and down.

BULLISH SIGNAL:

When price and volume is rising, it is an uptrend confirmation and a bullish signal.

BEARISH SIGNAL

If the price is rising but volume falling it indicates an imbalance in the market and is a sign of price exhaustion.

Kim Cramer Larsson is a Technical Analyst at Saxo Bank (Australia). This article covers a specialist subject and does not address the circumstances or skills of any individual. As these tools require expertise, they should be used in consultation with professional advice.