Anyone who was invested in a listed property fund throughout the GFC experienced a rapid destruction of wealth. Many former high flyers of the property world, such as Centro, Allco, MFS and City Pacific, had become highly geared in complex structures, and in the severe market disruption, were unable to rollover their debt. They faced years of complicated legal battles and capital restructuring.

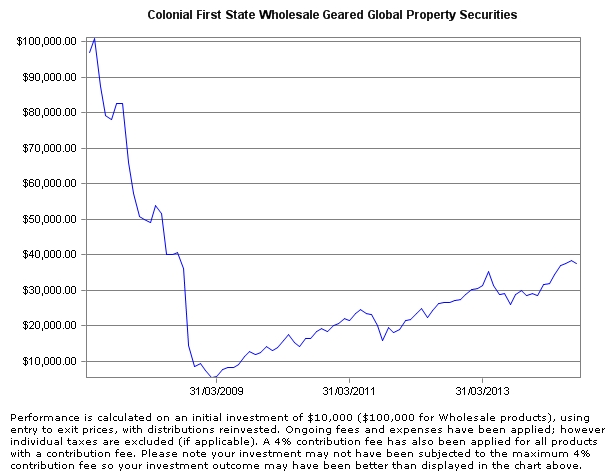

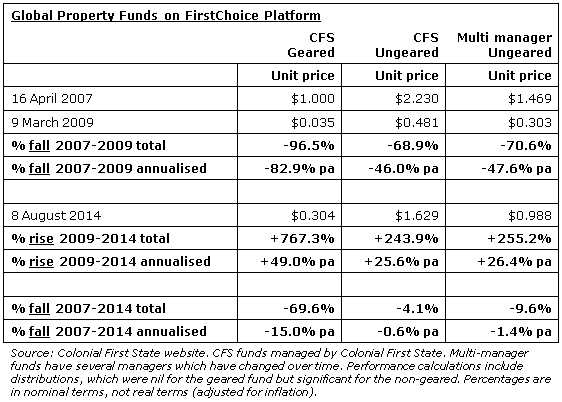

Amid this imbroglio, the wildest ride of all was the Colonial First State Geared Global Property Securities Fund. Launched in April 2007 at $1, it had lost almost 97% of its value less than two years later in March 2009, when it touched 3.5 cents. It has since risen to over 30 cents. It has almost become, as they say in the trade, an ‘eight-bagger’ – a return of 767% since the bottom of the market.

These changes in value show that the debate about SMSFs borrowing should not be confined to structures where the fund itself is the borrower. It’s the total leveraged exposure and the underlying assets that matter most, not where the borrowing resides. SMSFs investing in this fund had no borrowing in their own name.

Depending on investor timing, and defining ‘worst’ as biggest fall and ‘best’ as biggest rise, this is either the best or worst managed fund in Australia. Here’s the impact on $100,000 since 2007.

Of course, some other investments in Australia have lost all investor capital, but they are usually a single asset or share, or due to some fraudulent activity. This is a managed fund with rules about maximum investment in one stock and portfolio diversification, and these rules were not breached. Colonial First State has strict investment management compliance and any straying from the investment criteria is immediately corrected. And surely property is something you can see and kick, it’s not small resources and it’s not technology. How is it possible for a managed fund to go from 100 cents to 3.5 cents in less than two years?

There are two main reasons: first, any geared fund will amplify the losses of an ungeared equivalent fund. For an explanation of how this works, see this article. Second, the underlying assets themselves were highly geared, and while this may have been fine in normal market conditions, it was a volatile combination during the GFC. The strong market conditions of 2003 to 2007 created false confidence for the managers of both property securities funds and their investee companies.

As the table indicates, even the ungeared version of this fund fell 69% over two years. A multi manager fund in the same asset class over the same period fell 71%, despite an investment strategy which was:

“To invest in a diversified portfolio of property securities. The investments are managed by a number of leading global property securities managers, which is designed to deliver more consistent returns with less risk than would be achieved if investing with a single investment manager. The portfolio aims to hedge currency risk.”

What are some of the lessons from this experience?

- Any gearing structure should watch for gearing on gearing. Although almost all listed companies have some level of borrowing, property funds were historically highly geared going into the GFC, and the major feature of their subsequent restructuring has been to move to lower gearing levels.

- Internally geared funds have a role to play in a portfolio only where the investor fully understands and accepts the potential downside as well as upside. In general, a fund geared at 50% ($1 of debt for every $2 of assets) will have double the price volatility of an equivalent ungeared fund.

- Investors need far better performance to recover from a fall than the percentage fall itself. For example, if a $1 investment goes to 50 cents, it has fallen by 50%. But to recover from 50 cents to $1, it must rise 100%. In this geared property case, although it has risen an amazing 767%, it is still down 70% due to the 96.5% fall. The ungeared funds have risen far less but they fell less. On an annualised basis and including distributions, the ungeared funds are not far from their 2007 values in nominal terms (not adjusted for inflation).

- Excellent investment opportunities can come from periods of crisis. Most property funds rebuilt their balance sheets by issuing shares at fire sale prices, below Net Asset Values, and investors with the cash to fund this recovery have usually had great results.

- Perhaps most important, there are insights for the current debate about SMSF borrowing, where the primary focus has been on the SMSF itself borrowing to invest in residential real estate. The experience with internally geared funds (and assets which themselves are highly geared) shows it is the total amount of leveraged exposure that matters, not the vehicle in which the borrowing resides.

Property securities have given investors a wild ride over the last seven years, and the most amazing thing about the best and worst managed fund in Australian history is that it’s the same fund.

Graham Hand was General Manager, Capital Markets at Commonwealth Bank; Deputy Treasurer at State Bank of NSW; Managing Director Treasury at NatWest Markets and General Manager, Funding & Alliances at Colonial First State, where he was responsible for gearing management (not asset selection). Nothing in this article constitutes personal financial advice.