Introduction: A reader (and former colleague), John, sent this message to Firstlinks recently.

“I am an avid reader of your newsletter and remember fondly our time together at CFS.

I sometimes still find myself torn when one of my speculative trading decisions turns out to be a great long-term investment. These are usually in the technology and/or energy sector. I am constantly trying to keep up with new potential trends in these industries. Hence my email to you.

I wonder if you have published any articles on the energy sector potential winners.

I am reminded of the old Gold Rush days in Australia where the big winners were the companies who serviced the mining entrepreneurs who saw an opportunity to serve or exploit thousands of fortune-hunters.

Sometimes I wonder what part of the energy sector will be the big winner in the rush to find non polluting sources and controlling/storing/distribution the power. I read a lot about Sources (Solar, Nitrogen, Wind, Gas, Oil, Gas and Nuclear) as well about storage and distribution offers.

I would love to see some of your articles simplify this.”

We checked around our regular contributors and David Costello of Magellan recently presented to the Portfolio Construction Forum on the energy transition, and this is an edited transcript.

***

We're on the verge of an abyss and we cannot afford a step in the wrong direction. These are the words of António Guterres, the United Nations Secretary-General, reflecting upon the narrowing path that humanity will have to traverse if we're to avoid a climate disaster. Analysis by the Intergovernmental Panel on Climate Change (IPCC) suggests that under current policy settings, we're on a path to more than 3 degrees of global warming by the year 2100. Scientists warn that a world with more than 3 degrees of global warming would be a dystopian place, with temperatures representing a threat to human life at the equator for more than 200 days each year, a world in which massive crop failures risk undermining global food security.

These projections are confronting but they should be viewed as a rallying cry. Climate scientists are clear that we still have the opportunity to avert the worst consequences of climate change and limit global warming to 1.5 degrees if we drive deep cuts in greenhouse gas emissions this decade and go on to achieve net zero around mid-century. The central estimate is that we need to cut greenhouse gas emissions by approximately 43% this decade.

Now, we have the means to achieve these deep near-term cuts in emissions. Virtually all of the technologies required to do this exist today and are already economically viable. What's required to realize their potential is capital. The International Renewable Energy Agency projects that limiting global warming to 1.5 degrees will require cumulative total investments of US$115 trillion over the period of 2050, a nearly fourfold increase in prevailing levels of investment in clean technologies.

So, as allocators of capital, we're confronted with a choice. We can choose to continue to allocate capital in a manner that yields destruction. Or we can allocate capital for impact and preserve our planet for future generations.

Compelling financial and economic reasons

John Kerry, the U.S. Special Presidential Envoy on Climate, has described the energy transition as the greatest economic opportunity since the Industrial Revolution.

I believe the energy transition, the decarbonisation of the global economy, will represent the defining investment thematic of our lifetime. And capturing the potential of this thematic will require a tailored investment framework to optimise results.

My conviction in this opportunity rests on two key inferences.

The first is that those companies that provide the products and services that enable the decarbonisation of the global economy will sustain growth at a multiple of global GDP throughout the energy transition.

And the second inference is that a thematic investment exposure to the energy transition will serve to mitigate prominent business and market risks and therefore enhance the risk-adjusted characteristics of a portfolio.

Electric vehicles

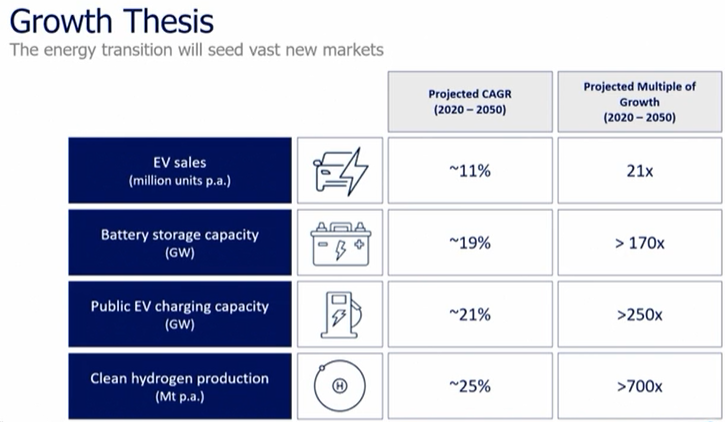

The capacity for the energy transition to sustain growth at a multiple of global GDP stems in large part from its capacity to seed vast new markets. The IEA projects that electric vehicle sales, for instance, will grow at a compound annual rate of more than 10% over the next 30 years. In the near term, those rates are more like 20% to 30% per annum. They project that battery storage capacity and EV charging capacity will grow at compound annual growth rates of approximately 20%, while clean hydrogen production in net zero scenarios is expected to grow at 25% per annum. And there will be opportunities all throughout the value chains.

The six key vectors of decarbonisation

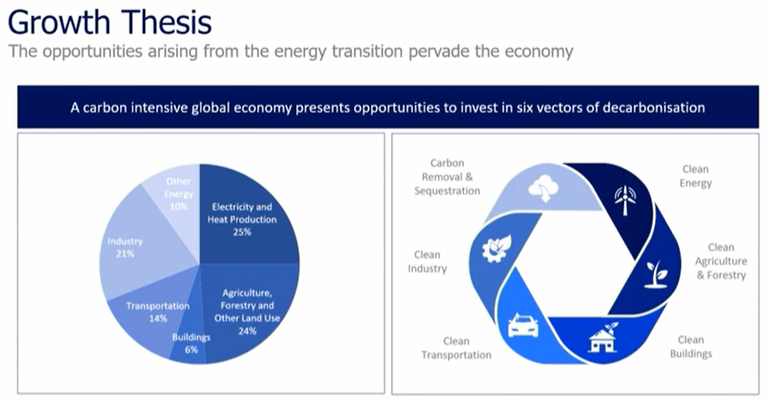

Our extensive reliance on fossil fuels as an economy means that they will pervade the global economy. On the left-hand side of the chart below is the world's inventory of greenhouse gas emissions attributed by economic sector. And we see significant contributions from all of the major segments of the economy – electricity and heat production, agriculture, buildings, transportation, industry.

The implication of this is that the energy transition will present compelling investment opportunities in six key vectors of decarbonisation – five that broadly correspond with the major sources of the world's emissions, clean energy, clean agriculture and forestry, clean buildings, clean transport and clean industry and a sixth which acknowledges that we'll never abate all of the world's emissions. So, we'll need to withdraw carbon from the atmosphere requiring carbon removal and sequestration.

The breadth and quality of these opportunities is also enhanced by inextricable links between digitalization, automation and decarbonization in the energy transition. For example, it will only be possible to achieve net zero if we deploy for instance semiconductors that radically enhance the energy efficiency of products in industry, in transportation and communications. It will only be possible to achieve net zero emissions and decarbonise our global building stock through the deployment of smart building controls and building management systems that use insights derived from machine learning and artificial intelligence to optimize energy efficiency in real time to reflect factors like occupancy and ambient temperature. So, an abundance of opportunities to grow at a multiple of GDP created by the energy transition.

Optimising the investment framework

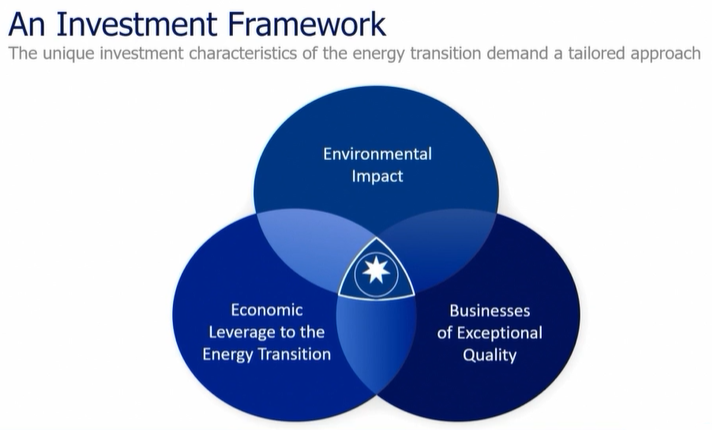

There's a particular investment framework that's likely to optimise your prospects of delivering outsized financial returns and meaningful environmental impact.

Seek to identify opportunities at the intersection of environmental impact, economic leverage to the energy transition, and businesses of exceptional quality. Now, those three elements, that framework, reflect three deeply held beliefs or convictions.

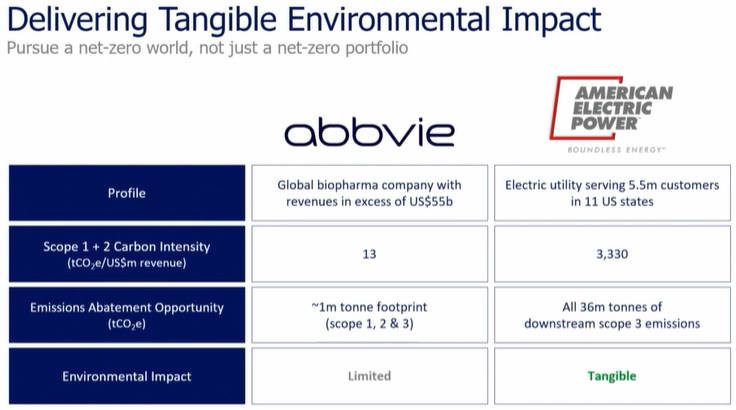

The first conviction is that we ought to pursue a net zero world, not just a net zero portfolio. Now, this distinction carries critical implications for the kind of companies you might invest in.

AbbVie appears in a lot of energy transition benchmarks. It's a global biopharmaceutical company with revenues of approximately $58 billion last year. Now, AbbVie's business model is inherently low emissions. In 2021, its full value chain carbon footprint was estimated at approximately 1 million tons, Scope 1, 2, and 3. Now, frankly, you could decarbonize all of AbbVie's operations, all 1 million tons. The company is not targeting that just yet. They're targeting a 50% reduction by 2035. But you could fully decarbonize its operations. And it would be a rounding error in the context of the world's 59 billion tons of anthropogenic carbon dioxide equivalent emissions last year. So, AbbVie's environmental impact is limited. And I'd contend that the energy transition will alter its financial results not one bit.

If, however, you believe that we ought to pursue a net zero world, then you might like to consider investing in a company like American Electric Power. American Electric Power is a U.S. electric utility, serving approximately 5.5 million customers in 11 predominantly Midwestern U.S. states. Now, unlike AbbVie, American Electric Power screens with a high level of carbon intensity, more than 3,000 tons of carbon dioxide equivalent emissions per $1 million of revenue. Last year, it generated 56 million tons of Scope 1 and 2 carbon dioxide emissions. On a full value chain basis, that rises to more than 100 million tons. But AEP has a plan to get to net zero by 2045. They've already made significant strides along that journey, investing to replace aging coal-fired power plants, replacing them with renewable clean energy. They're augmenting distribution and transmission networks to connect more renewables and to support the electrification of the economy in support of the energy transition.

Now, when American Electric Power decarbonizes their operations, and again, they've achieved a 70 % reduction relative to a 2000 baseline already, not only will they decarbonize and abate all 56 million tons of their own Scope 1 and 2 emissions, but all 36 million tons of carbon dioxide emissions attributable to the use of their products by customers downstream. So, relative to AbbVie, American Electric Power's environmental impact is more than 90 times greater. But that's important not just for the environment, it's important financially because it points you to the most significant beneficiaries of the energy transition. You see under the regulatory construct, every dollar that American Electric Power invests in its network earns the authorized rate of return. So, all of the money they're spending to replace aging infrastructure, to build out new renewable generating capacity and to augment their distribution network, delivers highly visible growth in earnings per share, and we can foresee a world of high-single-digit growth in earnings per share at this business for a multi-decade period.

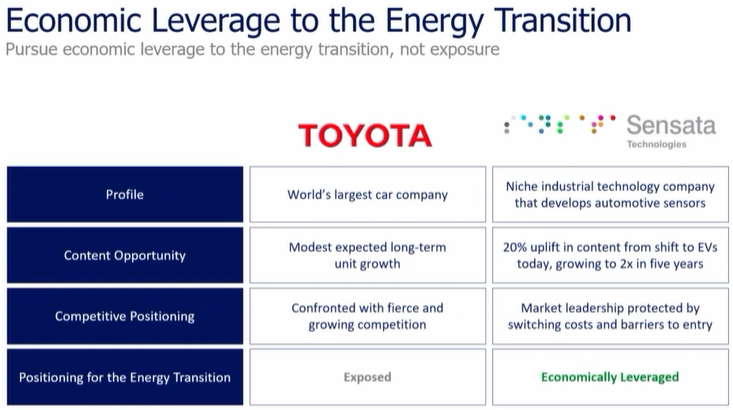

The second element of the framework is economic leverage to the energy transition. This reflects the conviction that we ought to pursue economic leverage to the energy transition, not exposure. Comparing a company like Toyota with Sensata reveals a critical distinction. Of course, Toyota is the world's largest car company, but the transition to clean transportation doesn't materially change the long-run volume outlook for cars. Car sales will continue to grow at a low-single-digit level in the long run.

But think further about Toyota's positioning within this ecosystem and what its returns might do. The transition to electric vehicle involves Toyota having to undertake a meaningful CapEx cycle, which will weigh on returns at least in the near term.

It appears that Toyota may have backed the wrong technology. They've prioritized development of hydrogen fuel cell vehicles, where it appears that battery electric vehicles are likely to dominate. And they'll continue to face fierce competition from companies like Ford and General Motors and Hyundai, who might perceive this transition as an opportunity to take significant market share. But of course, they'll also be confronted with growing competition from companies like Tesla and BYD. So Toyota is exposed to the energy transition, but not necessarily in a favorable way that's likely to deliver attractive financial returns.

By contrast, Sensata is an industrial developer of niche automotive sensors. Today these sensors measure things like brake and tire pressure in your vehicles. But as we transition to electric vehicles, Sensata has already seen a 20 % uplift in the value of their content on an electric vehicle relative to an internal combustion engine vehicle. Secured contracts give this company visibility to a doubling of the value of their content relative to internal combustion engine vehicles. And management is guiding to a 50% per annum compound annual growth rate in electrification revenues over the next five years.

Now, unlike Toyota, where your leverage to the growth in EVs might be a bit tenuous, Sensata's market leadership in these industrial automotive sensors is protected by imposing switching costs and formidable barriers to entry. They design these products in collaboration with the auto OEMs, they're subject to a strict qualification process, which means that they're almost never replaced during the life of an automotive platform that might span seven to ten years. So, Sensata is economically leveraged to the energy transition.

The third element of the framework is businesses of exceptional quality. If you took the view that growth in and of itself is paramount, you might invest in a business like JinkoSolar. Jinko is a Chinese manufacturer of commoditised solar cells and modules. Now the rapid deployment of solar PV means that Jinko is going to grow significantly. Bloomberg consensus suggests something like 70% revenue growth this year and another 30% next year.

But competition in this industry has historically meant that Jinko has generated returns on tangible invested capital of about 8%, a level that I'd suggest is broadly in line with their weighted average cost of capital. Now, rudimentary corporate finance theory will tell you, you can grow all you want, but if you don't earn a return in excess of your cost of capital, no incremental value accrues to shareholders.

By contrast, if value accretion is paramount, you might invest in a company like Hubbell. Hubbell is a manufacturer, US-based, of mission critical electrical and utility hardware. If you imagine the power pole in your local neighborhood, Hubbell makes virtually everything that connects to that power pole, but for the line itself. Hubbell won't deliver anything like the growth that JinkoSolar will see over the next couple of years, but the energy transition, the replacement of aging infrastructure, the need to augment the grid will deliver a double-digit-plus compound annual growth rate in earnings per share over the next four years.

But unlike Jinko, formidable barriers to entry and a profound set of competitive advantages mean that Hubbell generates returns on tangible invested capital of approximately 25%, approximately 3 times reasonable estimates of their whack. So, while growth at Hubbell is lower, value accretion is far more significant.

A thematic of a lifetime

To summarise, I've advanced two propositions.

The first is that the energy transition will be the defining investment thematic of our lifetimes, presenting investors with the opportunity to compound attractive risk-adjusted investment returns over a multi-decade horizon.

The second proposition is that it will require a tailored investment framework to optimise the intersection of environmental impact, economic leverage to the energy transition, and businesses of exceptional quality.

And if you read beyond the popular press and into the literature of the IPCC reports, the International Energy Agency and the International Renewable Energy Agency, you will share my belief in a portfolio tailored for the energy transition.

David Costello, CFA, is Portfolio Manager at Magellan Financial Group in Sydney. This article is general information and does not consider the circumstances of any investor. Magellan is a sponsor of Firstlinks. This material was originally presented at the Portfolio Construction Forum on 3 May 2023 and is republished with permission.