Investors have been the target of political pressure because they acknowledge and intend to manage climate risk. The criticisms are largely unfounded and have been refuted by investment and legal practitioners. Australia’s difficulty managing climate risk is the result of vested interests that have led to years of insufficient action and weak policy. Many of the comments regarding investors motives are misleading and not reflective of the principles of responsible investing, especially in relation to mining.

Australia needs more mining with one exception

Our large land mass is rich with minerals that make the world turn. Australia benefits from the global demand for our minerals. Responsible investors and advocates of sustainable growth support mining when conducted under global best practice environmental, social and governance (ESG) guidelines, with one standout exception, the extraction of fossil fuels for power generation.

Responsible investors are not anti-mining, but they are most concerned about thermal coal-fired power and the risk of a devaluation of coal assets leaving investors stranded. Ironically, coal itself is not the problem. As Dr Phil McFadden, former Geoscience Australia Chief Scientist declared, the problem is what we do with it. We burn it. Avoiding thermal coal power generation is key to reducing mankind’s impact on climate change. Thermal coal is one of the most carbon intensive methods of producing power.

Significant reductions in global carbon emissions are required if we are to keep average global temperatures from rising beyond 2 degrees.

Australia can stop mining thermal coal for power and remain a global mining powerhouse. Australia produces a lot of thermal coal, but the economics demonstrate that Australia can benefit more from mining the minerals required to produce renewable energy materials and infrastructure.

Investors must think carefully about the long-term decisions that are made today as we cannot mine everything all at once. Australia needs to be strategic about where resources are allocated and what is mined as it will determine the quality of our future. Australia approved coal mining in the Galilee basin, which some have declared uneconomic, while other countries such as Germany are kissing the last of their mined coal goodbye.

Political consensus but disagreement on how to act

The argument to manage climate risk is pervasive and the message from science is clear. In addition to the consensus amongst scientists, all three Australian financial regulators acknowledge climate change as a material risk. In Australian politics, the Labor Party has been transparent with its views on climate change, and the Liberal Party has acknowledged "the science of climate change” and support “national and global efforts to reduce greenhouse gas emissions" (see Emissions Reduction Fund Green Paper 2013).

Given the political consensus, it is a shame that climate change becomes a divisive federal election issue. The solutions required span many election cycles. Australia needs stable policy that lives beyond the election cycle. Australians should campaign to create an independent body that addresses our country’s climate change needs for the long term, rather than leave it to the government. Such independent bodies exist for other critical economic roles, such as the Reserve Bank of Australia.

Australians have little time to waste and cannot afford to make poor investment decisions. In June 2019, Australia was heavily criticised by the European Union on its ability to meet the Paris commitment given the reported projections and existing policies. More troubling is that the targets set by Australia are insufficient to contain global temperature rises to 2 degrees. The current Paris commitments would see the world exceed a 3 degree rise in global temperatures by 2100. Five times more effort to reduce emissions is required to limit global temperature rises to 1.5 degrees, says Dr Joëlle Gergis.

The roles of companies and investors

Companies have a role to play in reducing emissions and investors are monitoring company progress in managing climate risk. Recent MSCI ESG Research found that approximately 40% of the MSCI AU200 Index companies are not on track to meet Australia's carbon target, published in “Alignment to climate regulatory scenarios: A case study of Australian companies”.

Responsible investors analyse more than just the fossil fuel reserves. Assessments of the mining operations include reviews of the impact on the environment and local communities. Some companies are better than others at managing the environmental impact of their operations and ensuring the safety and security of their work force and customers. They have robust strategies in place to manage climate risk. Investors who integrate these impacts into their investment decisions review the strength of management and performance to targets.

So responsible investors are not demanding Australia shut up shop and stop mining. Rather they desire the government provides a strategy and stable policy to rapidly transition from thermal coal mining to mining other minerals.

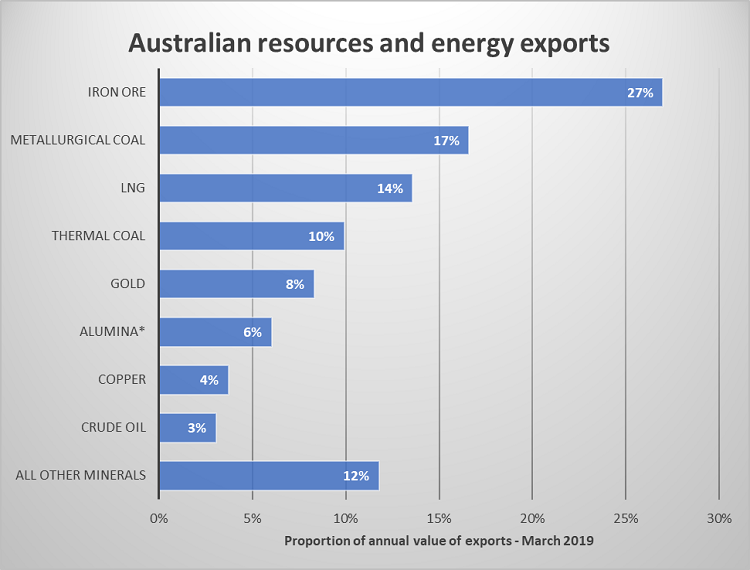

Australia's annual resource and energy exports totaled $228 billion as at March 2019. As shown below, the five largest contributors were iron ore (27% of the total), metallurgical coal (17%), LNG (14%), thermal coal (10%), and gold (8%). Australia is by far the largest seaborne exporter of metallurgical coal globally and the second largest exporter of thermal coal.

Data source: Australian Government – Department of Industry, Innovation and Science | Chart notes * Alumina includes exports of Bauxite and Aluminium Ingots

The need to transition from thermal coal is supported by declining global demand. World thermal coal consumption peaked in 2013, while Australia has increased thermal coal exports by 76% in the last 10 years. Australia is making progress at a fast pace, but in the wrong direction.

The transition away from thermal coal energy to renewable energy could benefit Australia's mining industry. Professor Martin Green from the University of New South Wales suggests the economic benefit could be five times greater for Australia to replace the thermal coal mining with the equivalent minerals required to produce solar panels for the same quantity of electricity. These minerals include iron, metallurgical coal, alumina, copper and cobalt. The chance is now to reset the compass.

This renewable energy opportunity aligns well with the recently published Australian National Outlook 2019. The report foresees the opportunity for Australia to generate and sell energy generated from solar power to the rest of Asia, becoming the regions renewable energy hub.

Climate change high on investors’ agenda

Investors globally are solving for climate change risks and opportunities. As an indication of the priority given to climate change, a third of the breakout sessions at the recently held 2019 PRI (Principles of Responsible Investing) conference directly referred to climate change in the title. Investors can engage companies on physical and transition climate risk issues, reduce their investment or divest. They can also identify opportunities to invest in profitable solutions that provide positive outcomes. A focus on renewable energy would meet Goals 7 and 13, affordable clean energy and climate action, of the Sustainable Development Goals, which have been adopted by a growing number of companies and investors.

The Investor Group on Climate Change (IGCC) points to the increased involvement of investors and their desire to manage climate change. The survey indicates a strong increase in the proportion of investors implementing low carbon strategies from 54% in 2017 to 90% in 2018. Some local investors who are broadly managing climate risk with low carbon strategies include New Zealand Super, Vision Super Australian Ethical, and Christian Super, while Local Government Super apply materiality screens to fossil fuels and HESTA restricts investments in new thermal coal.

The investor action on climate change is not just an Australian phenomenon. Investors including Norway's Sovereign Wealth Fund, UK EAPF, AP4 and CalSTRS are implementing low carbon strategies or divesting from coal.

However, more needs to be done to educate investors on the financially material risks of climate change. Slightly more than 40% of superannuation funds believe that climate change was financially material in APRA’s survey from 2019. That leaves a large proportion of funds that are not currently concerned.

Climate change transition risk could occur rapidly due to changing policy and technology. Markets could be caught by surprise. The survey found that ‘Reputational’ topped the list of climate risks, while ‘Regulatory and Energy’ ranked lower. Arguably the latter two should be of primary concern as they could materially impact company performance. In a scenario were carbon emissions were regulated and priced, thermal coal could be rapidly devalued and investors would be left with a stranded asset.

Australians hold the key to supporting superannuation funds initiatives to protect their assets from climate risk. Contacting superfunds and supporting better climate risk management would help them stand up to the political criticism, putting Australia on the right path to become a renewable energy leader.

Michael Salvatico is Executive Director at MSCI ESG Research. This article is general information and not financial advice. It does not consider the circumstances of any investor.