In the middle of yet another review on superannuation, this time looking at the retirement income system, it is important to capture the views of the people the system is meant to help. Challenger has partnered with National Seniors Australia since 2012 to form a better understanding of how Australian retirees (and older Australians not yet retired) feel about life and their finances in retirement.

Lack of confidence in retirement

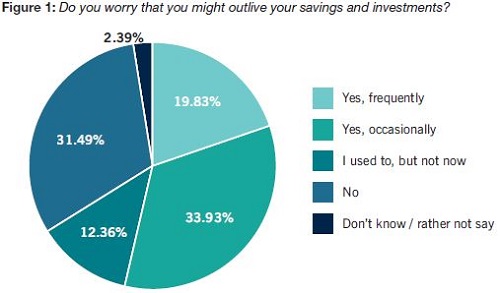

The latest report, Retirement Income Worry. Who worries and why? indicates that the system has more work to do to provide retirees with more confidence in retirement. The report found that most older Australians (53%) are worried about outliving their savings, with women (59%) more worried than men (47%).

This high level of worry contrasts with global comparisons that rate Australia as one of the best retirement income systems in the world. This isn’t simply a case of Australia being the best of a bad lot. The underlying issue is that despite the many strengths of Australia’s super system, people worry whether they have enough, particularly approaching retirement.

The report delves into the underlying factors leading to worry. Gender differences are significant. Women are more likely to worry about running out of money in retirement than men. And, by 'running out of money', people are talking about their super. While the age pension is a backstop for people who run out of super, respondents were worried that it might happen to them. Living solely on the age pension is viewed differently from having your own money to spend.

People with less than $500,000 were more likely to worry than those with more. There are more women with lower balances as a result of broken lifetime work patterns, part-time arrangements and the gender pay gap. The report also notes that women with higher balances were more likely to worry than men with the same balances.

Longevity differences not addressed

The difference in life expectancy could also impact the level of worry in women. On average, women live 2-3 years longer than men, and half the women who turn 66 in 2020 are likely to live into their nineties. The standard retirement income options in super don’t deal with this longevity and this seems to cause many to worry about their money running out.

It follows that retirees with a guaranteed source of income for life (from either a defined benefit pension or a lifetime annuity) were the least worried.

The evidence points to the need to improve the super system to keep it world-leading. The current government focus on designing better retirement income products will help as would other tweaks that haven’t received the same traction, such as removing the $450 threshold on compulsory super payments.

Better adjustment in retirement

On the positive side, once people retire, they report less worry. People tend to adjust to what they have and to actual retirement. It implies that some people are working only because they are worried about not having enough.

The survey also reinforces the idea that retirees know that super is for spending. Almost two-thirds of the respondents who had been retired for at least five years expect to spend most of their savings over the next 20 years. Super was created as a consumption-smoothing mechanism. Participants defer wages as a sacrifice during their working lives, so they are entitled to spend those unspent wages (compounded many times over) on themselves in retirement.

Summary of major results

In brief, the degree of worry about retirement income was:

1. 68% higher in those not already retired. Previous work has indicated that people adjust to their actual circumstances in retirement, whether they planned for them or not.

2. 65% higher in those who have less than $500,000 in savings. This is as expected, since they may not have the money to pay for a ‘comfortable’ retirement.

3. 53% higher in those who expect their main source of income in retirement to be the age pension. This is expected because it is a minimum basic income with accompanying worry about ‘making do’.

4. 47% higher in women. This is after taking out the effects one or more of the previous three factors above and may be associated, in part, with expecting greater involvement in caring roles and a real risk of outliving their partners.

Jeremy Cooper is Chairman, Retirement Income, at Challenger. The full report can be downloaded from the National Seniors website.