Ethical or socially responsible investing (SRI), which focuses on environmental, social and governance (ESG) criteria, has been around for a while. More recently, other names have emerged such as sustainable or green investing.

SRI has been gaining traction recently with investments into 'core' responsible investment up 26% (according to Responsible Investment Association Australasia (RIAA)) to $64.9 billion or 4.5% of Australia's total assets under management. 'Core' responsible investment approaches mean that at least one of the primary strategies applies, including: negative, positive or norms-based screening (adherence to global norms on environmental protection, human rights, labour standards, and anti-corruption); sustainability themed investing; impact investing, community finance; or corporate engagement.

Beating mainstream funds over the long term

The SRI industry makes a strong case that returns are not forfeited by this investing approach. A report launched recently by the RIAA showed “‘core’ responsibly invested Australian share funds and balanced multi-sector funds have outperformed their equivalent mainstream funds over three, five and 10-year horizons” to 31 December 2016 (the benchmark being S&P/ASX 300 accumulation index). One major player, Australian Ethical Investment Ltd (ASX:AEX) was established in 1986 and now has over $1.5 billion under management, returning 10% p.a. to its investors over the last 20 years.

SRI covers a broad subjective range of industries and practices. What is unethical to one person may not be to another, which leads to many different types of SRI, and difficulties pinpointing one strategy for all. RIAA says that nearly half of Australian funds (44%) are using some form of responsible investing strategies that include one or more of the following: negative screening, impact investing, sustainability themed funds and the integration of ESG considerations.

To see a positive outcome and return on SRI, a long-term approach must be taken. Factors such as changing working conditions, educating workers, restoring the environment or turning a building green take time and money. Long-term returns depend on the sustainability of the companies’ initiatives to remain ethical.

Benchmark concerns

One of the issues with SRI is the lack of a performance benchmark. An index such as S&P/ASX200 may not be an accurate comparison. The Materials sector is 16% of the S&P/ASX200 index and BHP Billiton is nearly 5% of the index. Excluding BHP (plus other miners that do not meet ESG standards) means a significant underweight to a major sector and stock. Miners are more likely to be excluded from SRI funds because of environmental impact or fossil fuel mining and coal seam gas. The absence of mining stocks, in particular BHP and Rio Tinto, in ethical funds would have benefitted performance of the funds during the downturn in the mining cycle, especially since 2010

Banks may be screened out because of their lending to coal mining companies. Australian Ethical Investments only holds Westpac (6.3% of the index) and does not hold the other three major banks, although there are holdings in other financial service companies and smaller banks. Excluding the major banks (24% of the index) would be a big dent in a SRI fund’s exposure to the index S&P/ASX200.

In global portfolios, companies that avoid paying tax in Australia or promote unhealthy lifestyles may not get the tick. Apple, for example, makes most of its money in Ireland due to the Irish government granting the company special tax status. Apple Australia’s net profit for its financial year to September 2016, fell 97% on the back of a tax ‘adjustment’ for previous years. The ‘Google Tax’ applying from 1 July 2017 may lead to changes in the multinationals’ tax affairs.

Passive ETFs and ethical companies

The increasing popularity of passive exchange traded funds (ETFs) in Australia also raises the question of how these funds can meet ESG requirements. It is impossible for a broad-based index ETF to be considered ethical as they are currently structured, as they simply track the broad benchmark with no ethical screening.

For example, around 69% of Vanguard’s funds are broad-based and passive, according to Barrons, which limits its ethical stance. However, on Vanguard’s website is the statement “as one of the world's largest investment managers, we recognize that our voice carries considerable weight. Because the funds' holdings tend to be long term in nature (in the case of index funds, we're essentially permanent shareholders), it's crucial that we demand the highest standards of governance from the companies in which our funds invest”. Recently Vanguard has stepped up its corporate governance by requiring Exxon to report on its impact on climate change, alongside some other big fund managers including BlackRock and State Street Global Advisors.

BlackRock, one of Vanguard’s major competitors, has been more proactive around corporate governance but also would find it difficult to incorporate into its passive ETFs.

Ethical ETFs listed in Australia

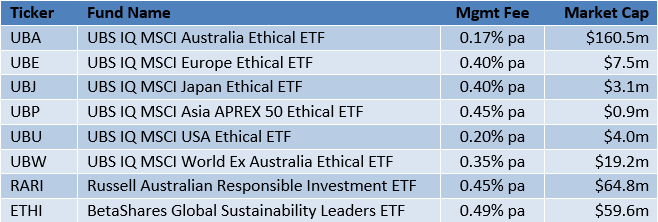

However, several ETF issuers have introduced ‘ethical’ ETFs to Australia to meet the growing investor demand and attention on the SRI issue, as listed below:

Source: ETF Watch as at 27 July 2017

BetaShares launched the Global Sustainability Leaders ETF (ASX:ETHI) with its objective being to “provide exposure to 100 large global stocks (excluding Australia) which are climate change leaders and which are not materially engaged in activities deemed inconsistent with responsible investment considerations”. The benchmark is Nasdaq Future Global Sustainability Leaders Index which is provided by Nasdaq.

The Russell Investments Australian Responsible Investment ETF (ASX:RARI) “provides investors with a simple, cost-effective and transparent means of accessing an environmental, social, and governance (ESG) enhanced portfolio of Australian shares”, by tracking a “custom-built, smart-beta index”, Russell Australia ESG High Dividend Index. A custom-built index is one way around the problem of creating a passive ETF that meets ESG criteria. It is worth noting that all four big banks are held (total weight of 32% as at 27 July 2017) in the underlying basket of stocks, so in their view banks are not failing to be socially responsible. BHP and Rio are not part of the basket.

UBS manages six ETFs using MSCI benchmarks but only exclude tobacco companies and dangerous weapon manufacturers. MSCI Australia would not be overly exposed to these two industries so investing in the broader indexes is just as effective for a lower fee.

In other developments, a new roboadvisor called Balance Impact will launch soon, using SRI screens to actively select stocks and ETFs for other parts of its asset allocation process.

Demand will continue to grow

SRI will be a growing part of the managed fund and ETF industry driven by consumer demand due to the increasing focus on social change and global warming. Millennials, a larger cohort than baby boomers, is particularly pushing the demand alongside other generations. According to the 2015 Nielsen Global Corporate Sustainability Report, “66% of global consumers say they’re willing to pay more for sustainable brands – up 55% from 2014.” Furthermore, 73% of global millennials are happy to pay extra for sustainable products, which is up from 50% in 2014.

Rosemary Steinfort is a Research Coordinator at Cuffelinks, and recently attended the launch of the RIAA Benchmark Report 2017.