(Editor's introduction: the author is a lawyer who specialises in protecting family assets and who is a keen observer of related court cases. For many of our readers who are considering what to do with their estates, the law might not be as straightforward as assumed).

I have a personal interest in this legal case because, 20 years ago, my first abode in Australia was in Louisa Road, Birchgrove in Sydney’s Inner West. We lived in the worst block on, arguably, the best street in the area. The road is or was home to other celebrities including Bryan Brown, Bruce Beresford, Georgie Parker and Rebel Wilson. They may be surprised at the drama that was developing around them. Or then again, they may not have been surprised in the slightest!

No matter where you live in Australia, a fight in the neighbourhood attracts the interest of all the locals.

Following other articles on carers allegedly behaving badly, we are pleased to share a story of neighbours who acted honourably, looked after an elderly lady and were found, after a stressful legal battle, to have done nothing wrong.

The case is Moore v Aubusson [2020] NSWSC 1466.

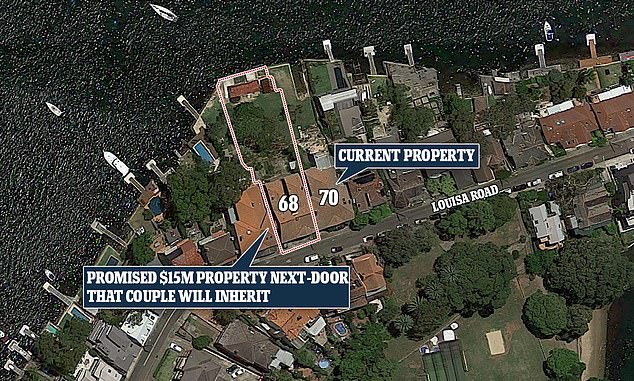

Mr Moore and his partner Ms Andreasen (the plaintiffs) lived in 70 Louisa Road and the deceased, Ms Barbara Murphy, owned 66 and 68 Louisa Road. The defendant was the sole surviving executor, Mr Aubusson. The plaintiffs sought a declaration that the executor held, not just the $25,000 that was allotted in the Will but the whole of the deceased’s estate on trust for them and an order that the estate be transferred to them.

The plaintiffs based this claim on the fact that the deceased had promised to leave them her whole estate in return for them looking after her for the rest of her life. They had also agreed not to undertake their desired renovations to the extent that those works would impede the view of Sydney Harbour from the deceased’s property. Family members and friends of the deceased and the plaintiffs gave evidence that they were told of this arrangement.

Affidavits about these representations were sworn 12 years later and the defendant tried to make much of the delay.

The plaintiffs held up their part of the arrangement and looked after the deceased until her death in 2015. After her death, they were advised that the deceased had left her estate in equal shares to her siblings and left only $25,000 to Mr Moore.

Everyone’s evidence was properly heard and considered but the Court quite publicly preferred the evidence of some witnesses and found others to be partly 'implausible' and to have colluded in their evidence.

It's your estate but the Court could intervene

The Court found that the deceased’s promise only concerned the deceased’s two properties and not the whole of the estate. The Court further found that a detrimental reliance on the deceased’s promise had been established as the plaintiffs cared for the deceased at the expense of their own family commitments and by making personal sacrifices. On this basis, the Court ordered that the properties be transferred to the plaintiffs.

As always, the lawyers got paid and Chief Judge Ward pointed out, there were “two applications by the executor(s) for judicial advice, the first heard by Lindsay J in 2016 and the second by Rees J at the beginning of 2019. I simply note that this may be relevant if there is, as was foreshadowed, ultimately a dispute as to the executor’s right to be indemnified from the estate for the costs of these proceedings.”

In our experience, the executor’s costs would usually be paid out of the estate in situations like this.

The moral of the story is to by all means do what you want with your estate but be mindful there can be issues and challenges and all roads lead to Court. Older people can be very vulnerable but they can also tell people what they want to hear!

If you take away all the drama, this is a typical story of an elderly person who wanted to live in their home and not be taken away to live in a nursing home with strangers. Some reports said the carers reportedly got assets worth $40 million for their trouble.

I still live in the Inner West but in a less glamorous street. I wonder what might have happened if I had stayed there and befriended Mrs Murphy …

Another case ...

Another instance in which it can be seen that a promise made in one’s lifetime may bind their estate long after their death is McNab v Graham [2017] VSCA 352.

Mr Turner and Mrs Turner lived in and owned two semi-detached maisonettes, numbers 73 and 75 Ormond Road in Moonee Ponds. We do not know how close to Dame Edna’s house this is!

They had no children and of course needed to be cared for in their later years. Luckily for Mr Turner, he met Mr Graham at their local social club and proposed to Mr Graham that he and his wife live rent-free in No 73 in exchange for providing care to Mr and Mrs Turner and that Mr Turner would leave no 73 to the Grahams upon his death. No written agreement in respect of the arrangement was ever prepared or executed. Mr Graham insisted they paid rent which was decided to be $80 per week in comparison to $120 per week they paid for their previous flat in Essendon which was smaller.

Sadly, Mrs Turner died in 1980 and Mr Turner died in 1997. Unexpected to Mr Graham, the Will granted a life interest in property at number 73 to the Grahams but it was to be given to the Freemasons Hospital upon their death. When Mr Graham sought legal advice from one of the other executors who was the partner of the law firm (McNab) that drew the original Will, he was (incorrectly) advised his claim had no hope of success and that it would be defended. As a consequence, Mr Graham decided not to challenge the Will.

A rethink and a challenge on the Will

Fortunately for Mr Graham, in 2013 he stumbled upon a newspaper advertisement and sought legal advice again as he incorrectly believed upon his death that Mrs Graham could no longer live at the property. Mr Graham brought a claim against the estate based on equitable proprietary estoppel. At trial, Mr Graham gave evidence that Mr Turner promised that on Mr Turner’s death, the property would be left to the Grahams.

At first instance the Court found in favour of the Grahams and ordered that steps be taken to execute the property transfer. The executors sought leave to appeal the decision. However, the appeal was dismissed, and the property remained with the Grahams as the court found that Mr Turner made a promise that they would inherit the property in exchange for care and the Grahams relied on this promise.

This can happen anywhere, even in Dame Edna’s backyard in Moonee Ponds so it is important that your estate planning involves identifying any potential claims against your estate and mitigating these risks. We also assist with preparation of evidence to support people who have done the right thing.

Donal Griffin is the Principal of Legacy Law, a Sydney-based legal firm specialising in protecting family assets, and author of 'An Irish book of living and dying' (the first book in the 'Be A Better Ancestor' series). Legacy Law is not licensed to give financial advice and this is general information.