With significant demographic shifts occurring around the world, one useful approach for investors is to use demographic themes and trends as a compass for future investing.

Focussing on companies that will benefit from slow moving, long duration and highly predictable demographic trends can help investors predict areas of future opportunity.

There are three main themes that stand out – an aging population, population growth, and a growing middle class. The long-term implications of all three are far-reaching.

Longevity and aging population

A quick look back at history offers a guide to how much older society is becoming, and how quickly. During the Roman empire, the average life expectancy was only 25 years. Life expectancy then increased to 33 years in the Middle Ages, with a big jump to 55 years in the 19th century.

More recently, the average life expectancy across the globe has increased to 72 years, with the Western world at 80 years and Japan at 84. Dutch scientists expect that in 50 years’ time, life expectancy might reach over 125 years.

At the same time, the overall population itself is becoming, on average, older. For the first time in human history, people older than 60 will soon outnumber 15-year-olds and younger. This has profound implications on how people are spending, which in turn has repercussions for what industries and companies will succeed over the longer term.

Population growth and shift to the middle class

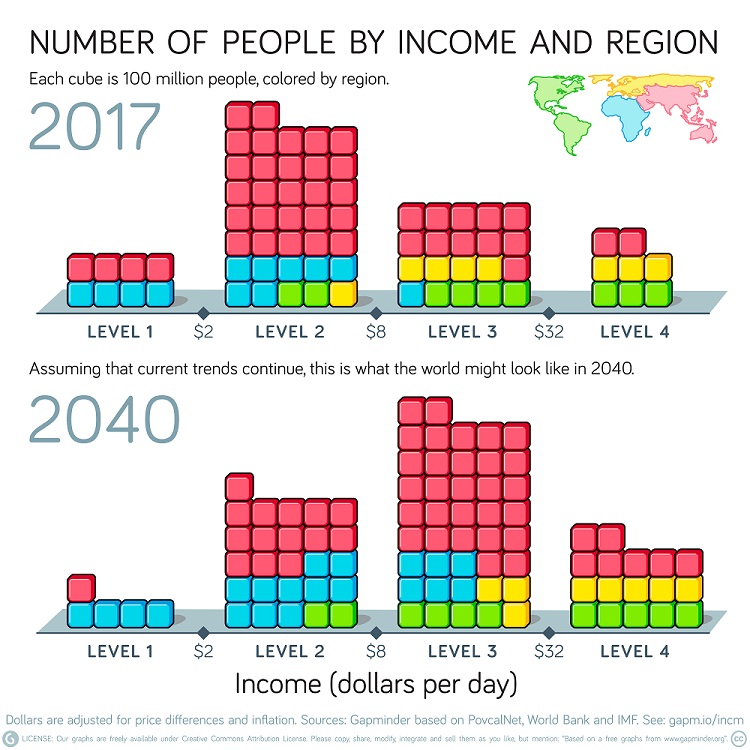

There are noticeable shifts within this population growth. We are at a point where, for the first time in human history, the number of people in the middle class will make up the majority of the population.

From an investment perspective, this means that the level of household wealth is, on average, rising globally.

Source: www.gapminder.org.

This increase in household wealth is noticeable in Australia, particularly due to the effects the pandemic and Australia’s reaction to it, with household savings levels reaching historically high levels. The US and China are still the two largest economies in the world, but even with the pandemic downturns in 2020, Australia is now the 13th largest economy in the world, overtaking the likes of much bigger countries such as Spain. Australia is still a country with just 25 million people, making it comparatively rich on a per capita basis.

Movements from cities

Another shift that is a direct result of the pandemic is the significant change in where people choose to live. For many decades there has been a one-way movement from regional and country areas into Australia’s cities. However over the past 18 months there has been a trend of younger people, particularly millennials moving away from the cities and into the regions, creating a property boom in these areas.

Younger people are looking for a lifestyle change and prioritising more space for their young families. Some potentially are wanting to get away from the spread of Covid in the higher density city areas, which of course bring more lockdown measures. Regional housing is also cheaper for younger people and ‘working from home’ measures have allowed younger people and families to work from the regions, rather than just commuting to the city.

Opportunities for investors

Some of the industries that are set to grow from these demographic shifts include healthcare, technology, and logistics, which will offer attractive opportunities for investors.

For example, since more people are working from home and living outside of the cities, the warehousing and logistics sector is set to grow even further. Although shops are closed, people are buying just as much as ever, but consumption is moving online, driving demand for more warehouses and delivery services. Therefore, quality logistics and freight companies that have a good geographic range through warehousing and distribution centres, along with a wide range of delivery capabilities, display a good pipeline of growth.

Another industry set to grow is healthcare, specifically technological advancements in healthcare due to the aging population.

As people age, they have different healthcare needs, ranging from hearing aids, hip replacements, glasses, certain drugs, or heart operations. For example, eyesight declines with age, so the eyecare sector is likely to grow. The increased use of screens and electronic devices is also having a negative impact on eyesight. Out of a global population of 7.6 billion, it is estimated that 60% of people need eye correction, but only 40% are getting it done. So, the opportunity here is set to expand. For investors this means finding healthcare opportunities that seek to improve patient care through leading niche technologies that are already out in the market.

The aging population creates more people needing surgery. This is where technology advancements in healthcare come in through the likes of robotic surgery. The use of robotic surgery allows for treatment in a minimally invasive manner. The benefits of this are greater accuracy, lower complication rates, and ultimately, reduced days in hospitals, which saves the healthcare system money.

The healthcare industry is expected to innovate more to get ahead of any future variants and other viral infections. Innovation in the case of Covid-19 and other viral infections can open a new world of opportunities for investors. Investors can put money behind companies to help accelerate these treatments, while allowing these companies to bolster their cash flows, in turn, creating a solid investment.

Therefore, there is ample amounts of opportunity to invest in a more dynamic future through changing demographics. Industries of healthcare, technology, and logistics, along with many more, will thrive from these demographic trends.

For investors, a good place to start is with those companies where a significant proportion of value creation comes from demographic factors.

Aneta Wynimko is Co-Portfolio Manager, Fidelity Global Demographics Fund at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.