The decision whether to hedge your international equity portfolio can impact your investment over the short and medium term, but an analysis of the data shows that currency impact over the long term is negligible.

Currency hedging international exposures

The decision to hedge your currency exposure is an important one as movements in the Australian dollar can either erode or add value to your international investment. Any drop in the Australian dollar helps unhedged investors as it magnifies gains when assets are converted back into Australian dollars. So if, for example, the Australian dollar fell by 10%, all other things being equal, the value of your offshore investments would rise by 11%.

However, the converse is true and any rise in the Australian dollar diminishes returns when foreign investments are converted back into Australian dollars. This is where hedging an international portfolio may be advantageous, as it will benefit from rises in the value of the Australian dollar.

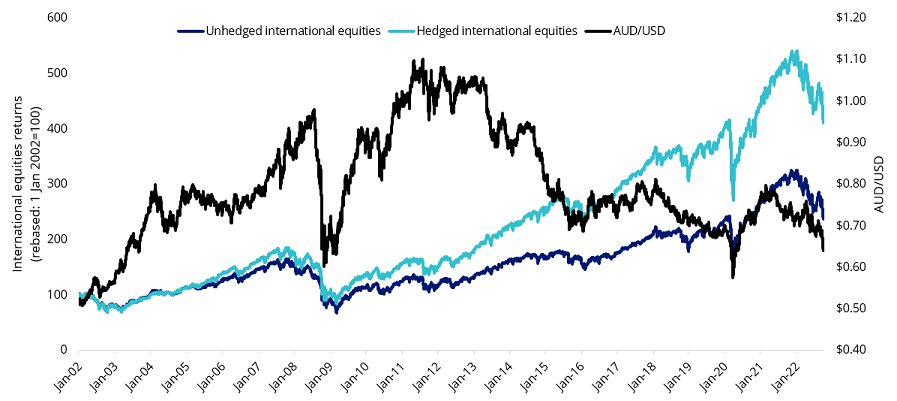

The chart below shows the impact of movements in the AUD vs USD on the value of international equities over the past 15 years. As the Australian dollar appreciated into 2008-09, hedged international equities outperformed. When the AUD fell sharply from April to August 2013, unhedged equities benefitted significantly while hedged equities gained only from underlying stock performance.

As the AUD depreciated further in 2014-15 hedged international equities continued to gain due to underlying stock performance while unhedged equities gained more. Finally in March this year, you can see that the value of hedged international equities fell much more sharply and in line with the broader market crash, versus the unhedged equities which were cushioned with the simultaneous collapse of the Australian dollar.

Chart 1: Australian dollar and hedged and unhedged international equities returns

Source: Bloomberg, 1 January 2002 to 30 September 2022. Unhedged International equities is MSCI World ex Australia Index. Hedged International equities is MSCI World Ex Australia 100% Hedged to AUD Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

AUD/USD fell below 50 cents back in 2001

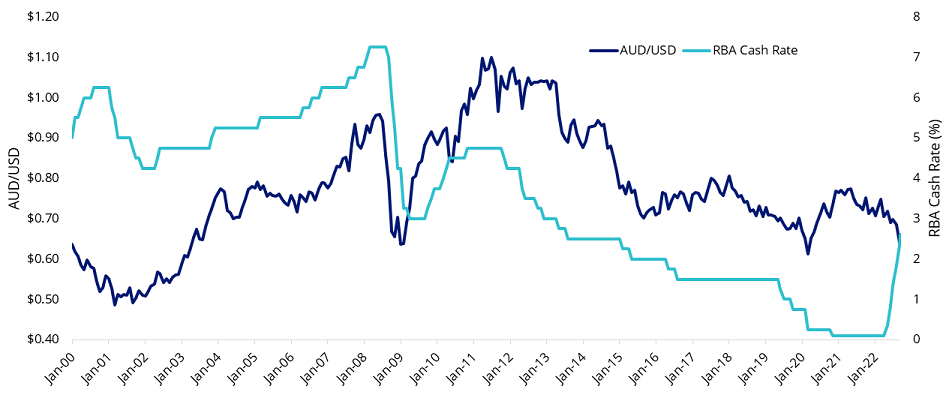

When the Australian dollar tested lows before, in 2001, 2008, and the Covid crisis it was different from the current rate environment. At US$0.67, it currently is a long way from those depths.

Back in 2001, times were different. Monetary policy was orthodox, and the RBA cash rate was high. In 2008, Australia went into the GFC with among the highest cash rates in the developed world and avoided the need for unorthodox policy.

Now there is a range of different factors to consider including the fallout of the unorthodox monetary policy that was implemented in the wake of the Covid crisis, the global recovery and associated supply shocks from COVID-19, the deleveraging of government balance sheets, the Fed’s rapid rate rises in the face of 30-year high inflation and Australia’s lower cash rate relative to other crises. During the current RBA rate rising cycle, the Australian dollar is not appreciating as it has during past hikes (2002 to 2008, and 2009 to 2010).

Chart 2: Australian dollar and the RBA cash rate

Source: Bloomberg, 1 January 2000 to 30 September 2022.

To hedge or not to hedge a Quality international equity exposure

This year's fall in the Australian dollar has led investors to ponder: should they be investing in hedged or unhedged international investments, or a bit of both?

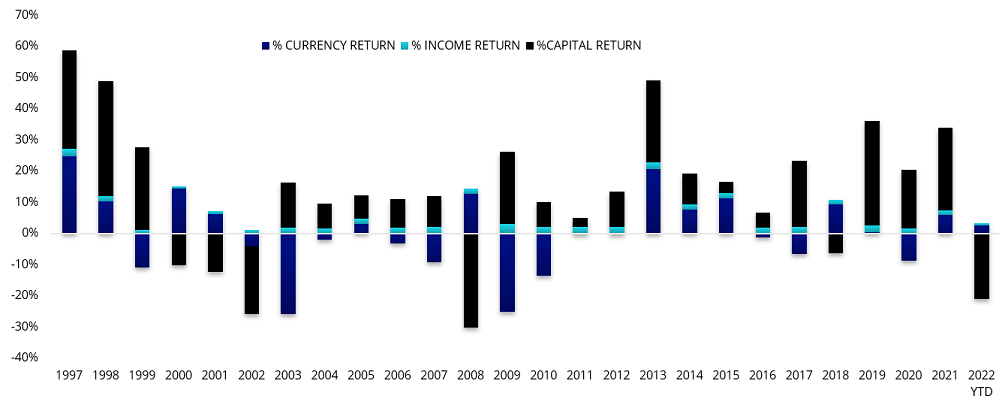

It’s important to remember over the long run, currency risks even out – what goes up, must come down – and currency volatility is smoothed out. Chart 3 below shows the long-term returns for the unhedged index tracked by QUAL.

Chart 3 Calendar year breakdown of MSCI World ex Australia Quality Index’s returns

Source: MSCI. Annual returns to end of each calendar year data. 2022 is to 30 September 2022. Past performance is not indicative of future results.

The total return from currency for the calendar years from 1997 to 2022 is -0.03% p.a. Over that same time the index has returned 10.34% p.a. In other words, over a long-term period of nearly 26 years the decision to hedge or not hedge your international equities investment would have had a negligible impact on your overall portfolio performance. For short to medium term investors, the decision becomes more important as can be seen in blue in the chart above in which there are fluctuations from year-to-year.

It's impossible to predict markets and the same could be said of currencies. As always, we recommend talking to a financial professional to determine which currency strategy is right for you.

Alice Shen is a Senior Associate, Investments & Capital Markets at VanEck, a sponsor of Firstlinks. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. This is general information only and does not take into account any person’s financial objectives, situation or needs. Investors should do their research and talk to a financial adviser about which products best suit their individual needs and investment objectives.

Key risks

An investment in QUAL carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

For more articles and papers from VanEck, click here.