In an exclusive from Hamish Douglass, he shares 13 investment lessons he has applied in building the Magellan business. He divides the insights into four topics: finding investments, letting them work for you, temperament and risk.

Digital Platforms Inquiry

The ACCC Digital Platforms Inquiry Final Report is a fascinating study of corporate power, mainly exercised by Facebook and Google. Facebook has spent US$23 billion acquiring 66 companies in the last 12 years, many of which the ACCC says could have developed into competitors. The purchase of the now-ubiquitous Instagram for only US$715 million in 2012 was a stroke of genius by Facebook, "entrenching its power in the supply of social media services."

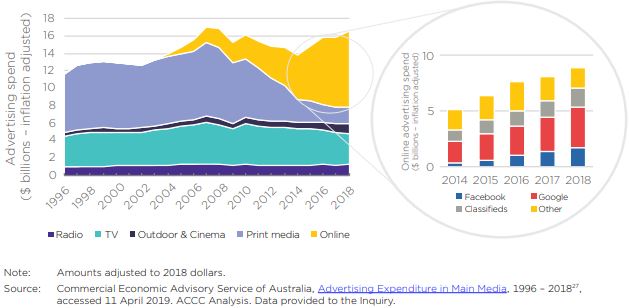

The chart below from the Report shows how print media has been decimated by online advertising. As Warren Buffett said in 2006, "Very few businesses get better because of more competition", although television and radio seem surprisingly resilient.

Advertising expenditure by media format and digital platform, adjusted for inflation

The ACCC highlights the loss of media outlets which are vital for the functioning of a democracy:

"News and journalism generate important benefits for society through the production and dissemination of knowledge, the exposure of corruption, and holding governments and other decision makers to account ... There is not yet any indication of a business model that can effectively replace the advertiser model, which has historically funded the production of these types of journalism in Australia."

My favourite table in the 619 page report is on page 548. We're in good company.

A focus on financial advice

This week, Ministers Josh Frydenberg and Jane Hume jointly announced legislation would be introduced today to ban the grandfathering of conflicted remuneration paid to financial advisers. It's a watershed moment for financial advice, as thousands of advisers rely on these payments in their business models. The Media Release said:

"Conflicted remuneration is where the payment of a benefit to a financial adviser may incentivise them to recommend to a consumer a financial product that may not be in their best interests. Grandfathered conflicted remuneration can entrench clients in older products even when newer, better and more affordable products are available on the market ... We are also going further, by including in the Bill a power to make regulations to establish a scheme that will provide that those people paying conflicted remuneration rebate clients for any remuneration that would be paid after 1 January 2021."

The recent Adviser Ratings Musical Chairs Report showed 2,825 financial advisers left the industry in the six months to June 2019, mainly due to the coming licensing requirements under FASEA regulations. Advisers are also moving to independent licensees rather than institutions.

It is timely that Jodie Hampshire reports on research which shows the value of financial advice. For an industry battered by poor headlines, this is a good news story that advisers should share with their clients and prospects. Some independent advice businesses are thriving, and this week, Unisuper announced it employs almost 100 advisers with funds under advice of $13 billion, a quadrupling over five years. The demand for and need for advice is out there.

Meanwhile, the APRA Capability Review will cement its authority. Geoff Warren reports a new focus on super member outcomes, and a challenge to find a way to measure fund performance.

On investment ideas ...

Emma Rapaport provides a summary of three alternative active management structures that every self-directed investor should understand, active ETFs v LICs v unlisted managed funds.

Most professional investors are worried by the all-time market highs driven by optimistic growth valuations rather than fundamentals. Stephen Dover reveals his views on the current market which he calls 'end-of-cycle investing', and Lawrence Lam says he is finding good niches beyond the FAANG and WAAAX acronyms.

If you manage your own investments, perhaps in an SMSF, how did you go in FY19? Our look at Chant West's report on super funds and Mercer's on managed funds shows some good numbers.

This week's White Paper from Fidelity International answers a question every investor should ask: is it better to outperform in a rising market or protect a portfolio in a falling market?

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.