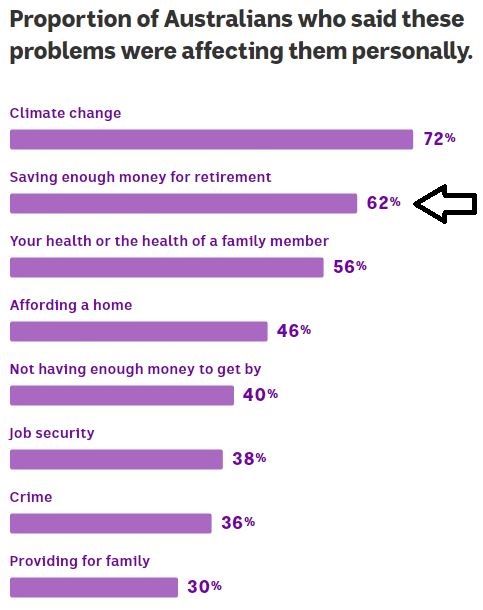

When you consider all the things people might worry about, the current ABC survey called 'Australia Talks', uncovering our attitudes and experiences, is producing surprising results. Based on 54,000 responses, ahead of health but behind climate change, comes 'Saving enough money for retirement'.

Source: ABC 'Australia talks', October 2019

Retirement saving is double 'Providing for family'. The Government's Retirement Income Review is therefore timely, although as we wrote last week, expectations should be tempered. Nick Callil describes three ways retirees can spend their super, balancing running out of money ('ruin') with leaving it behind ('wastage').

There's no other country in the world where superannuation influences headlines and politics as much as Australia. Bill Shorten acknowledged last week that what the Liberals dubbed the 'retiree tax' had damaged Labor:

"We misread the mood in terms of the franking credits. What everyone thinks about the system in hindsight - and of course, hindsight is never wrong, is it? - what we saw is that there were a lot of older people who felt vulnerable and it also laid the seedbed for the fake campaign on the death tax."

He should read Firstlinks, because in the seven years of this publication, we have never received so many comments on one subject. Over one thousand. Shadow Treasurer, Jim Chalmers, has already flagged that Labor policies will change before the 2022 election.

In other highlights ...

Elizabeth Bryan and Chris Cuffe are two of Australia's most experienced board chairs and directors. It was fascinating to hear their views on how a good board should function, with tips for aspiring members to transition from executive to board roles. It's not suitable for everyone.

Plenty is being written about bubble asset valuations as investors scramble for returns, and Roger Montgomery gives specific examples of how some investors have lost perspective.

In looking for both yield and lower volatility, Adrian Harrington makes the case for quality property with first-class tenants and long lease (Weighted Average Lease Expiry or WALE) terms, and it's worth understanding more about 'triple net leases'. Similarly, real assets including infrastructure have a role in most portfolios, and Andrew Parsons shows the opportunities.

Adam Grotzinger explains that as opportunities in traditional markets become constrained, a flexible approach to global opportunities can enhance risk-adjusted returns.

We like to think markets are subject to a vast array of forces, but one dominates all others: the actions of central banks. They've fed us on sugar for years, and we all know what happens eventually when we consume too much sugar. Ashley Owen draws the chart and the conclusions. When central bank balance sheets have gone from US$10 trillion to US$22 trillion in a decade, as shown below, do we expect them to continue expanding to feed our endless appetites?

Finally, on the subject of major market trends, this week's Sponsor White Paper is from Martin Currie Australia (an affiliate of Legg Mason), on why the value style of investing will soon have its time in the sun after being in the shade of growth and momentum for many years.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.