There's always more happening in money markets than most people realise, with significant implications for investors and borrowers. Like an iceberg with more under the surface than we see from above, the Reserve Bank of Australia (RBA) injects or withdraws billions of dollars into the financial system each week to manage liquidity. In the professional cash markets, the RBA is currently providing plenty of stimulus and banks are funding loans easily.

This lack of need to compete aggressively for deposits is one reason why bank cash accounts pay negligible returns and term deposits are not much better. Worse for people relying on these accounts for income, Governor Phillip Lowe has outlined the circumstances in which cash rates could go lower.

"If the unemployment rate were to be moving materially in the wrong direction and there was no further progress made towards the inflation target, the balance of arguments would tilt towards a further easing of monetary policy."

Lowe went on the explain the requirements for an Australian version of Quantitative Easing (QE), where he appeared to rule it out:

"The threshold for undertaking QE - that is, the RBA purchasing assets through balance sheet expansion - has not been reached in Australia and I do not expect it to be reached. So, it is not on our agenda at the moment."

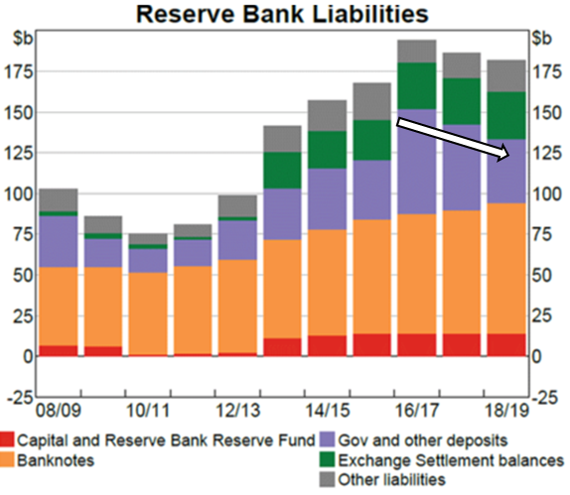

However, Peter Sheahan, an institutional deposit broker at Curve Securities, told me that a form of QE is already underway. He points to the level of Government deposits held by the RBA (the purple bar in the chart below). It has been falling rapidly as Government agencies appear to be circulating money back out to the financial system as soon as possible and not holding deposits with the RBA. The amount on deposit has fallen a further $23 billion from $41 billion to $18 billion since 30 June 2019. Some banks believe there is already more liquidity in the system than ever before and it's one reason the RBA did not cut rates last week. It's "cash flow optimisation to stimulate activity."

Nobody has spent more time in Australian money markets than Tony Togher. He oversees the $60 billion cash and fixed interest portfolio at First Sentier Investors for both retail and institutional investors. In this interview, he explains the wide variety of securities in his funds, and how the market has changed fundamentally in the last decade. Cash is not just cash.

In a wide range of other important investment topics ...

Joe Magyer describes the value of letting your winners run, and anyone who sold out of a great growth story like CSL, Xero, Amazon or Magellan will know the pain of taking profits early.

Bank hybrids have become a massive sector in the 'reach for yield', especially for retirees replacing term deposits, and part of the return assumption depends on when a bank will repay this perpetual instrument. Fixed interest experts, Justin McCarthy on one side and Simon Fletcher and Charlie Callan on the other, disagree on a NAB hybrid which has seen significant price movement recently.

Fidelity International has released new research on the value of advice. Alva Devoy reports on the higher proportion of people who worry about their future when they do not seek advice, but most importantly, there is a link between financial and mental health.

The wide margin between low bond rates and the yield on high-quality non-residential property continues to drive flows, and Adrian Harrington shows the sectors attracting the most attention. Like residential property, the market is very strong.

The window for submissions to the Retirement Income Review recently closed, and Roger Cohen highlights the 'retirement gap' that punishes saving, and he offers an alternative.

Finally, Peter Cook believes low interest rates force a rethink of 'Total Return Investing', because below a certain income threshold, investors need to accept some level of capital volatility.

This week's White Paper from Magellan looks at the ways technology is changing modern medicine. No wonder we are living longer, and many companies are benefitting.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.