Weekend update: The US finished Friday on a weak note, with the S&P500 down 2.4% and NASDAQ losing 2.6% driven a loss of advertising revenue at both Facebook and twitter. Fears of a second virus wave pushed both the Australian and global stock markets down margionally for the week. A closing of economies will be even more difficult second time around.

***

Since March, the stock market has defied most equity pundits and pushed through fears of ongoing recession, job losses and business closures. In Australia specifically, the loss of stimulus from population growth and immigration is underestimated. Releasing new population data last week, ABS Demography Director Lauren Ford said:

"The population at 31 December 2019 was 25.5 million people, following an annual increase of 349,800 people."

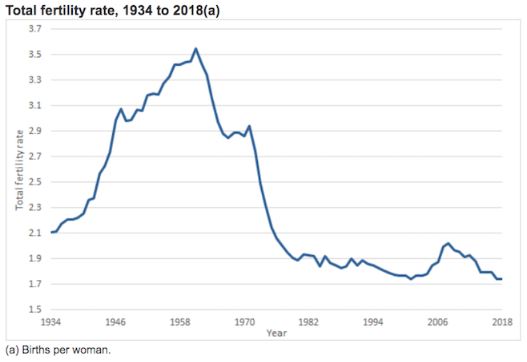

Natural increase accounted for 39.8% of the population growth, while net overseas migration claimed 60.2%. With 305,800 births and 166,700 deaths, the natural increase of 139,100 was a drop of 5.2% over the previous year. In recent years, there has been a decline in Australia's fertility rate, with births per woman down to about 1.7 (Source: ABS). We're not replacing ourselves.

We rely heavily on migration for population growth, with 533,500 overseas migration arrivals and 322,900 departures resulting in net overseas migration of 210,700 people in one year. It creates demand for a lot of houses and sofas and cars and washing machines.

That was before COVID-19. With travel bans in place, borders closed and many parts of the world unable to control the virus spread, net overseas migration is forecast by the Government to fall 85% for the next two years. It will continue at lower levels for years as we raise the drawbridge with political pressure to give Australians jobs before migrants.

This major change will also take some pressure off infrastructure, house prices and wages. Shane Oliver at AMP Capital estimates that underlying demand for houses will fall by 80,000 dwellings a year due to immigration falling.

ANZ Chief Executive Shayne Elliott said recently:

"The reality is there is no V-shaped recovery because our economy is open and very, very dependent on exports and tourists and migrants and foreign students."

The 300,000 less permanent arrivals over two years represent a further setback for budget recovery, as many would have been skilled migrants and high-level taxpayers.

Meanwhile, over in the US, the Federal Reserve injections of liquidity took a new turn this week with Standard & Poor's Global Ratings adding a record number of companies to its 'fallen angel' list. These are bonds the Fed is buying which might soon be rated junk or never repaid, and that's not how a central bank should manage public money. S&P said:

"Potential fallen angels, or issuers rated BBB- with negative outlooks or on CreditWatch with negative implications, climbed to a fresh record high of 126 in the five months to May from 111 in the January-April period on lingering credit pressures due to the coronavirus pandemic."

And if we ever needed proof that future returns will be less than in the past for a very long time, Austria issued a Euro 2 billion bond this week for 100 years yielding 0.88%. At least none of the buyers will see it mature.

In this week's edition ...

When a market continues to rise defiantly, it's often because there is a source of new money or existing investors are doing something differently. Damien Klassen dissects where this demand is coming from to judge if it is sustainable. The US market fell heavily overnight and Australia will follow today.

Last week's article on 'Robinhood' investing had a tragic footnote when the next day, Forbes reported that a 20-year-old had committed suicide when his balance was reported as negative US$730,000, said to be the result of the timing of some complex option trades. Noel Whittaker has been advising clients for decades, and in describing his worries about these new, inexperienced traders entering the market, he reveals his trading secret I had to double-check to believe.

A traditional 60/40 investment portfolio seeks to buffer the risk of equities with the downside protection of bonds, but Amy Arnott believes it needs reviewing with bonds offering poor future returns. How do investors cope with the added risk if they go 80/20?

Rodney Lay researches many LICs and LITs, and the ongoing problems of funds trading at a discount to NTA have led him to the view that all boards and investment managers must review whether their structure is in the best interests of investors and not just themselves. He highlights a new development they should all consider. It's a frustrating space for investors, with another example this week at the highly-regarded VGI Investors. A senior portfolio manager, Douglas Tynan, resigned to move to a non-executive role, and at the time of writing, VG1 is trading at $1.89 versus an NTA of $2.32, a whopping 18.5% discount.

The latest data on SMSFs released by the Australian Taxation Office gives a much-improved picture on expenses compared with a previous study by ASIC. Franco Morelli reports on how much it costs to run an SMSF to see how you compare.

Dr Paul Mazzola examines social impact investing, and especially the potential to introduce a Social Impact Credit System to give investors better information.

Jonathan Rochford's look at the global news media links to quirky, revealing and sometimes controversial items most of us miss.

In this week's Sponsor White Paper, Neuberger Berman makes the case for investing in credit and bonds in the coronavirus climate at a time when new allocation decisions for FY21 are underway.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Chi-X releases a new range of TraCRs, US-listed companies now tradeable in Australia

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website