As the Covid-19 pandemic persists, the universal public health system continues to be stretched and the longevity of the subsequent global economic crisis remains uncertain. The consequential social impact is far reaching, exacerbating problems of poverty, mental health, social dislocation, domestic violence, and potentially crime, and the level of unemployment continues to rise.

The long-term social costs could be disastrous. As the economy continues to deteriorate, what happens to the low socio-economic segment of our community? Will economic resuscitation relegate social benefit programs? And what happens to climate change action? Will it continue to be the victim of political jostling or forgotten altogether?

It seems that all sectors of the economy are distressed. The government is fiscally exhausted, and the household sector is facing various challenges including increasing unemployment and already historically high levels of debt, which now stands around 120% of GDP. Furthermore, the small-to-medium-sized business sector is facing a decline in consumer sentiment, a raft of closures and a spike in potential bankruptcies.

Where do social and environmental causes turn to for support?

Is investment management our white knight?

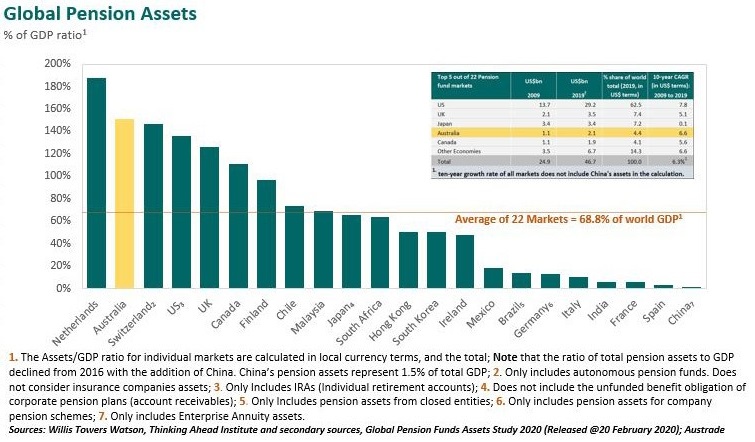

Two groups still have ammunition to spare: the corporate and institutional investment management sectors. The Australian Bureau of Statistics shows that the institutional investment management industry in Australia has funds under management of almost $4 trillion. According to the Willis Towers Watson Global Pensions Asset Study 2020, the superannuation sector is the largest within the industry and finished 2019 with the world’s fourth-largest superannuation market.

Before the onset of the Covid-19 pandemic, Australia also experienced one of the highest growth rates of superannuation fund assets in the world. Assets rose to 151% of GDP in 2019, representing an increase from 110% a decade ago, and a compound annual growth rate of 9.2% between 2009 and 2019. Fast, long-term growth rates have now created the second-highest superannuation asset to GDP ratio among the world’s 22 major superannuation (pension) markets.

How can our white knights rescue us?

An increase in asset allocation to Social Impact Investing (SII) is a possible solution. SII is defined as the type of investing that generates positive financial and social change. SII is differentiated from traditional investing by its intent and measurement so that both financial and social returns (impact) can be identified. Impact Investing Australia, an independent not for profit organisation, which serves as the operating entity of the Australian Advisory Board on Impact Investing (AAB), suggests that the market in Australia will reach $32 billion by 2022—although acknowledges that precise figures are difficult to determine. Nevertheless, this is dwarfed by the Australian ethical investment market, which has over $630 billion of assets under management.

An obvious application of SII is as a co-investment strategy between government and private sector organisations. Through a variety of agreed social investment activities, government could enhance social welfare outcomes and generate efficiencies. A co-investment strategy is a productive means for government to enhance economic outcomes through the multiplier effect. The alleviation of poverty and potential reduction in unemployment translates into higher consumption, taxation revenue and GDP growth.

Moreover, supplemental social benefits will accrue. One of the challenges in the growth of the SII market is the greater level of uncertainty of returns. So how can we incentivise SII? The answer can be found in the development of a universally accepted and applied social impact credit system.

Social impact credit system

The social impact credit system is one that is designed to attribute value to investments that generate a positive impact to society. It assigns a score for each SII, taking into account the nature and amount of the investment. Scores, otherwise known as credits, can be publicised by the investor thereby promoting their own corporate social responsibility (CSR) and perpetuating a ‘good corporate citizen’ perception.

It is a model that allows comparisons between organisations and incentivises social investing, volunteering and gifting in society. Ultimately, the concept of routinely incorporating CSR considerations into investment decisions could find its way into corporate mission statements, investment mandates and strategy and policy documents. This would engender a way of doing business that considers social as well as financial outcomes in investment decision-making frameworks.

Industry has struggled with the reporting of their social impact, whether through their annual reports or other media due to two major issues.

Firstly, there is the complexity and ambiguity relating to some measurement methodologies, many of which utilise subjective data.

Secondly, there is disagreement as to the preferred model. The absence of a simple universal measurement methodology accepted and used by all corporations, hinders comparisons between entities and discourages its application.

A unique social credit system has recently been established in China that suits its cultural and political system. The difference is that it is targeted at individuals instead of corporations. The Chinese system rewards individuals’ positive moral behaviour with credit points and applies negative points for anti-social behaviour. This system is unique to China and in no way reflects the proposed system for Australia. However, the common theme between the two systems is its intended influence over behaviour.

The measurement problem

Resistance to SII from the corporate sector has largely stemmed from the deficiencies and variability of various impact measurements. Effective impact measurement is essential in the corporate setting, where accountability and efficient allocation of resources is an institutional practice. A sound measurement model not only assists investors but is helpful for investees by aiding them to assess their own performance in meeting targeted social goals and use results to inform engagement in future projects.

According to a UK study in 2011, Gibbon and Dey favour a measure known as social return on investment (SROI) which accommodates key characteristics of simplicity and clarity. The ‘SROI ratio’, simply calculates a quantitative ‘return’ on a notional dollar of investment. The appeal of this measure is its bias towards quantitative factors that are well understood by industry. The model relies less on subjective factors, which use ‘financial proxies’ to quantify ‘soft outcomes’. It would seem logical for any research for a measurement methodology to consider a linkage to social development goals (SDGs) to satisfy the universal call to action to end poverty, protect the planet, and ensure that all people enjoy peace and prosperity by 2030.

A comprehensive study in 2017 by Rawhouser, Cummings, and Newbert in the Journal of Entrepreneurship, Theory and Practice found that standards for measuring an organisation’s social impact are fragmented and underdeveloped. Therefore, they obfuscate a clear understanding of trends and best practices regarding their conceptualisation and measurement. One important observation is the need to devote resources to the collection of new data sources in order for social impact research to progress quickly.

A call to arms

The progress of research in the development of a universal measurement model to advance the acceptance of a social impact credit system should be facilitated by a concerted effort between government, academia and the corporate institutional investment management sectors. An independently controlled administrator is recommended to gather and centralise data, monitor social impact credit measurement, and compile and publish scores.

Only with a consensual approach can a universal measurement model be accepted by the SII community. This is a call to arms for a champion to further this cause.

Dr. Paul Mazzola is a lecturer in banking and finance in the Faculty of Business at the University of Wollongong. The author wishes to thank Mr Greg Peel, Mindhive, for his insightful contributions to this article.