The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular stock pick articles from the week. You can check all previous editions of the newsletter here.

Weekend market update

From AAP Netdesk: Investors pushed the ASX to a record close as they look for more bumper payouts next earnings week. Shares in biotech CSL rose by more than 2% prior to its full-year earnings on Wednesday, while consumer discretionaries were also popular. The big banks were almost all higher. The Commonwealth was the exception as investors trimmed its share price from the record reached after Wednesday's full-year earnings. The benchmark S&P/ASX200 index closed higher by 41 points, or 0.5%, to 7628.9 on Friday. The Commonwealth Bank, IAG, Rio Tinto and Telstra were some of those to deliver better shareholder payouts. The market gained 1.2% for the week. Macquarie Bank shares traded for a record $164.89, while Wesfarmers, which owns Bunnings and Officeworks, had its shares hit a record $65.30.

From Shane Oliver, AMP Capital: Global share markets continued to rise over the last week with reopening and earnings optimism offsetting Delta concerns and propelling US and European shares to record highs. US shares rose 0.7%, Eurozone shares gained 1.3%, Japanese shares rose 0.6% and Chinese shares rose 0.5%. Bond yields fell in the US and Europe but rose slightly in Australia. Oil and metal prices rose but iron ore continued to slide and is now down -26% from its May high, but is just back to April levels which is still very high. On Friday, US stockmarkets were little changed.

So how can Australian shares be at record highs given the hit to the economy from the lockdowns? While it may seem perplexing there are good reasons:

1. Earnings news has been strong with investors cheering the return of capital via dividends and buybacks from several companies

2. Last year's experience showed that the economy will bounce back strongly helped by massive fiscal support

3. Monetary policy may now be easier for longer

4. Lower bond yields and the surge in earnings have made shares cheaper

5. Some are expecting more M&A activity, and

6. Vaccines are providing optimism that we will see a more sustained recovery from later this year.

While shares are at risk of a short-term correction, we ultimately see the rising trend continuing.

***

Big numbers that once grabbed our attention have lost their impact. They whizz past our consciousness every day and we are no longer impressed. How easy millions became billions and now trillions. Billionaire ... big deal ... there are 2,755 of them according to Forbes, and Amazon's Jeff Bezos is one 177 times over. With 493 new names on the list in 2021, that's a new billionaire every 17 hours.

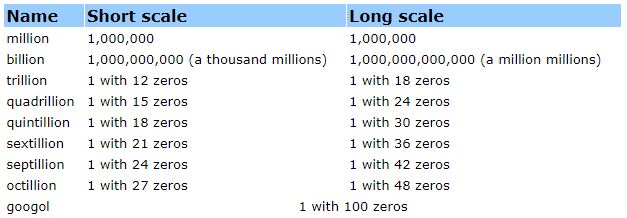

The old UK definition of a billion was a 'long scale' million million (12 noughts), but English-speaking countries, including Australia and the US, now accept a billion means a thousand million (9 noughts). It's not quite so difficult now to become a billionaire and Bezos is 17.7% of the way to becoming a trillionaire.

Pretty soon, these will become serious amounts of money. We can see why Google chose its name based on 1 with 100 zeros, as it sees its potential reach as unlimited. With Alphabet (Google) valued at US$1.8 trillion and Apple at US$2.4 trillion, it will be a long time before we need quadrillion in our lexicon. Where are zillion and gazillion in the list below? They are informal words with no precise meaning.

Remember how China is a communist country and all aspects of life are under authoritarian control? No capitalism there. The recent tech and education crackdown by the Government cost Chinese billionaires billions but don't worry. They're not down to two-minute noodles yet, despite losing ... yes, billions.

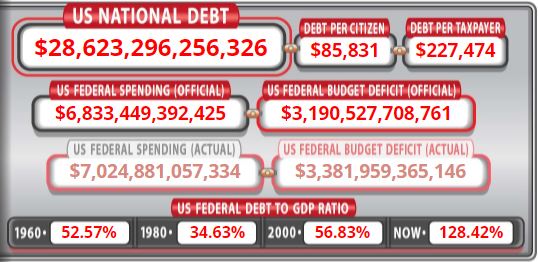

Let's move on from mere billions. The US national debt is nearly US$29 trillion, an increase of US$5 trillion in the last year. It is estimated to reach US$89 trillion by 2029, even without the US$1.5 trillion infrastructure bill recently approved and a coming US$3.5 trillion antipoverty and climate change plan. Major overhauls of health, education, welfare and infrastructure far exceed political desire to tax people.

The US Congressional Budget Office projects that US GDP will reach US$34 trillion in 10 years. In this context, what's a few trillion on some decent bridges and roads? It's fascinating to watch the US debt clock in real time. As soon as you take a screen shot, it is out-of-date. There's the US$29 trillion, with US$1.3 trillion a year spent on Medicare/Medicaid and US$1.1 trillion a year on social security.

So what? Well, as we become inured to the big numbers, we accept that a six-year-old BNPL called Afterpay that has never made a profit should be worth $39 billion, unlisted Canva is worth US$15 billion and tech startups are worth hundreds of millions on little more than fumes and a good idea. When future cash flow potential is discounted by tiny interest rates, numbers head to infinity. There is so much money sloshing around that investors park US$1 trillion in spare cash in the US Federal Reserve every night earning zero.

Well-known US analyst and fund manager John Hussman said last week:

"It may be the greatest collective error in the history of investing to pay extreme multiples for extreme earnings that reflect extreme profit margins and extreme government subsidies, while imagining that those multiples also deserve a 'premium' for depressed interest rates that reflect depressed structural economic growth."

More powerfully, Hussman quotes Ben Graham, the 'father of value investing' whose principles are followed by Warren Buffett and many leading investors, from his writing in 1959:

"Speculators often prosper through ignorance; it is a cliché that in a roaring bull market, knowledge is superfluous and experience a handicap ... All my experience goes to show that most investment advisers take their opinions and measures of stock values from stock prices. In the stock market, value standards don’t determine prices; prices determine value standards."

Think about that. Knowledge is superfluous. Experience is a handicap. Prices determine value standards, not the other way around.

In this week's edition ...

We summarise last week's Reader Survey on retirement income, with more support for Government initiatives than expected. Many thanks to the 1,200 or so readers who responded, an excellent result, and we have included a thousand comments in a large PDF attached to the article. A great cross section of retirement views which we have sent to Federal Treasury. Some bed-time reading for Josh.

Still on retirement, former asset consultant, Don Ezra, who wrote a popular piece on his own retirement spending a few weeks ago, responds to some of the comments on his article this week.

Moving on to other investment stories, Ned Bell identifies six stocks he calls 'COVID opportunists'. It is fascinating to read the types of companies that have prospered in such a difficult climate.

Then James Maydew highlights how real estate is also changing, with new non-traditional sectors also benefitting from the way the world is changing. Anyone looking for commercial property exposure should look beyond the traditional office and retail.

We often hear analysts talk about the ways bond and share prices should move together, citing the 'negative correlation' benefits. Warren Bird dissects these claims with a warning about asset allocation and correlation assumptions.

It's the middle of reporting season, but what does this mean? Hugh Dive takes us inside the life of a fund manager or broker or institutional asset manager faced with an intense period of company announcements and meetings.

While the market loved the CBA result this week, pushing the stock to an all-time high, there was a nasty number hidden in the details. The remediation bill owed to Countplus after its purchase of parts of the CBA financial advice business has topped $260 million, in addition to the billions CBA has already paid out elsewhere. Rodney Horin argues financial advice that says 'do nothing' is often the best. What a poor job the major banks did when defending themselves at the Financial Services Royal Commission. The lawyers who told bank witnesses to lay down and die are not the ones taking the consequences.

Overall, the August 2021 earnings season has gone well so far as many businesses benefited from the massive government stimulus (and $25 billion of JobKeeper was retained by companies who ultimately did not meet the criteria), a rise in consumer spending and the reopening of the economy, and the current lockdowns have not delivered a reality check.

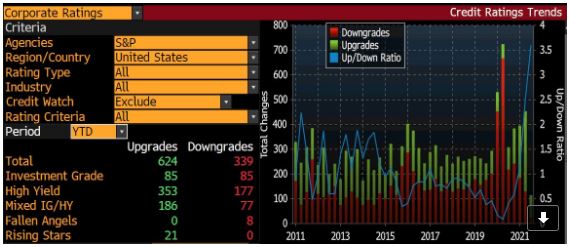

The good times are also rolling in the US. According to Bloomberg, as shown below, Standard & Poor's has upgraded the corporate ratings of 624 US companies and downgraded 339 in the year-to-date. Most of the upgrades are in the 'high yield' (non investment grade) space, showing what an amazing job low interest rates and easy liquidity have done to improve balance sheets. The blue line in the right hand chart of the up/down ratings ratio shows a remarkable recovery in 2021.

This week's White Paper from Capital Group explains how ESG bonds have become a popular way for fixed income investors to signal their ESG preferences, but how can investors avoid paying the 'greenium'?

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Australian income investors face a challenging environment. Interest rate cuts have crushed returns on deposits and caused asset yields to compress. Gareth James has identified 10 franked income stock ideas from Morningstar's coverage list. And strong results at Commonwealth Bank are a chance for investors to trim their exposure while prices are high says Nathan Zaia.

Given the thousand-plus comments last week (check them in the Reader Survey article) with so many great thoughts, we are reluctant to nominate a Comment of the Week, but this from AlanB was too good on the point of the Warren Buffett challenge.

"I'm going to say it. We're all tone deaf! If this was an exam or assignment everyone would have scored an F with the only marker comment: Read the question.Buffet, Hand, et al., are inviting us to consider making the world a better, fairer place. We're talking about: the risk of paying some extra tax because our Sydney property is more valuable than one elsewhere; the absurd notion that we're rich simply because we work very long and hard (not because we live in a uniquely privledged country); taxing or not of franked dividends; etc. Please re-read the question, and re-submit your paper. Or withdraw from the course and avoid the course fee."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website