The Ozempic moment for SaaS (software as a service) refers to a pivotal disruption scenario where a transformative technology threatens to erode or fundamentally reshape an established market leader’s core business model, much like the hype around Ozempic (and other GLP-1 drugs like Wegovy) did to ResMed (ASX:RMD) around 2023.

Back in mid-2023, as Ozempic exploded in popularity for dramatic weight loss, investors panicked over its potential impact on ResMed, the dominant provider of CPAP machines and sleep apnea devices. Obesity is a major risk factor for obstructive sleep apnea (OSA), affecting a large portion of patients. The fear was straightforward: if millions lost substantial weight via these drugs, demand for ResMed’s hardware; masks, flow generators, and related consumables could collapse, shrinking the addressable market and pressuring recurring revenue from resupplies and adherence.

The market reaction was brutal. ResMed’s shares plunged roughly 30-40% in the second half of 2023 (from highs around $33-34 AUD to lows near $21), with some periods seeing over 25% drops tied directly to GLP-1 headlines. Analysts and headlines screamed “Ozempic overshoot” or “end of ResMed,” drawing parallels to how weight-loss drugs might cannibalize device sales. Valuations compressed sharply, with forward P/E dropping from historical averages near 30x to lows around 18-21x amid “nonsense sell-off” commentary. Investors priced in a structural decline, fearing GLP-1s would reduce OSA prevalence or adherence rates.

Source: Morningstar

Yet the reality diverged. By late 2023 and into 2024, ResMed’s data showed GLP-1s as a tailwind, not a headwind. Patients on these drugs entered the healthcare system more motivated, showed higher propensity to start CPAP therapy (up to 10.5% in some analyses), and maintained stable adherence/resupply. Many used combined therapies, and not all OSA stems from obesity (about 50% of cases aren’t weight-related). CEO Mick Farrell repeatedly downplayed the threat, calling fears overblown. By 2024, shares recovered strongly, with the company beating forecasts and declaring the “headwind thesis completely gone.” The initial panic proved exaggerated; the disruption was real but incremental and slower than feared, with adaptation (e.g., hybrid treatments) preserving demand.

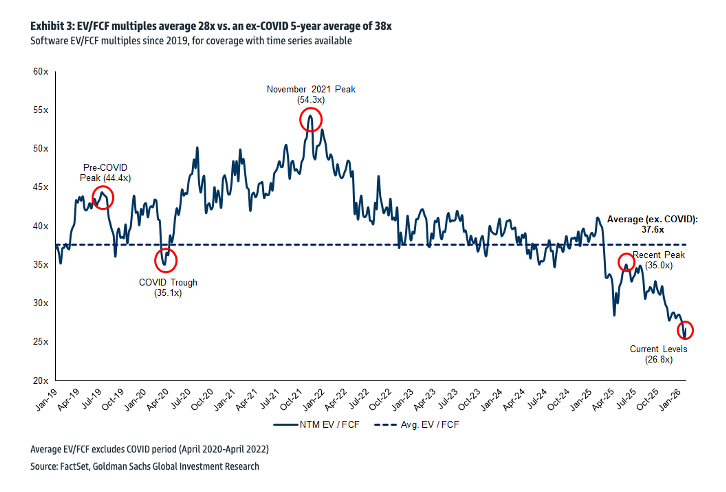

Fast-forward to January 2026, and SaaS faces its own Ozempic moment – this time from agentic AI and generative tools. Investor sentiment toward software/SaaS companies is overwhelmingly bearish, mirroring 2023’s ResMed rout. Stocks like ServiceNow, SAP, Salesforce, Adobe, and others have seen double-digit plunges post-earnings (e.g., ServiceNow down ~10% despite beats, SAP cratering 16% on guidance shortfalls). The Philadelphia SE Software sector is down sharply, with phrases like “SaaS meltdown” and “software apocalypse” dominating commentary.

The core fear: AI agents could replace human workflows, eroding seat-based/per-user pricing models that underpin SaaS giants. One AI agent might handle tasks previously requiring multiple licensed users, enabling in-house builds or cheaper alternatives. Horizontal/point SaaS without deep proprietary data or complex integrations looks especially vulnerable to commoditization. Investors demand immediate, exponential AI-driven growth to justify elevated valuations, yet guidance often shows steady (but not explosive) 18-20% subscription increases, triggering sell-offs.

Source: Goldman Sachs via Jeff Richards [@jrichlive], on X platform.

Like ResMed’s case, though, the threat may be overstated in the short term. Agentic AI adoption remains slower than hyped due to enterprise caution around trust, governance, security, and integrations. Many incumbents (e.g., Salesforce’s Agentforce, ServiceNow) are embedding AI deeply, shifting toward outcome-based or hybrid pricing. Vertical/deep-domain SaaS with proprietary workflows could endure or thrive as AI augments rather than replaces. Insiders predict evolution, SaaS reinvented as intelligent orchestration hubs, rather than outright death.

The parallel is striking: hype drives sharp deratings, but real-world data often reveals adaptation, tailwinds, and slower disruption. For SaaS today, as with ResMed then, the market may be over-discounting extinction while underpricing resilience and reinvention. The next 12-24 months of agentic progress and adoption will tell if this is another temporary panic—or a more profound shift.

TAMIM Takeaway

Every investing cycle has its Ozempic moment, a narrative shock so compelling that the market briefly forgets how slow real-world change actually is.

ResMed lived it in 2023. The story was clean, frightening, and wrong in its timing. GLP-1 drugs did not kill sleep apnea. They nudged behaviour, pulled more patients into the system, and ultimately reinforced demand for therapy. The sell-off was real. The extinction thesis was not.

SaaS is now in the same psychological phase.

Agentic AI is genuinely transformative. But transformation does not arrive overnight, and it rarely destroys incumbents before they adapt. Enterprises move slowly, governance matters, integrations are messy, and mission-critical workflows are not casually handed to autonomous agents. The seat-based model will evolve, pricing will change, and margins will be pressured at the edges. That is not the same thing as obsolescence.

History suggests the winners will be platforms with deep customer embedment, proprietary data, and the ability to orchestrate AI rather than compete with it. Just as importantly, history suggests markets overshoot on fear before they recalibrate on facts.

For patient investors, these moments are not warnings to flee. They are invitations to think clearly while others extrapolate headlines. The SaaS extinction trade may yet prove as exaggerated as the ResMed panic, and the opportunity may lie in separating real disruption from narrative excess.

Ron Shamgar is Head of Australian Equities at Tamim Funds Management and Portfolio Manager of the TAMIM All Cap Fund. This article contains general information only and should not be considered financial or investment advice. It has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions.