The start of a financial year always brings new rules for super funds. For the 2020/21 financial year, two changes are the abolition of the work test for anyone aged 66 and 67 wishing to make personal non-concessional contributions (NCCs), and an extension of spouse contributions from age 70 to 75.

The continuation of the 50% reduction in the minimum pension rate for account-based pensions due to the COVID–19 pandemic will apply for the whole year. We are still waiting for the change that will allow access to the bring forward rule.

Let's look at some rules, new and not-so-new, in more detail.

Abolition of the work test to age 67

Until 30 June 2020 there was no need for a member to satisfy a work test for personal concessional and NCCs before reaching age 65. However, once they reached 65 in the financial year a work test of 40 hours in 30 consecutive days was required to be met at some time during that year and prior to the contribution being accepted. Providing the work test is met in a financial year, personal concessional or NCCs can be accepted up to 28 days after the month in which the person reaches age 75. But there are exceptions to the work test where personal contributions are made in the year after ceasing work or for purposes of downsizer contributions.

From 1 July 2020 it is now possible to make personal contributions without needing to satisfy a work test until age 67. In the financial year the member reaches age 67, personal contributions can be made prior to reaching that age but a work test must be met at any time during the financial year before the contribution is made.

Ceasing work contributions

Ceasing work contributions are permitted on a once-only basis after the member has reached 67, previously age 65. Personal contributions can be made on a once-off basis in the financial year after work has ceased and the person has a total super balance of less than $300,000 on 30 June in the previous financial year. These contributions can be accepted by the fund up to 28 days after the month in which the person reaches 75.

Downsizer contributions

Downsizer contributions can made after the sale of a person’s main residence, as described for capital gains tax (CGT) purposes, which they have owned for at least 10 years. To be eligible the person must be 65 or older and a contribution of up to $300,000 must be made within 90 days of the sale. The person’s spouse may also be eligible to contribute up to $300,000 if they are 65 or older. There is no upper age limit applying to downsizer contributions or any work test that applies.

Employer contributions

When it comes to employer contributions for anyone 65 or older, there are no work tests or age limits for compulsory employer contributions such as superannuation guarantee contributions or those made under an industrial award. But a work test must be met if the employee wishes to salary sacrifice to super and they are unable to be made 28 days after the month in which the employee reached age 75.

Access to the bring-forward rules from 1 July 2020

It is possible for anyone who is under 65 to trigger the bring-forward rule which allows up to two years of NCCs to be made over a fixed period. The period commences from the year in which the person makes an NCC that is greater than the standard annual amount of $100,000.

Whether a person has access to triggering the bring-forward rule depends on their total superannuation balance on 30 June in the previous financial year. For anyone with a total super balance of less than $1.4 million they are able to bring forward up to two years' standard NCC and anyone with a total super balance of between $1.4 and $1.5 million is able to bring forward up to one year’s standard NCC. Once a person has a total super balance of between $1.5 and $1.6 million only the standard NCC is available and there is no bring forward amount. With a total super balance of $1.6 million or more, it is not possible to make a NCC without incurring a tax and interest rate penalty.

It was announced in the 2018 Federal Budget that the bring-forward rules would be amended to apply to anyone who was under 67 on 1 July in a financial year. However, the bill has a way to go prior to becoming law.

Those fund members in the 65-66 age bracket are in a bit of a dilemma until the time the passage of the legislation is clear. From a practical point of view, it is only those members with a total superannuation balance of less than $1.5 million as at 30 June 2019 or 30 June 2020 who will be impacted if they wish to maximise NCCs by using the bring-forward rule.

Spouse contributions and the tax offset

It is possible to make contributions for an eligible spouse which are treated as NCCs and counted against the spouse’s NCC cap. If the spouse has an adjusted income of less than $37,000 it is possible for the contributor spouse to receive a tax offset of up to 18% on the first $3000 of any non-concessional spouse contribution. The tax offset amount phases out between $37,000 and $40,000 on a dollar for dollar basis.

Until 30 June 2020, it was only possible to make spouse contributions up until age 70. Between age 65 and 70 the spouse was required to meet the work test of 40 hours in 30 consecutive days for the year in which the contribution was made. However, from 1 July 2020 this has now been extended to apply for spouse contributions made between 67, and 28 days in the month after the spouse reaches 75, which puts it in line with other personal superannuation contributions. The work test must be met prior to spouse contributions being made to the fund.

Reduction in minimum pensions for account-based pensions

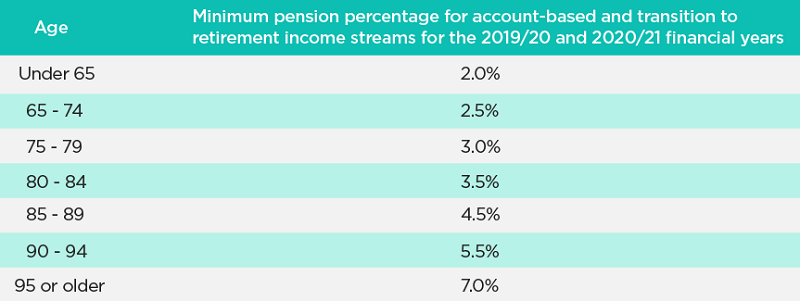

In March 2020, the government amended the minimum percentage required to be paid for account-based pensions by 50%. This meant that account-based pensions, transition to retirement pensions and market-linked income streams would have their minimum pension percentage reduced by 50% for the 2019/20 and 2020/21 financial years.

Here are the reduced percentages that apply:

What next?

The extension of the work test exemptions to age 67 for personal superannuation contributions has been a bonus in these difficult times as well as the extension of the age at which spouse contributions can be made. However, we wait with anticipation for the extension of the bring forward rule to age 67 to become law when parliament resumes in the next few months.

Case study examples of each of these super regulations is contained in this attached longer version.

Graeme Colley is the Executive Manager, SMSF Technical and Private Wealth at SuperConcepts, a sponsor of Firstlinks. This article is for general information purposes only and does not consider any individual’s investment objectives.

For more articles and papers from SuperConcepts, please click here.